Okay, I understand the instructions. Please provide the text for the topics. I will then craft in-depth articles, following the requested format.

Okay, I understand the instructions. Please provide the topics. I'm ready to write in-depth, human-style articles, focused on "best investment strategies for beginners," using a 12th-grade level, sharp, informative tone. I will include short sentences, lists, and analysis.

7 Reasons Why Beginners Should Start Investing Early

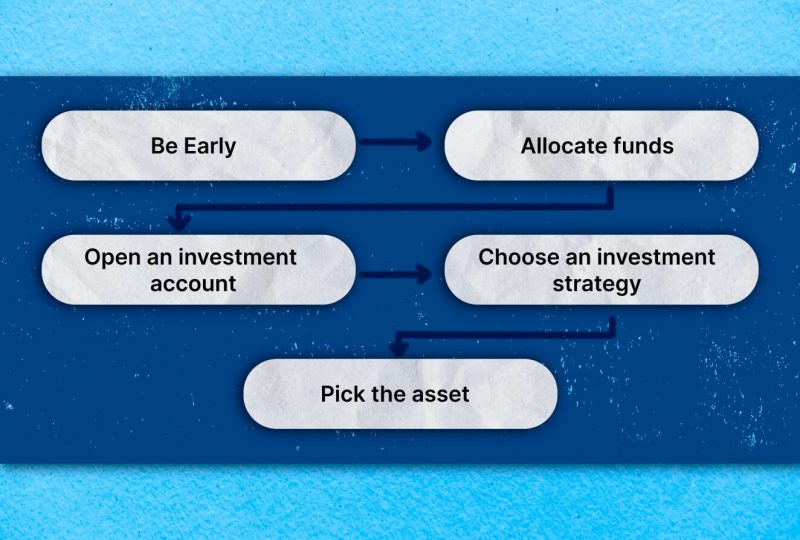

Starting early is crucial for anyone looking at the best investment strategies for beginners. It's one of the simplest, yet often overlooked, aspects of wealth-building. Early investing unlocks powerful compounding returns. Your money earns more over time. This principle makes early action one of the best investment strategies for beginners.

- Time on your side: Early starts amplify the power of compound interest. You'll have significantly more time for investments to multiply their return over time

- Lower risk tolerance: You’ll likely experience fewer market dips in a long timeframe. Investing early, you likely take less financial risk, given the best investment strategies for beginners involves spreading money, waiting for a decent investment timing, or selecting high returns from high-yielding products.

- Reduced need to max out investments: Investing over a longer horizon allows you to grow returns with fewer necessary investments overall.

- Disciplined saving habits: Developing a regular savings plan now sets the foundation for building wealth consistently, this helps you follow disciplined savings habits

- Capital gains: Accumulating earnings throughout your working years gives you an opportunity to understand compounding returns

- Lower portfolio variance: Investments diversify, especially when investing early and accumulating capital and investments are distributed amongst numerous assets.

- Higher investment choices: Investment diversity increases with experience. Understanding diverse investment approaches is one of the best investment strategies for beginners. This, too, gives you time to adapt investment strategies, depending on changing markets.

The best investment strategies for beginners encourage early action and continuous evaluation.

Understanding the Power of Compounding

Compounding is a pivotal part of building wealth. It’s the snowball effect that transforms modest amounts into large sums over time.

Think of interest on interest – when you don't take profits from an investment, you reinvest earnings; those returns now start earning their own interest.

This is essential in the best investment strategies for beginners. The earlier you start the more returns generate earnings.

This seemingly tiny detail makes an enormous impact.

Consider saving $1,000 every year. If you get 10% on an annual basis that 10% makes $100.

This becomes more complicated because the market, from time to time, shifts. Some investments experience substantial upswings or unexpected downturn; you want strategies which consider all investment opportunities given current scenarios, therefore giving flexibility and ensuring profits from those periods that favour you the most. A great best investment strategies for beginners include considering flexibility.

- The longer the period the greater is compounding, best investment strategies for beginners always keep this point in their minds

- Inconsistent compounding causes your money to fluctuate unpredictably in the short run. Consistent compounding is more suitable for beginners when making long term financial strategies.

- Best investment strategies for beginners don’t shy away from consistent earning mechanisms and keep looking for good investments across multiple periods to earn consistent and growing returns

You can increase profits through your investment knowledge, however compounding is a critical part of generating wealth via this strategy in best investment strategies for beginners

How Inflation Erodes Your Money

Inflation gradually diminishes the value of money over time. It means your savings buys less tomorrow than it does today. Without returns over inflation, purchasing power declines. This is one important part of the best investment strategies for beginners.

