Stock Scanners for Day Trading: A Quick Overview

Stock scanners for day trading are powerful tools. They help traders find hot stocks, the kind with potential to fly or fall like a rocket in the market. Knowing where to search for these good options is critical. These stock scanners for day trading sift through massive amounts of market data in seconds, enabling rapid analysis of trading opportunities. Stock scanners for day trading are becoming vital.

What are Stock Scanners?

Stock scanners for day trading are software programs designed to scan large quantities of data across the market to identify stocks fitting specific criteria. These criteria cover everything from price fluctuations, volume levels, and trading patterns, like breakout opportunities. Stock scanners for day trading sort out the noise in the market for your personal selection. Think of them as automated market explorers designed specifically to find gems in the market. Stock scanners for day trading save tons of time, right?

Top 5 Stock Scanners for Day Trading

Pinpointing the best stock scanners for day trading is tricky. Different traders have different preferences. The best scanner for a trader heavily relies on the exact trade characteristics they focus on. But in the market right now, there are these top picks often used and discussed:

- NinjaTrader: Powerful tools. Plenty of indicators and charting, suited for advanced analysis, maybe a little bit expensive.

- Thinkorswim: Known for powerful and complex tools, but user-friendly. Usually has enough info for even average people.

- TradeStation: User friendly interface for comprehensive trade management. It is reliable. Well structured to ensure you make no mistakes.

- TD Ameritrade: Good integration with other services from the same platform. Very affordable if using services through TD. Pretty intuitive for new users too!

- Interactive Brokers: Wide selection of trading assets; offers many charting tools. Advanced features appeal to very serious traders.

These stock scanners for day trading give you a leg up! They identify stocks with specific technical qualities, like strong support, good volume and unusual patterns. Stock scanners for day trading make the searching process easier.

