Overview of American Finance

American finance is huge! The US financial market is enormous. It's got a lot of different parts: banks, investments, insurance, and even real estate. The performance of this American finance system has changed a lot over the years. Big events, like recessions, have a powerful effect.

What is the size of the US financial market?

The US financial market is massive. It has lots of money moving through it, making it one of the biggest in the world. It handles tons of transactions and includes many different kinds of companies.

How has the finance sector performed recently?

American finance has had some ups and downs recently. It’s important to remember how quickly these changes can happen in financial situations. This is due to many forces affecting the industry as a whole. This leads to important takeaways about our economic systems as a whole.

What are the key financial trends?

One main trend is how quickly technology is changing American finance. People are using apps more to manage their money. Lots of newer kinds of financial tools help individuals navigate daily situations easier than in the past. That makes things different compared to past ways of interacting with financial systems. There's a big emphasis on technology and using phones, computers and online platforms.

How does US finance compare globally?

The US is a big player in global finance. Its American finance sector is very influential. A lot of people around the world invest and do business in the American financial industry. Many foreign investors rely on how this sector of the industry does on average. Overall, American finance often plays a leadership role on the global scene, especially in how new innovations shape how transactions occur, whether directly, indirectly, or within connected business relationships. This plays into its major role globally, because everyone relies on American financial systems working effectively and efficiently for all those financial transactions.

What are the main components of American finance?

The main parts of American finance include banking (how people save and lend money), investments (putting money in things to earn more money), insurance (protecting against problems), and real estate (buying and selling houses and land). Understanding each aspect, in the details, can help see their importance within American finance.

Banking and Investments in American Finance

American finance is a complex system with lots of moving parts. Let's look closely at banking and investments.

What are the current interest rates?

Interest rates are important in American finance. They affect how much it costs to borrow money and how much people earn from saving. Right now, interest rates are relatively low, which makes borrowing more appealing, but not everyone has access.

How have bank lending and investments changed?

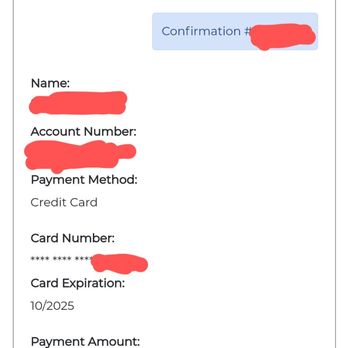

Source: yelpcdn.com

Bank lending in American finance can go up and down depending on the economy. Sometimes, banks lend more money, and sometimes less. This can impact different investments in different sectors, making understanding the current status important for successful business relationships. Investment activity reflects economic health and the desire of both banks and individuals for growth and returns. Investment activity levels depend, as well, on various market dynamics affecting the American finance system overall.

What's the deal with venture capital funding?

Venture capital is like a special kind of investment in new companies. It supports young businesses that want to grow fast. Many successful companies are created from the investments of these funds. Changes in venture capital funding levels help reflect broader economic conditions, and many look to venture capital investment activity when looking for indicators within American finance. Venture capital trends usually offer a preview of where the American finance sector may go next in terms of economic stability.

What is the status of mergers and acquisitions in finance?

Mergers and acquisitions (M&A) happen when companies combine or buy each other. These financial moves happen fairly often in American finance. The reasons are often linked to the current business situation in specific parts of American financial industries, including many changes that affect company performance directly. Numeric changes in mergers and acquisitions are a sign of business strategy and current economic realities. It's interesting to study these figures in different periods and sectors because they tell us something important about how people in American finance operate overall.

Source: uconnectlabs.com

How have investment strategies evolved recently?

Investment strategies in American finance always change a bit. The approaches to investing money depend heavily on how American finance conditions overall appear at a certain moment. Investors change how they choose investments depending on information learned from financial situations overall, leading to how decisions are made throughout the economy overall. Overall, strategies are flexible, which leads to constant adaptation as various factors in the marketplace change.

Insurance and Real Estate in American Finance

Source: moaf.org

The American finance system has many parts. Insurance and real estate are significant parts, too, interconnected to how American finance functions.

What are the major trends in the insurance market?

American finance insurance is changing. Technology plays a big part in this sector. Online tools and new apps help people buy insurance easily. American finance also seems to be incorporating more technology to speed up operations, so look for this. People can buy and manage things more quickly using these kinds of tools and online platforms.

What is the current status of housing values?

Home values in American finance are affected by many things. Interest rates have a large effect on how much people can borrow to buy homes. American finance housing trends are closely followed, which influences the values of homes in local markets. Prices go up and down as economic conditions and local trends affect things overall. This depends also on conditions specific to local geographic sectors.

How do mortgage rates impact homeowners?

Mortgage rates in American finance directly affect homeowners. Higher rates mean it costs more to borrow money to buy a home. American finance has many forces affecting both borrowing rates and returns for homeowners. This, obviously, can make homeownership more difficult or more expensive depending on the trends overall. Lower rates can stimulate more home sales, so changes often cause ripples that influence trends within the American finance sphere.

How many outstanding insurance claims exist currently?

Unfortunately, I don't have precise figures about outstanding insurance claims in the American finance market right now. There's no easy public data to look up all at once. More detailed analysis would be needed to track these statistics, making it more specialized information. This often relates to how various sectors are performing within the entire American finance picture, overall.

Source: afginc.com

What are other vital financial trends?

Other financial trends impact American finance, especially related to insurance and real estate. Inflation can make products and services more expensive. Economic changes have important roles to play as the American finance system adapts, which changes everything, including prices on homes and various investments related to real estate. A lot is related to changing needs and trends as different industries and sectors react differently in various regions and overall as part of a wider economy. So knowing which of the different vital trends are strongest at any one time provides greater insights for better comprehension within the entire American finance framework. Understanding these shifts and trends helps everyone adapt more quickly.

