Best Personal Finance Tips for Beginners

Personal finance is tricky, but it doesn't need to be a headache. Mastering your money is achievable with the best personal finance tips, small steps and dedication. These simple steps unlock a world of financial freedom. Best personal finance tips are crucial. Best personal finance tips empower.

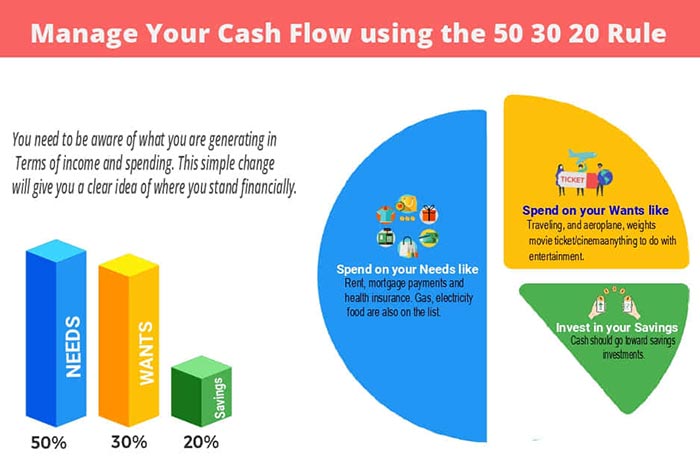

Budgeting Basics: Creating a Spending Plan

A spending plan is your map to financial security. First, track every penny. Pinpoint areas where money goes. Identify your needs and wants. What percentage of your income is needed for essentials? Which categories can be trimmed? Be honest. Review regularly. Re-evaluate monthly, maybe bi-monthly. Adjust accordingly to changing priorities, events. A budget should adjust with your life. Best personal finance tips highlight the necessity for a robust budget.

Saving Strategies: Building Your Emergency Fund

Emergency funds are vital, not an option. How much do you need in savings? Aim for 3–6 months' worth of living expenses, first. Automate these deposits for convenience. Find the best interest rates if you're considering a savings account or some specific fund. Review the amount occasionally and top up if necessary, adjusting based on your lifestyle changes. Your safety net starts building now, through small efforts over time. Consistent contributions to your emergency fund, regardless of amount, provide peace of mind and are best personal finance tips at work. Best personal finance tips mean early wins in securing financial health.

Debt Management: Strategies for Paying Off Debt

Source: pinimg.com

High-interest debt is a financial foe, often costing more over time. Identify your debts: car, loans, credit cards etc., order debts from lowest to highest interest rates and conquer. A dedicated debt-repayment strategy. The Snowball method prioritizes the smallest debt, while the Avalanche method focuses on highest-interest debt. Set your goal – clear it off immediately if possible. Pay extra every chance you get! Sticking to a well-defined debt-payment strategy is one of best personal finance tips you will find anywhere. This builds a clear roadmap, focusing on short-term, measurable, goals and the benefits of best personal finance tips are immediately evident in eliminating debt.

Investing 101: Starting Your Investment Journey

Investment decisions can feel complex, but understanding the basic principles simplifies the approach. Start early! Learn and analyze the markets in the beginning! Understanding market trends are key. You might start with low-risk, like bonds. Explore savings options offering growth, with long-term vision. Be aware that your risk and reward profiles can vary. Investment decisions might include a combination of savings accounts, or a specific bond/stock portfolio. Investing requires diligence. Seek guidance, get good advice. Best personal finance tips recommend starting young and building a strong portfolio for your long term plans and financial security. Following good personal finance tips creates long-term strategies for better, sustainable outcomes.

Best personal finance tips empower financial awareness for good outcomes. Understanding money's role brings long-term freedom. Best personal finance tips should be integrated in our daily plans and efforts, one step at a time. The best personal finance tips are in a combination of these different elements. Best personal finance tips bring the freedom of your future in sight. The simple yet best personal finance tips highlight the simple fact, that consistent effort brings results.

Best Personal Finance Tips: Track Your Expenses

Best personal finance tips start with tracking your spending. This is a vital, fundamental piece of any solid financial strategy. It's not just about the numbers; it's about understanding where your money goes. Best personal finance tips often emphasize this foundational step. Accurate expense tracking is the cornerstone of responsible money management. Ignoring this element undermines all other best personal finance tips.

