Budgeting Basics: A Strong Financial Foundation

Mastering personal finance starts with budgeting. Best practices for personal finance require a clear, defined plan. It's the bedrock for achieving financial freedom, and these foundational steps will be beneficial. Best practices for personal finance encompass careful planning and execution. Following best practices for personal finance helps ensure your funds work for you.

How to Create a Realistic Budget?

A realistic budget isn't just about numbers; it's about understanding your money. Best practices for personal finance starts with recording all income, then scrutinizing all spending. Consider each expense.

-

Income Sources: List every source. This includes salaries, side hustles, investment income. This clear and careful approach is fundamental to best practices for personal finance.

-

Essential Expenses: Pinpoint needs like housing, food, utilities, transportation, healthcare, education, subscriptions and essentials for your livelihood. Categorize. Track down your fixed and variable costs, the essential part of best practices for personal finance

-

Non-Essential Expenses: Identify areas where you can reduce or avoid spending; Entertainment, shopping, subscriptions. Be prepared to reduce spending if needed for achieving best practices for personal finance.

-

Create Your Budget Plan: List your essential expenses first. Allocate remaining income based on priority and allocate money accordingly based on your spending analysis. Best practices for personal finance focuses on creating budgets for planning. Use your understanding of your finances for budget creation.

-

Review and Revise: Budgets are a dynamic document. Adjust monthly as needs change. These tweaks are an important step in establishing best practices for personal finance. Revise monthly budgets often and consider changes for improved outcomes.

Tracking Expenses: Knowing Where Your Money Goes

Keeping tabs on spending, especially for developing best practices for personal finance is key. Analyze and review spending every single time, as this ensures best practices for personal finance will continue working

-

Categorize Spending: Create detailed expense categories for better budgeting comprehension, such as transportation, entertainment, etc. Tracking expenses accurately to maximize your financial capabilities, a cornerstone for establishing best practices for personal finance.

-

Track Expenses: Keep records electronically or using an old-fashioned notepad for analysis for tracking your cashflow patterns and insights and to stay within budgets to establish best practices for personal finance, as part of your best financial practices

-

Examine Patterns: Review and compare spending amounts. Is there a significant category needing adjustments? Be thorough with identifying patterns. Best practices for personal finance involves the meticulous record of spendings.

Building an Emergency Fund: Preparing for Life's Unexpected Expenses

Source: spoliamag.com

Creating a cushion for unplanned costs, emergency funds ensure protection and safeguard best practices for personal finance for financial independence.

-

Minimum Recommendation: Aim to save 3–6 months of living expenses; This will significantly help financial situations if unplanned incidents take place, establish best practices for personal finance to secure future finances.

-

Savings Strategies:

- Regular, systematic deposits.

- Dedicated savings account.

-

These are best practices for personal finance to aid securing and protecting yourself.

-

Emergency Preparedness: Consider unforeseen health situations, car repairs, and more. The best practices for personal finance encompass saving towards different emergency possibilities, and ensure protection.

Prioritizing Debt Reduction: Getting Out of Debt

Getting out of debt is an essential aspect for securing financial goals and building best practices for personal finance

-

Debt Assessment: Analyze every debt, identifying interest rates, minimum payments, etc.; This comprehensive debt assessment can form an organized attack on debt. It can become the very bedrock of your financial strategy and secure your best financial practices, too.

-

Prioritize High-Interest Debts: Strategically tackling the highest interest rates and amounts to reduce monthly expenses, following best practices for personal finance is a huge key for freedom from debts

-

Develop a Repayment Strategy: Increase payments or use snowball/avalanche methods based on priorities to effectively manage debts for long term financial gains to secure best financial practices. Establish timelines for debt repayment plans, especially essential for your success at best financial practices.

-

Consider debt consolidation/balance transfer options. It's a viable financial method. Analyze them if necessary for your strategy and security. This is very important for establishing financial security that you expect from best financial practices, by any possible mean, and any possible resource. Establish best financial practices, using every opportunity that arises.