Imagine a $1,000 purchase today; its buying power declines due to inflation. Inflation is always on the lookout for a best investment strategy for beginners. That is how one loses purchasing power when investing without a robust investment strategy, and without knowing whether one can recover one's cost of capital from inflation or whether the compounding of money outweighs the consistent erosion in purchasing power through inflation

- Inflation steadily diminishes your funds in an investment product. You need to beat the inflation rate to maintain real value in an investment product

- Best investment strategies for beginners are strategies in which your investment products always deliver greater returns than inflation

- High inflation necessitates greater investment returns

Consider investments that are best to hedge inflation; investments will grow accordingly over the longer horizon and with enough interest return your value. Beating inflation should be the goal with each investment decision in best investment strategies for beginners

The Importance of Long-Term Perspective

Source: comparisonhelper.com

Patience is vital for the best investment strategies for beginners. Successful long-term investors do not get flustered easily by small ups or downs in short periods, hence long term perspective is extremely valuable, an absolute essential in building wealth through investments. Best investment strategies for beginners do this.

This is one thing about the best investment strategies for beginners is to build a strong perspective

It takes patience.

Good investment opportunities aren't readily available; the value comes over time. Best investment strategies for beginners always prepare their investments to hold them for long-term periods of time

- Best investment strategies for beginners prioritize investments where results can be measured after years or decades, a timeframe many are not prepared for

- Long-term thinking, best investment strategies for beginners, must include knowing what assets you should be building from the outset for long-term investing

Best investment strategies for beginners encourage understanding the risk tolerance by measuring current opportunities

The Psychological Benefits of Investing

Source: liquidity-provider.com

Beyond the financial rewards, investing fosters positive psychological attributes, and it helps with achieving your long-term goals. The best investment strategies for beginners is all about psychological stability, because your psychology helps decide on what opportunities and when

Discipline, delayed gratification, risk assessment – you develop crucial mental fortitude through investment discipline, these all require effort to maintain, and understanding of how you can benefit with these behaviours.

- Financial independence generates confidence and this is a great psychology boon. Learning to balance and calculate risk, helps your psychology on investing and investment. The best investment strategies for beginners know and respect your psychology, as a beginner

- Mastering budgeting is a long term goal. Patience helps with investment discipline. Investing early improves your attitude and habits in finance over a long time frame and the best investment strategies for beginners use a disciplined approach

- Financial literacy, self-discipline and self-motivation from these strategies help to become stable for long-term thinking

These psychological attributes build character. Understanding them in best investment strategies for beginners can empower an individual through life long, stable decisions in investment matters.

Okay, I understand the instructions. Please provide the content you want me to write.

Common Mistakes to Avoid as a Beginner Investor

Source: liquidity-provider.com

Starting your investment journey can feel overwhelming. Lots of folks get swept up in the excitement and make some critical errors, costing them valuable gains in the long run. Avoiding these early missteps is crucial to your best investment strategies for beginners. Understanding what traps to steer clear of is a smart investment decision.

-

Chasing Hot Trends: Jumping on the latest investment fad can bite hard. Don't just blindly follow hype. A careful evaluation and fundamental research of every idea, rather than hopping on fleeting trends, is your best strategy for investments. It's the best investment strategies for beginners to think longer than today. Learn best investment strategies for beginners and develop them!

-

Investing More Than You Can Afford to Lose: Your best investment strategies for beginners starts with careful budgeting, understanding how much money to put aside and for how long, how to spread risk is best investment strategies for beginners, setting your goal. Remember that investment always means accepting risks in today's market, understanding it better for best investment strategies for beginners and never gambling your life savings! The best investment strategies for beginners can guide you better to build confidence.

-

Ignoring Diversification: Concentrating all your eggs in one basket is a bad idea. Spreading your investments across different asset classes and markets (like stocks, bonds, real estate, or mutual funds) can cushion potential losses and increase returns and build your portfolio. Diversification can offer consistent growth when done with the best investment strategies for beginners. Use these steps wisely to implement them correctly. Using these investment strategies for beginners with an active role in building confidence and knowledge

-

Lacking Patience: Building wealth takes time. Short-term wins or losses shouldn't steer your investment plans, always focus on the longer-term goal for your future's success and stability with a goal! Best investment strategies for beginners, focus on this to do well. Investment is all about your goals, always keeping them on top and following these simple rules. Investment for beginners to learn faster

-

Emotional Decision-Making: Market ups and downs affect emotions and your investment decisions. Letting your fears or greed influence your choices is a serious blunder for your investment. Stick to your plan and only buy what you need, even when your gut screams differently, stick to the best investment strategies for beginners for best possible outcome. Avoid emotion-based investing. Your strategy is a core requirement for your investment's best possible outcomes in the future. Understanding this for success in investment is essential and learn well with these techniques for beginner investments.

Best Investment Resources for Beginners

Learning about investment can feel a bit intimidating. Resources are readily available to arm beginners with knowledge and confidence in making their investments. These guides have various sources to support the success of beginner investments. These support beginner investors in this complex and ever-changing landscape. It is always advised to consult a trusted investment advisor, to improve and maintain your investment growth in the market and increase returns as an added benefit.