Best personal finance tips show you a clear path to controlling your finances. Without knowing where your money is going, any financial plan, even the most detailed best personal finance tips, is useless. This might sound obvious, but it's the core of sensible financial planning. Knowing your expenditure is like knowing your friend's heart- you can anticipate their moves if you are paying attention!

Tracking your spending involves:

- Listing every expense

- Categorizing these expenses

- Reviewing spending patterns frequently

- Regularly adjusting your strategy

- Staying true to your plan and adjusting your priorities

Why is tracking expenses part of best personal finance tips? Because it helps with budgeting, saving, and making smarter financial choices. Best personal finance tips frequently come back to the fundamental practice of examining what you are spending on.

Practical steps for tracking expenses:

- Pick a method: Use a budgeting app, spreadsheet, or notebook.

- Document everything: Include every purchase, big or small.

- Review your records: Examine spending every few days, weeks, and possibly monthly, to keep track of habits.

Tracking gives you valuable insight into your habits, revealing where to focus attention when tweaking best personal finance tips that serve you.

5 Ways to Save Money Effectively

Source: centscontrol.com

Saving money effectively takes dedication and good personal finance tips that can make a real difference.

- Cutting unnecessary expenses: Eating out less frequently and taking public transport will contribute to an efficient saving habit. Try to look at spending you could change for some of the best personal finance tips. This habit is a start towards better savings management

- Increasing income: If you're capable and allowed, take steps to make more income, and you'll improve your finances overall;

- Finding good deals: Comparison shopping helps with finding bargains while adhering to best personal finance tips! Look at different product features too to save!

- Automate saving: Putting aside money directly from your checking account to your savings, is a big help. Best personal finance tips have this in common; building financial discipline;

- Planning trips on a budget: Do some good research on different transportation methods that are cost-effective to reduce spending

Finding some ways to economize is usually a solid strategy within some best personal finance tips!

7 Reasons Why Budgeting is Crucial

Budgeting is the bedrock of sensible financial planning; It forms the basis for your finances! This is a strong idea underpinned by the many best personal finance tips;

- Gives clarity on spending: Knowing your spending reveals what to focus on for some best personal finance tips.

- Prevents overspending: Budgets allow one to restrict expenditures;

- Achieving financial goals: Budgeting helps reach set goals as per best personal finance tips.

- Facilitating saving: Budgeting often fosters a solid financial lifestyle and saving.

- Controlling impulsive purchases: Knowing your limits aids self-control over impulse buys. This is one good concept for best personal finance tips

- Providing for emergencies: Budgets usually prepare for possible economic situations, helping with emergency funding for financial security!

- Reduced stress and financial worries: Effective budget plans reduce mental strain, making handling money a more manageable job for many best personal finance tips!

Best Personal Finance Tips for Building Credit

Building a strong credit score requires disciplined effort.

Here are some of the best personal finance tips relating to establishing your credit. It takes some consistent discipline to keep on track and get the best of these tips.

-

Keep credit utilization low: Ensure spending is only a tiny part of your available credit.

-

Have good payment habits: Pay your dues on time, with good credit!

-

Check your credit reports: Look regularly at your reports, to avoid bad errors that affect your credit. This is important and a must-do!

-

Don't apply for many credit cards in a short span: Avoid the traps, take a good amount of time before starting on a credit card frenzy for this best personal finance tips for a balanced approach.

-

Open a secured credit card (when appropriate): Secured credit cards have less stringent demands compared to traditional cards for more balanced, secure steps with best personal finance tips.

-

Use credit responsibly: Use credit for necessary items, not just fancy gadgets and overspending! Follow personal finance tips for some well-grounded ideas about using your money.

Source: spoliamag.com

Importance of Financial Goals in Your Plan

A plan is only as good as the targets it establishes. Setting clear financial targets and incorporating these aims into personal finance plans are key concepts for some of the best personal finance tips.

-

Provides direction: Goals show you where your money should be focused for a successful trajectory for many personal finance tips! Financial direction makes for an essential factor when following some good advice.

-

Promotes discipline: Reaching objectives typically requires consistent financial practice.