-

Seek advice from personal finance experts on strategies relevant to individual circumstances and needs; for security and effectiveness.

Source: ataxcompany.com

Smart Spending Habits: Making Informed Choices

Best practices for personal finance begin with smart spending. A solid spending strategy is crucial for financial health. It's about understanding where your money goes. Best practices for personal finance involve a careful plan to achieve your goals and avoid financial pitfalls.

-

Track Every Penny: Detailed spending logs help spot hidden expenses. Best practices for personal finance hinge on recognizing and understanding how you spend your hard-earned cash.

-

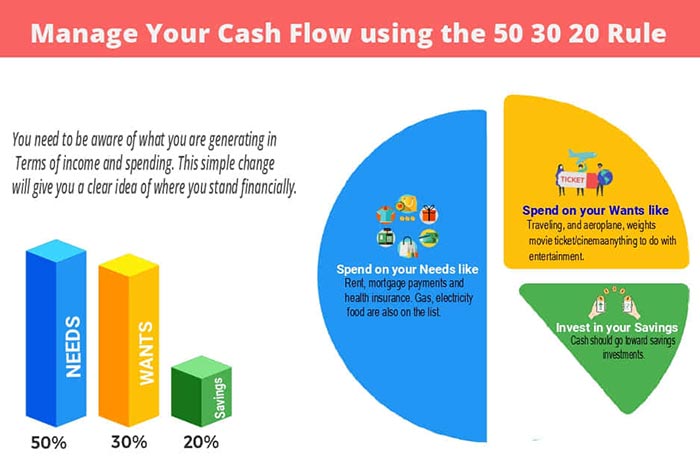

Budgeting is Key: Creating a budget forces you to prioritize needs over wants. A personalized budget, based on income and expenses, guides best practices for personal finance. How are you spending money vs. saving money each month? Best practices for personal finance ensure smart allocation of resources, every dollar counts.

-

Identify & Eliminate Excesses: Find spending patterns to adjust, especially impulsive buys. Smart spending is not about denial. Instead, consider what brings you the most satisfaction and find ways to enjoy those experiences without hindering financial objectives. This aligns your passions and values with best practices for personal finance, fostering peace of mind in finances.

-

Negotiate When Possible: Discounts can add up. Actively look for deals, coupons, and offers. Best practices for personal finance include savvy approaches to finding opportunities to save money. Smart financial decisions don't mean deprivation but more thoughtful choice.

-

Impulse Control is Paramount: Avoiding spontaneous buys can greatly influence your savings. Resist temptation, especially when shopping online. Plan your purchases to control the expenditure.

-

The Power of the Savings Account: Establish and nurture it diligently. Treat this account as an irreplaceable tool, critical for fulfilling your dreams.

Source: fuzia.com

Saving for the Future: Planning for Retirement or Goals

Building a strong financial foundation needs a roadmap. Future financial success relies on planning and patience. Best practices for personal finance incorporate foresight, anticipation, and effective implementation of the saving plans. Best practices for personal finance demand diligent saving habits to maximize your chances for fulfilling your personal goals and secure future.

-

Setting Realistic Goals: Long-term goals should align with income. Financial plans depend upon realistic goals that ensure consistency. Define them clearly and concretely and document in detail your expectations, making them specific and measurable.

-

Establishing a Realistic Budget: This outlines expenses, income, and areas to save. Savings require a specific amount budgeted regularly and consistently, to maintain long-term financial goals and habits.

-

The Importance of Compound Interest: Compounding magnifies your savings over time, maximizing returns from savings accounts or retirement funds, allowing significant growth over many years.

-

Early-Start is Key: Time value of money allows interest to compound sooner and faster in your favor. Consistent savings and early starting lead to wealth compounding, essential aspects of effective personal finance and investment.