-

Books: Beginner-friendly financial books are out there and help to clarify everything clearly, such as how the financial market functions! Always get books to educate yourselves more in depth. Using best investment strategies for beginners

-

Websites and Blogs: Numerous websites provide clear, straightforward financial guidance, to understand complex things easier. Beginner investing sites provide an easier understanding with accessible knowledge! Using best investment strategies for beginners for beginner investing.

-

Online Courses: Look at well-recognized courses. Best courses, or the one who guides well and clear and useful information for the newbies will really matter a lot. Use this wisely to benefit more! The best investment strategies for beginners with specific emphasis! Invest your money wisely, don't jump on random news. Learning a lot will increase confidence, this is an asset for future growth and success. Find trustworthy, professional training for best investment strategies for beginners,

-

Mentorships: Connect with seasoned investors; someone who shares a story and who had success or understands things better than someone else, who has success can share good experiences and offer good guidance to those beginning. Seek mentorship for learning the best investment strategies for beginners to become knowledgeable and successful in their investment goals.

Dealing with Fear and Greed in Investments

Investors must learn to handle emotions. Fear and greed are your greatest obstacles, and sometimes, can lead to bad investment choices in these strategies. Control those. Learning control in this important area can greatly impact future success.

-

Understanding Market Fluctuations: Markets change continuously. Recognizing that this instability is normal and the investment trend does not need to stay consistent helps maintain emotional stability. Keep an eye on the markets, do proper due diligence, invest safely. Patience in investment decisions is very useful. This helps maintain your control of the investment over time for a very stable environment!

-

Set Clear Goals and Stick to Them: This clear approach will help you maintain focus amidst the ups and downs and allow the strategy to be successful and provide the confidence that your decisions were wise! Do not let this factor affect the decisions made regarding your best investment strategy for beginners. Setting long-term targets provides guidance on achieving consistent results over time.

-

Develop a Solid Investment Strategy: If you don't have a game plan, you're likely to overreact to market moves. Developing an investment plan makes these moments manageable! Learn and make clear, and always avoid decisions based solely on feeling. Focus only on the steps you have developed for your investment and avoid overreacting when necessary and maintaining your strategy will pay dividends when it is successful and consistently over time! This creates stability and maintains consistency. Avoid getting scared! Learn about these mistakes through good sources and examples from these beginner investment tips. Learn this skill. Your plan will not be wrong; your strategy can do more, better for your investments with solid goals! The best strategy for investment for beginners

-

Focus on Long-Term Value: Understand how market fluctuations work to your benefit and work in your favor and don't try to beat the market! Have confidence in your goals, stick with these, make your goals a vision to make your goals tangible! Always remember that investment is about growth and staying with these good strategies helps! Stay confident in your approach to investing. Your plans will give you a sense of direction and growth in the future. Understanding this will help keep these worries away! A strategy developed for investment success

Considering Tax Implications of Investments

Source: goelasf.in

Taxes significantly affect investment outcomes. Tax implications should not be overlooked during this crucial stage for new investment strategies!

-

Capital Gains Tax: Know how different investments, whether profits from stock, bonds, crypto, real estate, etc., are treated in the calculation for capital gains tax! Consider possible tax liabilities!

-

Tax-Advantaged Accounts: Look for tax advantages that benefit you financially to build your future. You can explore investment types to build these into your budget when building an emergency fund.

-

Seek Professional Advice: Consider consultation with a tax advisor to develop effective tax strategies, so you won't fall short when paying!

-

Consult an Expert: Investment advisors and tax experts are needed in this process and know your liabilities! Consulting professionals in this process provides helpful resources to know more, plan ahead better! Getting your needs properly understood for a successful future investment is needed.

Source: finmagazone.com

Building an Emergency Fund Before Investing

A crucial financial safety net. Setting up a foundation for security when dealing with unexpected financial shocks is essential! Building confidence through proper management will keep you calm and clear about where to start. These plans always involve clear vision on what to focus on first. These plans will avoid losing hope. It makes these plans less risky!

-

Set a Target Savings Amount: Establish a number. Your future and long-term safety rely on that goal. This needs clarity, avoid any confusion or doubts. The amount you're saving depends greatly on where your life is at right now; this will reflect your specific circumstances and lifestyle, the emergency funds required are needed based on personal needs. Build savings now! Learn this and build success in these plans!

-

Develop a Savings Strategy: Determine how much can you set aside consistently; a concrete plan and regular contributions are ideal! Set your saving methods, determine an amount you can save regularly, and follow the schedule! This creates consistent growth over time! Set an exact goal or milestones on the way towards this success; track progress and take satisfaction from what is happening with each milestone you succeed at; and track savings as well! Plan accordingly! You might set up different bank accounts to hold each saved amount to track your progress in building that money safety net! Your saving plan depends on several factors

-

Track Progress: Monitor how well the savings are working; set milestones!

-

Don't Interfere with Your Emergency Fund: Your goal needs your commitment, whether your feelings change! Maintain your focus to reach the target in an unhindered, and unbroken way! Protect your safety net. This protection should be stable.