-

Motivation booster: Reaching your goals gives a strong sense of satisfaction and helps with maintaining a good attitude and plan for best personal finance tips

-

Leads to better decisions: Concentrating on defined targets empowers better and more insightful decision making with your financial matters as advised by several personal finance tips!

-

Measuring progress: Observing advancement keeps motivation high and ensures one keeps track of the journey to the ultimate aim for best personal finance tips!

Following best personal finance tips makes handling personal finances feel attainable and manageable.

Top 10 Best Personal Finance Tips to Improve Your Finances

Best personal finance tips are key to a brighter future. Best personal finance tips offer simple steps, easy to understand. Best personal finance tips are important in modern life.

- Budgeting: Track income, expenses meticulously. Allocate funds effectively, stick to your plan.

- Saving: Automate savings. Save small, frequent amounts for more bang for buck. Create different saving accounts.

- Debt Management: Pay off high-interest debts swiftly. Avoid accruing more debt. Best personal finance tips demand a debt management plan.

- Investing: Understanding different investment options can give a hefty ROI over time. A critical step for financial growth.

- Insurance: Protect yourself against unexpected setbacks with proper insurance. Review coverages, consider affordable options.

- Emergency Fund: Critical step, three to six months' living expenses. Prepare for the unexpected. A great strategy for best personal finance tips.

- Financial Goal Setting: Create and achieve your goals. Make SMART plans, best personal finance tips offer solid examples.

- Minimize unnecessary expenses: Eliminate subscriptions. Consider reducing dining outside budget and other unneeded expenses.

- Track Your Spending Habits: Use apps for budget and spending. Make records and do comparison. Important element in best personal finance tips

- Review and Adjust Plan Regularly: Things change! Review budget, goals at least quarterly. Check best personal finance tips that match your lifestyle

Simple Steps to Manage Your Money Effectively

Managing money effectively begins with knowing the exact picture, with best personal finance tips, life becomes easier.

- Record Your Income: Knowing exact figures will allow you to take smart actions, important step with best personal finance tips.

- List Out All Expenses: Include rent, food, transport, utilities, entertainment, all categories. Don’t miss anything, this will help develop strategies.

- Categorize Your Expenses: Group your expenses (rent, utilities, transport). Look for trends and save smarter using best personal finance tips.

- Track Your Spending for One Month: Analyze patterns. Pinpoint areas for reducing spending. Important, an aspect of effective best personal finance tips

- Create a Monthly Budget: Based on your recorded expenses, your income, allocate. Determine priorities for financial needs. With best personal finance tips, you’re a financial hero!

- Allocate money to needs first: Essentials first (shelter, food). Stick to your allocations religiously using best personal finance tips. Be dedicated in this journey.

- Review Your Budget Regularly: At least monthly. Are you sticking to it? Find areas for tweaking.

- Identify Savings Goals and Opportunities: Plan for large purchases. Finding hidden saving potential using best personal finance tips.

- Create An Environment Conducive To Keeping Records and Revisiting Budgets: Important to revisit monthly budgets with updated best personal finance tips

How to Create an Effective Emergency Fund Strategy

Best personal finance tips are key to success with creating an emergency fund.

- Set an Amount: Begin immediately, build slowly, even small amounts daily can matter, best personal finance tips say do this.

- Identify Unexpected Expenses: Consider car repairs, health problems, or loss of work.

- Decide on a Realistic Timeline: How quickly can you reach the target emergency fund amount, using the best personal finance tips?

- Automate Transfers: Set automatic transfers to the emergency fund. No more excuses to not put aside any amounts. Important with best personal finance tips. Make it a habit.

- **Build a cushion of security for any unforeseen event, best personal finance tips say you should not rely on the kindness of other for such financial needs, make sure to make an emergency fund on time, using the best personal finance tips.

Best Personal Finance Tips: Planning for Retirement

Best personal finance tips often offer insights to this key factor for retirement.

- Define Retirement Goals: How much you'll need monthly. Your retirement life goal and vision is an integral factor in planning retirement financially with the best personal finance tips.

- Estimate Expenses: Track down retirement expectations, assess current expenses, find ways to adjust future retirement. Calculate necessary investments for secure retirement, find good strategy for best personal finance tips.