-

Evaluate Risks: A realistic picture of future expenses can minimize financial shock and keep your financial plans solid. Best practices for personal finance dictate comprehensive reviews.

Investing Wisely: Growing Your Money

The financial future should embrace opportunities for gains and diversification. Best practices for personal finance highlight investing in diversified strategies to achieve a considerable amount of funds in a certain time. Investment diversification ensures you have a long and promising path. Investing wisely brings returns for many years.

-

Research and Diligence: Careful analysis is crucial, evaluating diverse market options, ensuring best returns while staying abreast with market trends. Best practices for personal finance demand diligence.

-

Risk Tolerance: Investments with varying degrees of risk exist. Understanding risk factors is paramount and essential for creating successful investing strategies that work for you. It's not possible to know future returns.

-

Professional Advice: A financial advisor, if appropriate, can offer helpful suggestions tailored to your needs and investment objectives. Be wary about their recommendations though; it’s wise to get several professional opinions and take independent judgments. Best practices for personal finance stress that self-analysis is required and crucial before relying on recommendations from professionals.

-

Diversification: The practice of spreading investments across multiple assets and financial products is imperative to lower individual investment risks, a core tenant in best practices for personal finance. Best practices for personal finance stress on how this contributes to effective asset management and mitigation of investment risks.

Source: hbr.org

Managing Credit Cards Responsibly: Avoid Interest Traps

Debt management through mindful card usage avoids significant financial problems. Understanding credit card dynamics is an essential step to mastering your financial stability.

-

The Need for Control: Stay well under your available credit limit. Keeping card balance under control is vital to keep debts in check and keep good financial health.

-

Pay More Than the Minimum: Prompt repayment is key to controlling monthly debt and improving credit scores. Best practices for personal finance stress upon prompt repayment. The debt trap begins from when payments get delayed or made grudgingly, which may eventually damage your credit rating.

-

Avoid Unnecessary Charges: Paying fees, interest penalties, or other penalties can easily sink the money that you've saved with so much effort and thought, which is detrimental to smart financial practices and principles. Understanding interest rate details for the cards, is important in maintaining a well-managed account and practicing sound financial habits.

-

Assess Interest Rates: Understand rates and fees carefully before applying for a credit card. Pay close attention and compare. Smart financial practices dictate reviewing and understanding card offers carefully. Best practices for personal finance demand you avoid card fees.

-

Credit Building Habits: Consistent, prompt payments strengthen credit, giving advantages. Building your credit score through your active repayment is another step toward effective personal finance practices and best practices for personal finance that focus on responsible use of credit.

Understanding Your Finances: What You Need to Know

Financial acumen is not about jargon. Understanding the essential building blocks enables better financial decisions. Knowing about interest, credit, and other essential terms makes your choices and planning processes significantly smoother. This enhances control and allows informed investment strategies.

-

Basic Accounting Principles: Balancing income and expenditure, calculating savings, understanding budgeting. Knowing basic financial arithmetic and understanding the underlying mechanisms of financial tools is critical and fundamental in any best practices for personal finance.

-

Managing Taxes: Learning how to understand taxes for individuals and managing personal tax. Best practices for personal finance require a degree of competence in financial reporting. Understanding taxation can free your earnings for your own growth.

-

Credit Reports: Recognizing your credit report as a financial snapshot, understand credit scores' significance. Analyzing financial reporting helps spot problem areas for fixing potential errors.

-

Investing and Money Market Options: Knowing various investment vehicles empowers wise decisions. Options are different financial investment choices that need deep insight, understanding, and attention. Smart analysis and diligent planning is part of sound investment and personal financial best practices.

-

Risk and Reward Awareness: Knowing when and how to take calculated risks and mitigate financial losses to maximize returns. Investment principles hinge on analyzing tradeoffs to minimize losses and boost your portfolio in the right way for your circumstances.