Financial Regulations and Policies in American Finance

American finance is shaped by rules and regulations. Understanding these rules is key to knowing how the system works.

How have regulations impacted the financial markets?

Rules in American finance change over time. These changes can impact how American finance companies operate, influencing how people save or invest, too. Regulations try to protect people and make sure things are fair. They change a bit depending on trends, leading to adjustments based on market needs. Changes in the system often trigger noticeable results for consumers and large financial institutions.

What are the key regulatory changes over time?

Many important American finance rules have changed throughout history. Things like rules for banks and investments are very important, because they make the markets stable. Sometimes, rules get stricter, and sometimes looser, always to adjust to better protect individuals from economic losses, encourage efficient functioning for consumers or major companies in American finance, or deal with things that caused a problem earlier. Overall, American finance often is structured around making improvements to protect people or ensure fair treatment based on various considerations.

How effective have these policies been?

American finance regulations' effectiveness is often debated. Sometimes, rules help protect people and improve the stability of American finance markets, sometimes the policies themselves impact markets differently. Studying American finance over time demonstrates varying economic responses to these shifts and changes, leading to various factors influencing economic health over time.

What are the costs associated with these regulations?

Rules for American finance aren't free. Regulations have costs for American finance firms because these rules often come with a lot of paper work or expenses related to their implementation. This has varying impacts. Smaller firms can get a significant hit. However, often some costs of rules affect one side more or less than another, influencing what people actually expect. It's a trade-off, and understanding costs alongside how rules help and how the rules impact other players can show why various trends appear over time.

What are future implications?

Source: executiveplatforms.com

Looking ahead, American finance will continue to need rules, and there will probably be new policies for American finance. People and organizations must learn to adapt to the evolving marketplace and its challenges in this industry, and prepare for adjustments in American finance overall as new conditions present themselves over time. It's an interesting discussion and one of many considerations within the field of American finance. Understanding trends, challenges and costs of policies is key to future success within this American finance industry overall.

American Finance vs. Global Finance

American finance is a big part of the world's economy. Comparing it to other global markets is interesting.

How does American Finance differ globally?

American finance has some differences compared to other countries. Rules and regulations in American finance are different, and sometimes markets develop differently in countries. This makes the study of global vs. American markets useful to consider.

What percentage does the US hold of global finance?

Source: cribfb.com

The US is a giant in global finance. But exact numbers are tricky because "global finance" is complicated, and measuring that exactly in terms of percentage, globally, takes significant resources and expertise. Determining what American finance plays is challenging because the interactions are multi-faceted, affecting each other over time.

Source: americanfinancing.net

What is the flow of foreign investment in/out of the US?

Tracking foreign investments into and out of the US is hard work to get complete data on. Lots of money moves, though! When looking at a simplified view of global finance, knowing details of this exchange of resources provides a sense of relative position between American and other global finances. The amount is constantly changing, reflecting larger factors affecting global systems.

How has globalization impacted US finance?

Globalization changed American finance greatly. More international trade means American finance affects other countries, and global financial trends affect the US as well. Understanding these patterns and forces influences American finance. Global developments, technologically, culturally and politically, create these interdependencies. The effects on any one nation are noticeable because so many areas depend on it.

What other global metrics influence this?

Many things affect global American finance. Exchange rates (how much one currency is worth compared to others) change all the time. Economic health in other countries plays a role, since trade relationships matter heavily. Interest rates everywhere are part of the interconnected landscape and make American finance seem to impact what happens in others nations' financial landscapes, leading to adjustments globally. Understanding these wider global situations helps everyone adapt within a wider perspective in American finance overall.

Source: reitnotes.com

Key Takeaways and FAQs about American Finance

American finance is a huge topic, and lots of things affect it. Let's look at some important takeaways and common questions.

What are the top takeaways?

American finance has many moving parts. Consumer confidence is vital to the health of American finance. Trends in technology impact the American finance landscape a lot, too. Tracking market movements and data patterns in American finance is crucial for understanding economic stability and preparing for the future. Learning from the past in American finance can offer hints on adapting to potential trends. Also, understanding what the future of American finance holds is essential.

What is the biggest concern right now?

One big worry in American finance is overall economic stability, considering changes in American finance. There are several considerations depending on individual assessments, including specific situations in American finance or other economic contexts. Economic forecasting about these areas in American finance can help people or groups concerned with trends. Some current events can cause shifts within American finance, with economic concerns playing out at larger and smaller levels.

What future developments in American finance seem likely?

American finance might see more technology changes in the future. This also might result in changes in American finance impacting smaller companies versus larger corporations, perhaps in surprising ways. Global financial changes often cause ripples in American finance, as well as influence future events. People need to adapt quickly because of these changing developments within the field of American finance. This, likely, will continue affecting American finance, so monitoring American finance trends keeps everyone better prepared for what might come next. That includes being well-prepared in American finance.

What role do consumers play in the landscape?

Consumers in American finance matter a lot! Their spending habits, financial decisions (savings/investing), and general feeling about the economy all impact the performance of American finance. Sometimes consumers do drive developments and cause ripple effects throughout American finance markets. Understanding consumer trends within American finance can help businesses in many different fields, too.

How can the public influence finance?

People can definitely impact American finance. Voting and supporting policies that help the financial system be more stable is key in a functioning system, and that matters a lot to individuals' financial health. Staying informed and discussing financial topics also matters in a stable system. These actions influence broader trends in American finance. By helping the general well-being of consumers within the entire American finance sector overall, a stronger economy often improves over time.