- Calculate How Much to Save Annually: Consider rate of return and growth over time with different investment options, best personal finance tips are valuable resources to build financial stability.

- Diversify your Investments: This will reduce the risk for any particular type of market conditions or other market uncertainties and help generate potentially consistent and sustained income over time with different best personal finance tips available

- Consider Tax Implications: Talk to a financial advisor regarding your possible needs in the best personal finance tips area of retirement planning to discuss and strategize in the process of building plans

- Revisit and Adjust Regularly: Life changes, needs adjust as time progresses, make adjustments and be vigilant and proactive to build financially, best personal finance tips will make this much more practical, achievable, simple

Understanding Different Investment Options

Investing wisely is an integral component in building wealth. Using best personal finance tips wisely helps you understand investments better, allowing you to grow your wealth in many ways with smart decisions and solid action plans using good best personal finance tips.

- Stocks: Owning pieces of companies, expecting to generate profits with price gains, with potential growth, with potential loss as well

- Bonds: Lend money to government or corporations with repayment agreement of principal at an agreed time and an amount.

- Mutual Funds: Pools of money, invests in different assets like stocks and bonds. Lower cost and higher diversity, some associated with additional management fees using best personal finance tips, a critical analysis needed.

- Real Estate: Buying physical property. A high return potential if done smartly, usually requires upfront cost with added associated costs and expenses to pay monthly for different investment options. Best personal finance tips consider this aspect.

- CDs (Certificates of Deposit): Bank account, locked away in particular amount and time. This requires discipline to build this financial plan while having best personal finance tips on the table for reference and possible comparisons for different financial options and investment.

- Investment Option for Different Time Horizones and Risk Aversion and Financial Goals: Best personal finance tips always remind to assess needs accordingly when comparing with similar or alternative strategies available in today’s finance market using specific and critical knowledge to best assess needs to choose proper options. Different circumstances exist.

3 Key Factors to Consider for Successful Personal Finance Management

Mastering personal finance is crucial for everyone. It's a game of managing your money wisely for a brighter financial future, building security, and planning for the unexpected. Applying the best personal finance tips builds a solid financial foundation. Successful personal finance is built on concrete action steps and good habits, a consistent approach to best personal finance tips will always take you far. There are no quick fixes, it's a marathon not a sprint.

Personal finance is all about smart planning. Best personal finance tips often highlight a few core pillars that underpin sound financial management. Three major factors stand out:

-

Budgeting: Understanding and tracking your income and expenses is non-negotiable in achieving sound financial strategies. How much are you making, and where does it all go? Best personal finance tips insist that budgets are living documents— they evolve with your needs. This leads you in a safe, structured personal finance planning journey.

-

Saving: Setting aside money consistently is a powerful best personal finance tips tool, even small savings become large wealth. A healthy saving rate is one of best personal finance tips key elements to stability and future investments. This might seem impossible at times, however, you will reap the rewards if you follow it, trust the power of best personal finance tips to secure a solid plan.

-

Investing: Wisely growing your money. Investments grow and change from moment to moment, there’s not one correct approach. It's more than a mere plan of savings; the essence of personal finance is all about investing as part of best personal finance tips, finding safe vehicles for your savings that suit you. Choosing one that aligns with your risk tolerance and long-term goals is another major facet of personal finance as best personal finance tips suggest. Best personal finance tips will also show you how to research various investment opportunities, allowing for long term financial security

Importance of Automating Your Finances

Automating your finances is key. Best personal finance tips emphasize the power of automatic processes. Many successful financial strategies benefit from this process.

- Setting up automatic savings transfers. You know when you set your alarm you’ll wake up right? This way you automatically set your finances right! Your personal finance becomes easier and effortless.

- Recurring bill payments are a win for anyone seeking the best personal finance tips, it saves time and avoids potential late fees and this helps save you more with less hassle. You simply want things automated!

- Paying your credit card bills in a timely fashion, no question about it! Make this the top priority in best personal finance tips; this process, again is simply important for the stability and soundness of your financial system.

- Automating your taxes also follows along these same ideas! Automation is for your personal finances; it makes your best personal finance tips more concrete. It removes a headache, simplifies financial routines, saves time, and strengthens overall stability, one part of your life you know is automated is fantastic and something to boast about for any financial beginner! With automation you will keep saving up and growing rich!