5 Steps to Build a Better Financial Future

Best practices for personal finance are crucial for a secure future. Start by making a budget. This is the bedrock of good personal finance. Track income and expenses carefully. Know where your money goes. Best practices for personal finance highlight this. Analyze your spending habits; cut unnecessary costs; create an emergency fund – 3–6 months of living expenses. Best practices for personal finance often suggest a significant portion of income dedicated to savings and investments.

-

Set Clear Financial Goals: Precise objectives are essential. Large goals? Break them down into smaller, attainable steps.

-

Budget Wisely: Prioritize necessities and then decide on nonessentials. Be brutal about needs versus wants. Budgeting is the cornerstone of solid best practices for personal finance.

-

Save Consistently: Even small savings build substantial sums. Automating savings makes this much simpler, and it's an often-used part of best practices for personal finance.

-

Invest Responsibly: Diversify, diversify, diversify. Explore a variety of options, not just a single stock or investment. Remember, a crucial component of the best practices for personal finance involves responsible investment strategies.

-

Seek Expert Guidance When Needed: Financial advisors can help when making tough choices about investments, debt management and more, especially within best practices for personal finance.

7 Financial Goals to Help Reach Your Potential

Best practices for personal finance often involve focusing on these seven crucial financial goals, to improve well being

-

Build an Emergency Fund: Three to six months of living expenses—essential for best practices for personal finance in any life stage.

-

Pay Off High-Interest Debt: Credit cards, student loans – these take priority. Reducing debt immediately helps personal finance well being.

-

Save for a Down Payment on a Home (if applicable): Owning a home brings big returns, making this often cited goal for many personal finance situations.

-

Plan for Retirement: The earlier the better! Best practices for personal finance often revolve around understanding early retirement plans.

-

Save for Major Life Expenses: A child’s education, wedding, car purchase – these aren't necessarily instant financial problems if planned, showing your knowledge in personal finance is impressive to know.

-

Make Investments (When Prepared): Investment needs time, don't take these lightly or put money where you'll lose everything and never plan ahead when practicing good best practices for personal finance.

-

Manage Insurance Wisely: Life insurance, health insurance, auto insurance; understand each one. These things make significant parts of any financial decisions and are an absolutely important area of best practices for personal finance

Best Practices for Personal Finance for Young Adults

Budgeting is a crucial life skill for any age, even at an early life stage. Young adults face a mix of freedom and financial unknowns.

-

Build Credit Responsibly: Establish credit wisely, understanding credit scores can affect financial outcomes.

-

Avoid Unnecessary Debt: Student loans or other credit can often be painful. Avoid them when possible for your well-being and best practices for personal finance in all areas.

-

Track Income and Spending: Understanding income and expenditure trends creates confidence, a vital piece of best practices for personal finance.

-

Invest in the Future: Setting up a savings or investment plan can start early with great returns from best practices for personal finance. Be sensible, and follow this guideline for yourself!

-

Emergency Fund First: Develop an emergency fund for when inevitable life changes pop up. Best practices for personal finance includes emergency savings.

Best Practices for Personal Finance for Seniors

Planning ahead is important at any age, particularly when entering senior years.

-

Manage Social Security Benefits Wisely: These benefits have complicated guidelines that change as life conditions develop and affect you financially; make your money last! Understand it completely to follow best practices for personal finance during this life stage.

-

Downsize Living Arrangements as Needed: Downsizing or making living expenses cheaper, a step in best practices for personal finance, can make your life cheaper with sensible solutions in place, or seek additional financial advice when necessary!

-

Adjust Spending for a Different Lifestyle: Understand expenses that decrease or increase as you change stages in life; analyze spending to make personal financial changes to your needs. Use these steps that showcase great best practices for personal finance during your stage in life

-

Prepare for Healthcare Costs: This isn’t always considered but the healthcare costs when it comes are inevitable. Ensure you plan for these issues, taking action for this part of financial issues, when planning with your financial planner for your best practices for personal finance

-

Consider Long-Term Care Insurance: This is a very important practice when entering the senior years. Best practices for personal finance suggest you should have a solid and long-term view of your financial health.