Essential Features of Day Trading Scanners

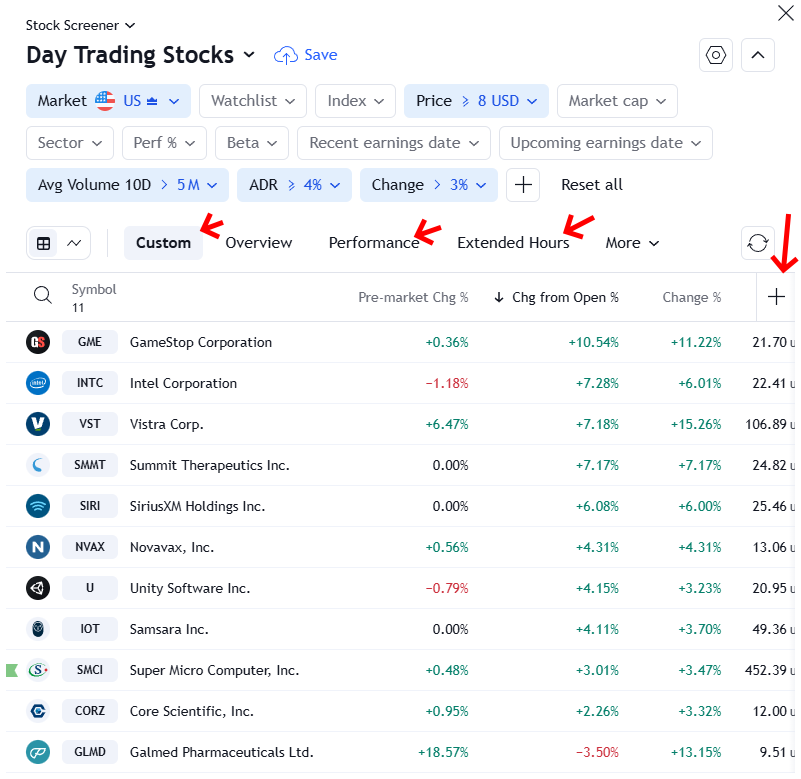

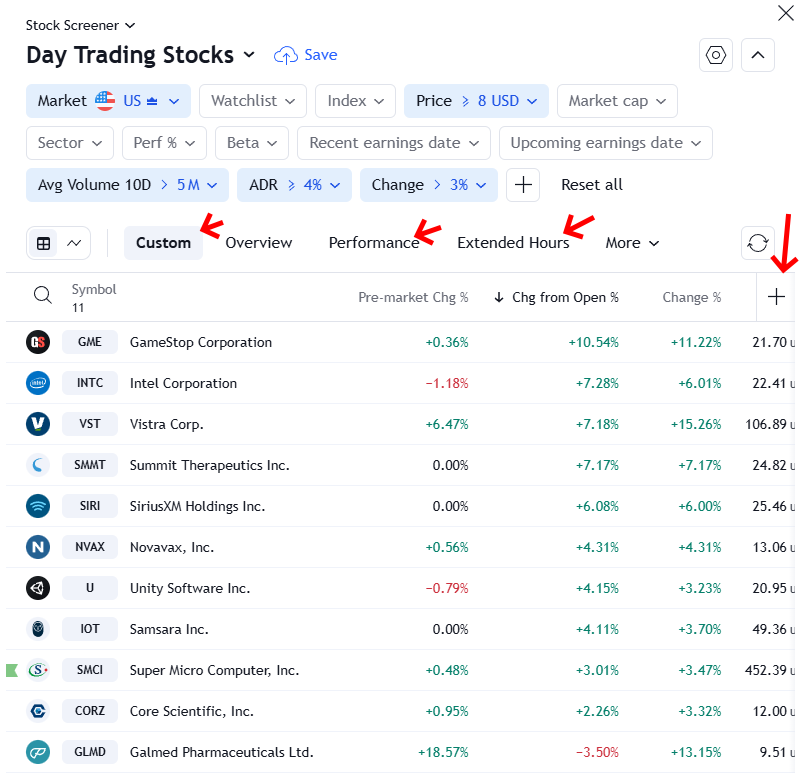

Source: tradethatswing.com

Successful stock scanners for day trading depend on useful filters. Here's a list of features needed:

- Customizable Alerts: Get notifications about market conditions that meet your specific criteria. Instant access for quick actions.

- Real-time Data: Up-to-the-second information about stocks, this helps adjust trade plans right away.

- Price Patterns: The scanners must quickly identify trending, oscillating or support price patterns, which indicate stock direction and strength. This should happen quickly!

- Volume and Technical Indicators: They need to use essential tools like MACD and RSI to identify likely trends with reliability.

- Extensive Screening: Allow complex and custom filters. So important in navigating the huge world of stock trades!

The quality of the scanner must match your preferred patterns for stock trades. Different scanners specialize in detecting specific characteristics of movement, creating an easier opportunity to capture your ideal trades. Stock scanners for day trading, once a rare tool, have improved over the years to become useful for finding new prospects for a new trend!

How to Use Stock Scanners Effectively

Using stock scanners for day trading requires careful preparation. It is key to set up these useful features correctly, ensuring a quality product from the tools! Here's a guide to using them properly:

- Define your strategy: Establish the parameters that qualify any target trade in your approach. Know the specific criteria your ideal day trade matches. Don't waste effort and time. Define exact rules from your perspective on trading.

- Fine-tune filters: Establish necessary specifications like price, volume, trends or other particular metrics to capture high-probability trades from the scans, which improve success. Set specific limitations for price actions, trade movements, and so on.

- Backtest your system: Before jumping in, ensure this scanner for stock analysis works by looking at historical performance. The scans must deliver expected and predictable outcomes for success! The success metrics, based on the particular specifications and the trades performed must deliver a high number of results. This approach tests the efficacy of any trade performed, even via stock scanner software.

Use a powerful tool to search the world of trading opportunities. Stock scanners for day trading are essential! Stock scanners for day trading will aid traders. Use them for best profits! Stock scanners for day trading is the new norm. It helps predict and analyze likely future moves and trade direction and will determine the price that you should be using when doing day trading.

Okay, I understand the instructions. Please provide the content you want me to write. I'm ready to craft those in-depth, expert-level articles on stock scanners for day trading, with a focus on a concise and straightforward approach.