Protecting Yourself Against Financial Scams

Being aware of common scams is crucial to safeguarding your funds! Best personal finance tips emphasize caution; one wrong step, can break your whole financial game! Financial security involves not just understanding best personal finance tips but also awareness against those trying to deceive you and exploit the most valuable things in our lives—financial wealth and security!

-

Spot fake investment opportunities: Recognize the telltale signs of a Ponzi scheme or a scam. Research these schemes diligently. Trust is important; beware of unknown schemes. Best personal finance tips help you by exposing potential scams!

-

Beware of email and phone scams: Be suspicious of unsolicited communications promising high returns and claiming urgency to push their best personal finance tips schemes. Be a skeptical seeker! Be prepared to expose these deceitful acts!

-

Protect your personal information: This goes without saying: never share sensitive data with unfamiliar parties via phone, emails, text or messages. Best personal finance tips emphasize safeguarding every important personal asset to help save your assets in crisis! Don’t do it without being wary. Best personal finance tips is a reminder— stay aware of what and how these fraud schemes occur!

Understanding Basic Financial Vocabulary

Financial understanding builds strong confidence in personal finance and empowers your knowledge of sound financial practices—knowing terms makes navigating finances easier and faster. Understanding your finances and money means knowledge in personal finance, following good financial principles and steps will help save more than usual with much fewer doubts. This is essential!

-

Interest Rates: The cost of borrowing money, crucial for loans, and even savings accounts. Best personal finance tips make it easy for you to comprehend these terms and conditions for making smart choices and avoid scams!

-

Credit Score: An indicator of creditworthiness, used by lenders for assessing your trustworthiness!

-

Net Worth: Total assets minus total debts shows your financial health at a specific time; helps assess where you are, how you can improve your net worth! Best personal finance tips emphasize knowing net worth calculation—it’s a big sign to know exactly what you can handle.

Key Reasons to Seek Professional Financial Advice

Sometimes, even the best personal finance tips may seem insufficient.

Seeking professional help is justified for specific reasons. Personal finance and finances in general can involve intricate factors and strategies that make them too much for average minds, so be wise and ready.

-

Complex Financial situations: Dealing with mortgages, inheritances, complicated investment decisions and managing your personal finances may warrant the involvement of financial advisors; many require an experienced professional’s best judgment.

-

Specialization and expertise: These financial experts have knowledge of numerous strategies that aren’t apparent at first! Be ready to learn a thing or two, if not be a learner then trust professionals. Best personal finance tips are sometimes insufficient or fail to address a very complicated problem or situation and sometimes expert advice from professionals in a specific area is necessary to have.

-

Objectivity and unbiased advice: Seeking advice from experienced experts who can offer different opinions on a financial matter makes good decision-making for you, a critical component in your finances; they will challenge the plan, or offer alternatives! Your needs as a personal situation for best personal finance tips requires professional handling or advice when needed!

Best Personal Finance Tips: Utilizing Apps and Tools

Source: com.au

Modern finance apps make handling your money easier, but they aren't all created equal. Pick tools that seamlessly integrate, allowing you to track expenses and incomes efficiently, showing your best personal finance tips in a snap. Budgeting apps, those super-handy companions, offer best personal finance tips, reminding you of those impending bills. Choose ones with features to auto-pay, or best personal finance tips that can track all your accounts for maximum personal efficiency.

Prioritize reliable and secure platforms when picking your financial tools. Secure storage for personal data is top-priority for best personal finance tips, preventing unwanted issues like data breaches. Read online reviews carefully for feedback from fellow users, crucial best personal finance tips! Compare these apps by functions, monthly fees, and usability for ultimate personal peace of mind. Avoid overwhelming apps with hundreds of features, as simplicity is key for best personal finance tips! Consider free trials and options with limited monthly access, a very savvy financial decision for personal success! Choose the app designed for you, that suits best personal finance tips for your daily money tasks. These apps will assist you with best personal finance tips, giving clarity for handling your daily monetary matters!

Choosing the Best Financial Planner

A financial planner provides you with an expert perspective for the best personal finance tips. A good one can greatly aid with complex scenarios or high amounts. Some specialize in taxes.