Best Practices for Personal Finance in Different Life Stages

Adapting best practices for personal finance based on a person's stage in life brings significant returns on savings.

-

Student years, recent grads: Budget, emergency funds.

Avoid student loan debt whenever possible. -

Young Professionals: Start now! Set financial goals, manage debt. Explore professional help in financial matters when necessary, showing good practices in personal finance at an earlier age.

-

Parents: Create family budget, save for future goals (child’s education, weddings). Understand financial practices when dealing with raising a family, applying personal finance methods that provide long term effects on your decisions when handling these important aspects.

-

Seniors: Adjust budget to align with retirement, downsize and manage social security; make your money last as long as possible following good financial methods that create results and follow best practices for personal finance as this life stage arrives.

-

Varying needs as personal changes develop and bring change, and need changes in habits. Keep adjusting! Personal financial life circumstances require adjustment! Adjust budgets and savings in all stages to keep on top of these practices and follow best practices for personal finance during different parts of life and changing life events, for personal betterment in financial matters that often need attention when these aspects develop in any life cycle.

Reviewing and Adapting your Plan: Being Agile in Finance

Best practices for personal finance demand flexibility. Life throws curveballs, and a solid financial plan must adapt. Best practices for personal finance hinge on constant evaluation and readjustment. Best practices for personal finance is vital.

-

Regular Review: Don't just create a plan and forget it. Schedule regular check-ups (monthly, quarterly, or annually). How is your plan faring?

-

Tracking Progress: Monitor income, expenses, investments. See where you're excelling and falling short with your best practices for personal finance plan.

-

Life Changes: A new job, marriage, kids – life's big moments necessitate adjustments. Best practices for personal finance include responding immediately. Your budget needs adjustments when such event happens.

-

External Factors: Market shifts, economic changes need your best practices for personal finance adjustment as well.

-

Flexibility is Key: Finance isn't static; your plan shouldn't be either. Constantly review and modify your best practices for personal finance. Best practices for personal finance should serve as a solid foundation

-

Adjust Spending: Have you fallen in love with a fancy new gadget or fashion piece and suddenly feel you must own it? Examine how to deal with temptation. best practices for personal finance includes a balance in personal desires with budget capabilities

-

Reallocate Savings: Is your planned 6 months emergency fund becoming less sufficient to cover all needs? Your best practices for personal finance also must allow reallocation or increase as circumstances dictate

How to Handle Financial Crises: Strategies to Combat Stress

Financial hiccups are unavoidable. Knowing best practices for personal finance include how to react and bounce back effectively, without being stressed to death.

-

Acknowledge Reality: Don't ignore the problem. Honest assessment of your financial struggles is the best practices for personal finance.

-

Identify the Problem: Is it an unexpected expense, a pay cut, or an investment loss? Clear analysis using best practices for personal finance allows pinpoint action.

-

Immediate Steps: Create a prioritized list. What urgent needs demand first action based on the best practices for personal finance?

-

Create a Short-term Budget: Curtail unnecessary spending. Strict budget based on the best practices for personal finance is crucial in the face of any economic disruption

-

Seek Support: Talk to a financial advisor, friend, or family member. Best practices for personal finance means understanding that seeking help or support is a perfectly valid step when things become extremely difficult.