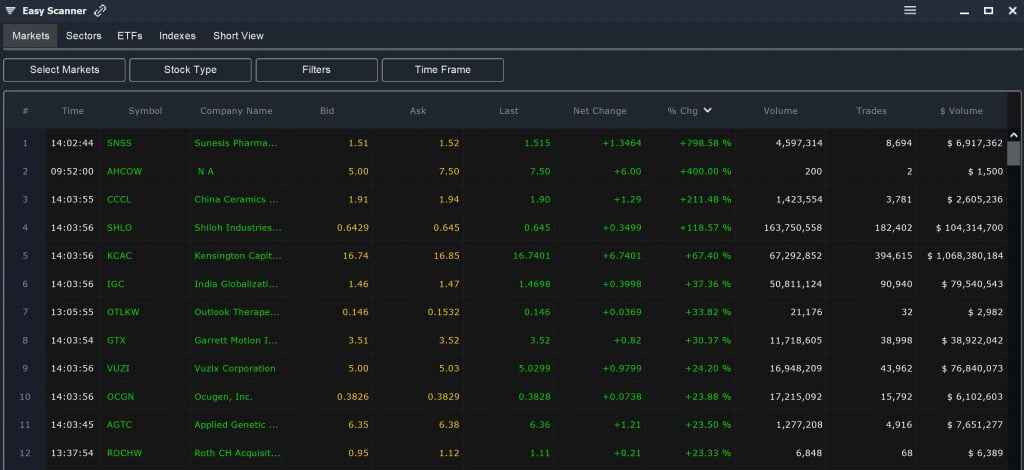

Source: twimg.com

Stock Scanners for Day Trading: Pricing Models

Stock scanners for day trading come in various price ranges. Understanding the pricing models is crucial. Some offer tiered plans, others charge by the number of scans. Daily or monthly fees are common. Factors affecting costs are scan speed, alerts, data sources, and functionality. High-end stock scanners for day trading often feature advanced analytics and customizable settings, but come with a heftier price tag. Budget-friendly stock scanners for day trading exist, but you typically get less advanced functions. A wise strategy for picking stock scanners for day trading involves carefully balancing needed features and your financial situation. Think of this: choosing a top-performing stock scanner for day trading should suit your overall goals, not your money alone.

Stock Scanners for Day Trading: Free vs Paid Options

Free stock scanners for day trading have limits, sometimes with restrictions on features and use. Paid scanners unlock additional insights. Free tools can generate alerts, providing signals or identifying stocks, but advanced features are locked behind paid tiers. Paid stock scanners for day trading provide complete access to various features including real-time data and custom screens. This adds substantial benefits to your strategy and can make the difference between successful day trading and occasional wins. Free options might help beginners explore ideas but not perform well if day trading stock. Evaluate paid versus free options; weigh features against a strategy that involves patience and consistency with trading stocks. Some tools offer trial periods so you can test them before committing, a vital decision in picking a tool. Examine several aspects. What about real-time, accurate data in a daily price analysis from the stock scanner for day trading? Real-time information is key to trading, and if there’s a delay, that delay in the scanner's information from market changes reduces potential profitability from stock scanners for day trading.

Day Trading Stock Scanner Features to Watch For

High-quality stock scanners for day trading offer crucial features. Accuracy is essential. Scanners must pull from reputable sources. Filtering is vital, enabling traders to narrow searches, targeting desired aspects. A customizable feature list should allow for specific criteria, important criteria like volume or market capitalization. Real-time updates and robust algorithms are must-haves to track real-time moves. These functions add a strong foundation to make smart choices using the scanners in day trading stocks. Stock scanning applications for day trading should offer indicators or allow you to include ones, making the information you gain insightful and impactful for decisions. Strong alerts, clear alerts on potentially favorable stock scanner patterns or stocks are crucial. Alerts help prevent traders from missing key moments in the market, letting traders catch opportunities quickly for their day trading.

Stock Scanners for Day Trading: Key Performance Indicators (KPIs)

KPIs play a major role in assessing stock scanner performance. Speed is critical; it directly impacts day trading results. Real-time or almost-real-time performance from the stock scanners for day trading will offer data as it occurs in the markets, thus improving day trading stock. Accuracy is equally significant: A low number of erroneous data points, avoiding misleads and enabling the user to act quicker based on real-time and precise stock scanners for day trading results, are key metrics for performance in evaluating scanners for day trading stocks. Reliability should also be rated; consistency in scanner performance and quality data input to support daily stock activities and decisions for day trading stock is critical to maintain performance levels in choosing scanners. High-quality scanners must operate flawlessly with reliability metrics showing how reliably they collect stock-related data, a useful measure of daily scan results. Thoroughly evaluate performance criteria for accurate and up-to-date results. It's crucial to look at several stock scanner reviews for day trading strategies and learn what works from each user. Accuracy rates give you valuable input on the reliability of results of daily scans that are critical to stock trading success for the day trading stock.