Selecting one fits personal demands. Start by identifying needs: retirement, student loans, buying a home – to pinpoint the most relevant expert advice on personal finance, especially if you have multiple aspirations! Seek recommendation via colleagues. Online search and social media might aid, leading to valuable connections based on their recommendations and expertise regarding best personal finance tips and advice. Evaluate their credentials and experience when picking. Consider whether or not your goals mesh, seeking a planner aligning with your financial requirements. Financial planners who use a personalized approach might well make the ideal pick, making it easy to find relevant best personal finance tips. The better, the less time for confusion! Trust, experience, and skills play a huge role. Planners skilled with personal touch tend to result in more helpful financial best personal finance tips! Compare costs for guidance, looking closely at what each plan includes – it's often useful to ask specifically about best personal finance tips you find intriguing or difficult! Find one comfortable and who shares a similar financial approach – an expert can boost the value for the best personal finance tips! Consider what tools each has access to as an expert in personal finances, because this can prove crucial for managing funds, especially for your own specific needs for the best personal finance tips.

5 Tips to Get Started with Smart Budgeting Practices

First, track your spending and identify wasteful areas of spending. It’s crucial for recognizing the source of financial struggles and choosing personal strategies, an excellent best personal finance tip. Create a balanced monthly budget. Evaluate income versus expenses, then allotting personal budget numbers in a chart. Aim for a balanced approach to manage money, leading to increased control of finances and demonstrating awareness regarding best personal finance tips. This step offers insight and highlights spending areas requiring careful review, providing insights and making personal financial changes much clearer and achievable for the best personal finance tips! Categorize income/expenses properly to ensure a meticulous grasp, for instance distinguishing necessities and luxuries, providing concrete financial tips and demonstrations that clarify issues, allowing easy execution to learn best personal finance tips.

Prioritize debt reduction for better money control. Look for small savings first! Starting with small achievable financial strategies leads to momentum and greater financial knowledge, proving best personal finance tips! Allocate surplus funds, prioritizing short term or long-term goals – savings, or even emergencies! Consider emergencies as another financial matter that deserves allocating a portion of personal income, enabling an opportunity for immediate reactions!

What Is Considered Responsible Personal Finance?

Financial stability relies on sensible use of income, aiming to eliminate waste and prevent overwhelming debts. Prioritizing savings and creating plans that allocate for expenses is essential for financial maturity, embodying best personal finance tips. It involves taking financial measures in order to improve financial safety – taking financial steps today that reduce debt and improve chances of prosperity in future best personal finance tips. Making thoughtful, measured personal spending choices are very important best personal finance tips to master. Financial maturity means setting savings goals that will build financial freedom and well being. This entails creating savings to reach goals and providing a safety net from sudden financial issues, representing essential personal finance strategies. Using an allowance method can clarify expenses, preventing surprise expenditures. Setting sensible expectations helps, recognizing expenses. Building a cushion versus having a constant battle is essential! Maintaining your personal money plan! Taking control of your financial status with this simple but important tactic gives value in terms of financial wellbeing, leading to positive, long term financial solutions – offering insights regarding personal finances that form great personal financial decisions for success!

Essential Best Practices for Family Financial Decisions

Clear communication amongst family members on financial matters is important, forming solid guidelines on household budgets – crucial advice on personal financial considerations. Defining shared family values or financial values within the household can establish core concepts regarding money matters, building solid habits around how people perceive finances and approach matters on best personal finance tips. Prioritizing financial goals in common can guide steps and strengthen their relationship, which ultimately improves everyone's finances! Using clear financial metrics improves awareness and accountability in reaching those goals, with financial benchmarks guiding personal finances! Tracking progress towards joint objectives, reviewing often and tweaking financial strategies according to needs is an effective family method for the best personal finance tips! Having these family discussions frequently fosters a productive and coordinated approach in navigating family finances. Setting limits regarding personal expenses when involving the family reduces tensions associated with spending – it clarifies expectations and reduces conflicts around finances in a family dynamic for best personal finance tips. Sharing information and responsibilities reduces tensions related to sharing and managing money. Using a system of joint contributions for larger expenditures streamlines shared financial activities for smooth interactions around common objectives to boost best personal finance tips! Agreeing on budgeting principles to form a solid financial foundation establishes accountability and understanding.