-

Develop an Action Plan: Outline a recovery path and establish timelines. Your best practices for personal finance should include a method of addressing crises systematically

Maximizing Your Income Potential: Getting Paid More

Boosting income takes strategy. Here's how best practices for personal finance plays an important role:

-

Skill Enhancement: Are there certifications or courses you could take to enhance your earning power? Always improve knowledge and use the best practices for personal finance

-

Upskilling for Income: Are there areas in your job that demand improved performance? Identify what are they and what can be improved

-

Negotiating Skills: Negotiating raises involves more than just asking; using solid skills with best practices for personal finance can dramatically increase your salary and boost your earning power significantly

-

Additional Income Sources: Side hustles, freelancing, selling services–explore alternatives. Best practices for personal finance may mean trying various earning methods and diversifying

-

Portfolio Diversity: Invest wisely with the best practices for personal finance to earn more income via dividends, royalties or other streams that can earn income for the future

Finding Ways to Live Below Your Means: Simple Habits to Save More

Saving more means managing what you spend, best practices for personal finance are involved.

-

Budgeting is Vital: Track where your money goes. Strict planning is integral. Best practices for personal finance require budget to save better

-

Unnecessary Expenses: Identify discretionary expenses (eating out, subscriptions). Curb spending, best practices for personal finance are used to make a drastic reduction in such expenses.

-

Free Alternatives: Exercise in your neighborhood. Best practices for personal finance allows to seek cheap options as replacements for pricey alternatives, so your financial needs will have better cover.

-

Meal Planning: Save on grocery costs by buying in bulk, cooking at home regularly; the best practices for personal finance requires some planning

-

Emergency Fund: Establish a safety net—a minimum six months worth of living expenses. The best practices for personal finance encourages proactive and organized steps in budgeting your income

-

Negotiation Power: Using your negotiating power using the best practices for personal finance can cut costs and save a good chunk

Effective Strategies to Boost Financial Literacy: Learn What Works

Understanding finance is fundamental. Learning financial best practices for personal finance is fundamental to a thriving personal life.

-

Start Early: Introduce personal finance concepts early to set a financial direction. Best practices for personal finance begins by having this discipline right away

-

Embrace Books, Blogs and More: Learning finance doesn't need formal studies. Online platforms, books, articles will greatly aid best practices for personal finance

-

Practical Exercise: Put learnings into action, try budgeting tools; Best practices for personal finance can be achieved with just one financial tool that works well

-

Mock-Exercises: Budget sample income and expenses and learn to balance different needs while using the best practices for personal finance; learning should always include real-world scenarios.

-

Ask for Advice: Don't be afraid to seek advice from a trusted advisor. Asking experts, while practicing the best practices for personal finance is important when financial confidence needs bolstering.

Avoiding Financial Pitfalls: Traps to Look Out For

Best practices for personal finance demand awareness of potential pitfalls. These traps often lead to lost savings and financial struggles. Recognize common traps and avoid them.

-

Impulsive spending: Don't buy things you don't need, even if they seem attractive. Consider delayed gratification. Best practices for personal finance often involve conscious purchasing decisions.

-

High-interest debt: Avoid loans with high interest rates. Best practices for personal finance encourage responsible borrowing. Interest rates quickly become burdensome and add to financial pain. Avoid the urge to take on large loans unless entirely necessary. A careful evaluation of debt's influence on personal finance is vital.

-

Ignoring your budget: A simple budget allows you to stay organized, aware of expenses. This is one of best practices for personal finance, saving your money for planned things like future investments or other things, avoid high amounts of personal loan debts. Create a detailed plan today; monitor monthly income and outflow. This essential component of best practices for personal finance allows for strategic management of money.

-

Poor investing choices: Don't blindly invest, understanding investment concepts are a fundamental best practices for personal finance. Impulsive and unwise investments can lose you your earnings, or worst, your investment completely!

-

Ignoring early warning signs: Look for these early warnings about best practices for personal finance, and take steps before things escalate; if debt becomes high and interest starts to build, take immediate action, that is, seek expert help. Best practices for personal finance dictate early interventions to control personal finances better.

Importance of Seeking Expert Advice for your Finances

Best practices for personal finance are more powerful with professional help. Experts provide informed financial decisions that consider all potential issues, and a good support group for all financial hurdles.