Mobile Stock Scanners for Day Trading: An Overview

Mobile stock scanners for day trading offer portability and accessibility, perfect for dynamic stock analysis. The speed and responsiveness needed are necessary with tools easily carried and readily available, which are both keys for stock traders. Day trading involves rapid-fire decisions, needing stock scanner tools easily accessible on smartphones and tablets to access live and current trading opportunities quickly. The range of scanners will be important when seeking a useful scanner for day trading, ensuring reliable functions and use. This feature from a stock scanner for day trading greatly assists day traders by helping quickly access up-to-date data from live markets, enhancing rapid and efficient transactions. Mobile stock scanner apps must incorporate intuitive navigation. Functionality from stock scanners for day trading and applications must be suitable, intuitive, and provide real-time results for a suitable day-trading experience. They can offer on-the-go alerts or signals in mobile applications. The selection of features available for different stock scanner app functionalities could dramatically affect day trading strategies and outcomes when selecting. Mobile accessibility brings crucial advantages for active day traders seeking real-time information to assist decisions based on analysis from a suitable stock scanner app for day trading needs.

Stock Scanners for Day Trading: Platforms to Consider

Picking the right stock scanners for day trading is crucial. The right platform makes all the difference. Many platforms boast sophisticated tools. But stock scanners for day trading differ vastly. Some excel in finding patterns, others provide real-time quotes. You need to scrutinize these differences carefully when deciding.

Key factors in evaluating stock scanners for day trading:

- Speed: Real-time data, super fast results are essential.

- Filters: Advanced filters are must. You want only perfect matches, nothing else.

- Data Updates: The faster data gets updated, the better the scan.

- Scalability: It should suit your current and future needs, scaling as you need.

Source: scanz.com

Stock scanners for day trading should cover your specific trade types (calls, puts, etc.). Features and functionalities determine which platform suits best. Research different platforms thoroughly, check user reviews, and weigh up the costs. Remember, stock scanners for day trading must meet your specific trading requirements, so tailor your search accordingly. Many high-quality scanners with extensive functionalities are accessible today, so finding a platform that's compatible with your preferences should be easy. Explore available options actively before settling on one.

Day Trading Stock Scanners: Integration with Brokers

Stock scanners for day trading need flawless integration with your broker. Seamless trading and swift execution are key. This seamless integration minimizes errors during buy or sell orders. Seamless stock scanners for day trading integration allows quick decision-making. Avoid losing valuable trading opportunities because your platform isn't communicating.

Consider these essential aspects:

- Order Management: Stock scanners for day trading need to submit trades through the broker without hassle. No hold-ups!

- Real-Time Data Feed: Stock scanners for day trading with up-to-the-second quotes are essential. Latency is detrimental to day trading profits.

- Tick Size Matters: Fine adjustments matter a lot. Your scanner needs accurate quotes at tick sizes matching broker's trading limits.

- Platform Compatibility: Examine broker compatibility closely, the ability to interact with the platform, ensure compatibility from the beginning!

The Role of Stock Scanners in Day Trading Strategies

Stock scanners for day trading assist in finding precise trading opportunities that suit each trader's individual plan.

- Identify Patterns: Stock scanners for day trading reveal hidden patterns and opportunities missed by the naked eye.

- Quick Screening: Identify candidates within minutes based on pre-defined criteria. This aids quicker reactions.

- Risk Management: Filter out high-risk options quickly. Limit downside losses using this process.

- Optimize Strategy: Optimize entry and exit points with specific scanning filters that apply for the strategy used, tailor scanner input for optimized entry/exit point finding.

Source: speedtrader.com

Good stock scanners for day trading give insight, enabling you to maximize winning trades, enhancing efficiency.

Tips for Using Stock Scanners Effectively

Utilize stock scanners for day trading by knowing your limitations and the scanner.

Tactics to Master Stock Scanners for Day Trading:

- Define Goals: Determine which indicators and filters need priority. Customize criteria that work specifically with the trader's individual strategy. Focus on stock scanners for day trading that have these tools readily accessible, making for more personalized configurations.

- Keep Up-to-Date: Learn the newest scan strategies in day trading. Understand adjustments as your platform evolves. Stay proactive in learning more about how to utilize the stock scanner for day trading that suits your current circumstances. Stock scanners for day trading are frequently updated.

- Stay Focused: Minimize distractions when scrutinizing results. Eliminate clutter that gets in your workflow, focus on using the scanner to meet objectives without needless delays. Stock scanners for day trading help organize and clarify data.

The Importance of Backtesting in Day Trading Stock Scanners

Backtesting is pivotal. It’s not merely important; it’s vital when using stock scanners for day trading.