-

Diverse perspective: Professional opinions offer insight often not noticed independently, especially when managing the whole financial situation from diverse approaches and areas. The best practices for personal finance gain from professional perspectives.

-

Realistic expectations: A professional advisor is more likely to provide accurate and reasonable expectations for savings, which is a part of best practices for personal finance. Avoiding unrealistic goals can result in better budgeting and spending planning. A financially-intelligent advisor can give useful perspective on potential financial decisions, fortifying financial decisions as best practices for personal finance.

-

Objectivity: Financial professionals' opinions lack personal attachments and biases. An outside eye can spot potentially harmful patterns and avoid unnecessary or dangerous financial traps. A necessary part of best practices for personal finance is professional support. Best practices for personal finance often rely on the insight that a financial expert can provide.

-

Comprehensive plan: Professionals develop integrated financial strategies from several angles – budgeting, investments, debt reduction – based on your needs. That makes financial plans more effective when done by professionals compared to trying to create this strategy alone. That's a must-have, a key best practice for personal finance.

Reviewing Your Insurance and Investments: Checking Your Policies

Regular reviews of your insurance and investments, that's the best practice for personal finance. Best practices for personal finance involve ongoing reviews and adjusting decisions.

-

Market fluctuations: Reassess investment strategies based on current market trends. An active awareness, based on reviews of trends, can be a vital component of best practices for personal finance.

-

Coverage needs: Evaluate if insurance coverage adequately addresses potential risks and loss of assets and possessions that often get overlooked when considering insurance options. The need to cover the required risk or asset values has been often ignored by individuals when setting best practices for personal finance, because individuals overlook certain values.

-

Cost-effectiveness: Assess whether current insurance plans remain competitive; best practices for personal finance demand a budget. Analyze your insurance and invest values and consider a cost-effective alternative where possible.

-

Policy adjustments: Review periodically if needed, best practices for personal finance involves adjusting policies according to your circumstances. Adjusting plans on a yearly or two-year review is a best practice for personal finance.

7 Common Mistakes to Avoid When Managing Personal Finances

These are common issues in managing personal finance that should be considered. Poor practices, financial mistakes should be avoided; this is critical when employing the best practices for personal finance.

- Procrastinating on saving

- Impulsive purchases

- Lack of planning

- Ignoring credit score

- Inadequate insurance

- Poor investment options

- Overspending/Budget inaccuracies.

Best Practices for Personal Finance in Times of Inflation

Adjusting to inflation necessitates certain best practices for personal finance. Maintaining and controlling your personal finance are very necessary when managing inflation's impact on personal finances.

-

Increase savings: Boost savings rates; best practices for personal finance advise consistent growth in savings rates.

-

Optimize investments: Best practices for personal finance encourage looking into opportunities with an advantage against inflation when planning for the future. Investing in options to handle the predicted effect of inflation will also be valuable for personal finance.

-

Reduce expenses: Minimize expenditures, cut unnecessary spending that becomes extra burdensome due to rising costs. Look at the most basic components in your personal spending and see which of them you can cut back on to account for inflation. Reduce unnecessary and unexpected expenditures that may have an increase due to inflation to balance your expenses against earnings. That’s one of the main best practices for personal finance.

-

Negotiate contracts: Actively negotiate or re-evaluate agreements; especially when it involves subscriptions or financial commitments. This negotiation aspect has strong and valid elements of best practices for personal finance. That can help to control financial strain caused by rising costs or high inflation rates and plan better ahead. Best practices for personal finance include renegotiation where it is necessary to combat or neutralize the impact of inflation. Best practices for personal finance also include renegotiating costs in contract-related issues.

-

Seek advice on asset allocation and diversification. Experts in financial best practices often recommend strategies tailored to each case for managing wealth growth or reduction. That's part of the overall best practice for personal finance to make sure your personal money doesn't get lost in these hard economic conditions or during inflation times.