- Accurate Feedback: Provides a verifiable method to adjust filters accurately. Accurate historical performance should be part of your backtesting strategy, enabling traders to tweak and refine scans for specific needs. Accurate and consistent data gathering should always come from stock scanners for day trading to produce best results in backtesting.

- Adjust Performance: Modify stock scanner filter rules and verify efficacy before taking the action in the actual markets.

This detailed overview helps understand stock scanners for day trading’s necessity in modern day trading methods. Utilize these insights, customize your criteria and use these tools effectively.

Free Stock Scanners for Day Trading: Finding the Best

Free stock scanners for day trading are tempting, but careful. Many boast impressive features, yet their usefulness hinges heavily on your trading needs. These scanners offer a way in for newcomers to stock trading or people who're looking for a simple way to find deals, but the limits of their tools, such as their data updates, may restrict trading success.

Consider these key questions when using a free stock scanner for day trading:

- How often does the scanner update?

- What trading signals does it produce?

- What kind of technical analysis does the free scanner have access to?

Free stock scanners for day trading are a mixed bag. They often have limitations compared to paid options, influencing profitability. Understanding these constraints is crucial before jumping in. Free tools may be better if your strategy does not rely heavily on advanced metrics. But these stock scanners for day trading aren't ideal for frequent, precise analysis or advanced techniques used by professional traders. A real trade winner requires thoroughness, and free stock scanners for day trading often compromise that.

Paid Stock Scanners for Day Trading: Evaluating Premium Options

Paid stock scanners for day trading offer significantly more features. These are designed for traders who need deeper insights, reliable updates, and more advanced analytical resources. They offer crucial details for informed day-trading decisions. These scanners' cost isn't just a price tag; it reflects the access to resources critical to consistent profits. For reliable day trading, the significant benefits of a premium stock scanner for day trading may outstrip free tools.

Investing in quality scanners for day trading provides superior insights, allowing you to adjust trades promptly. You should also review data sources' accuracy and consider historical accuracy records of any stock scanner. Consider, what features can differentiate a premium tool from a free version? Understanding this crucial distinction between free and paid stock scanners for day trading is key to trading strategy. Price matters, but don't just see it as the most important issue. Data and speed of delivery from stock scanners for day trading matter a lot, too.

Real-time Stock Scanners: Capabilities and Choices

Real-time stock scanners for day trading are paramount. They deliver information fast; they react as markets change quickly, providing timely insights critical to informed day trading decisions. In this dynamic market, data delivery timing is everything. Real-time access can enable swift reaction, turning slight price changes into profits. High-frequency stock traders particularly rely on these stock scanners for day trading, recognizing that the difference between success and failure often hinges on how rapidly trades are executed based on quick updates and timely signals. The market is a high-octane space; if you don't stay ahead of the data stream, your returns may dwindle significantly. These real-time updates enhance decision-making, improving odds for stock scanners for day trading strategies. Timely action fuels day trading successes.

Source: wp.com

Analyzing the Latest Features and Innovations

Constant development refines stock scanners for day trading. What are these innovative elements, and how should you use them? Features like AI-powered predictions and algorithmic trading assist in uncovering complex patterns; these advancements impact stock scanner efficiency and signal accuracy. New indicators help anticipate market trends and enhance strategy planning. Continuous innovation in this domain is crucial to keeping pace. In-depth analysis remains a vital part of successful stock trading. Staying ahead with updated features elevates success.

Looking ahead in day trading is a huge challenge for traders. Keeping up with new features improves signal accuracy, and, most importantly, gives you the needed resources for navigating the market’s dynamism. Advanced tools help evaluate opportunities and support smarter decisions, improving trader prospects.

What to Look for When Evaluating Stock Scanners

Finding the right scanner for day trading is crucial, influencing earnings or losses. Thorough evaluation should focus on features specific to trading. Prioritize a user-friendly interface to reduce transaction delays. The responsiveness of stock scanners for day trading needs scrutiny, since a lag may lead to losses. Reliability of data and promptness are musts, as timely reaction equals quicker earnings and minimizing losses. Security is equally crucial; safeguards should ensure account protection for seamless and worry-free activity. Prioritizing real-time data and ease of access means successful stock trading. Robust analytical tools help identify trading patterns and signals accurately. Prioritize a stock scanner that keeps pace with innovation and trends; features should complement your style and knowledge level. Stock scanner reliability should be the top priority. Don't settle for mediocre data delivery—only top-quality tools can be viable. Carefully weighing essential elements ensures suitability for long-term returns, while evaluating data accuracy remains crucial.