Best Way To Invest Money: Introduction

Investing your money wisely is crucial for financial freedom. The "best way to invest money" isn't a single answer, but a tailored strategy. This journey requires understanding your unique circumstances and goals, accepting the risks involved, and knowing different vehicles available. This guide dives deep into understanding the "best way to invest money" for you. It helps you map out a smart investment plan. Choosing the right path for your financial future is an essential aspect of "best way to invest money".

Understanding Your Investment Goals

First things first, identify your financial aspirations. Are you saving for retirement, a house, or maybe an exciting trip? A clear goal shapes your investment approach. A well-defined "best way to invest money" plan starts with your goals. You must clearly state the exact nature of your desired outcome to invest properly, understand your expectations and determine your strategy for the best outcome based on that. Define a specific date and exact outcome, as detailed as possible for every goal. Understanding your investment goals and connecting those goals with a proper strategy to earn returns on that specific goal will help identify the "best way to invest money."

Risk Tolerance and Investment Options

Source: isu.pub

Next, consider how much risk you're comfortable taking. Some investments carry high risks with big potential rewards. Others offer relatively low-risk, modest returns. The "best way to invest money" must align with your comfort level. Evaluating your tolerance towards financial risk is one of the steps in your financial plan and crucial part of choosing a way to "best invest your money." Knowing what fits your comfort level is the beginning point of determining how much you are going to risk. Determining the degree of financial risk will aid in finding the "best way to invest money."

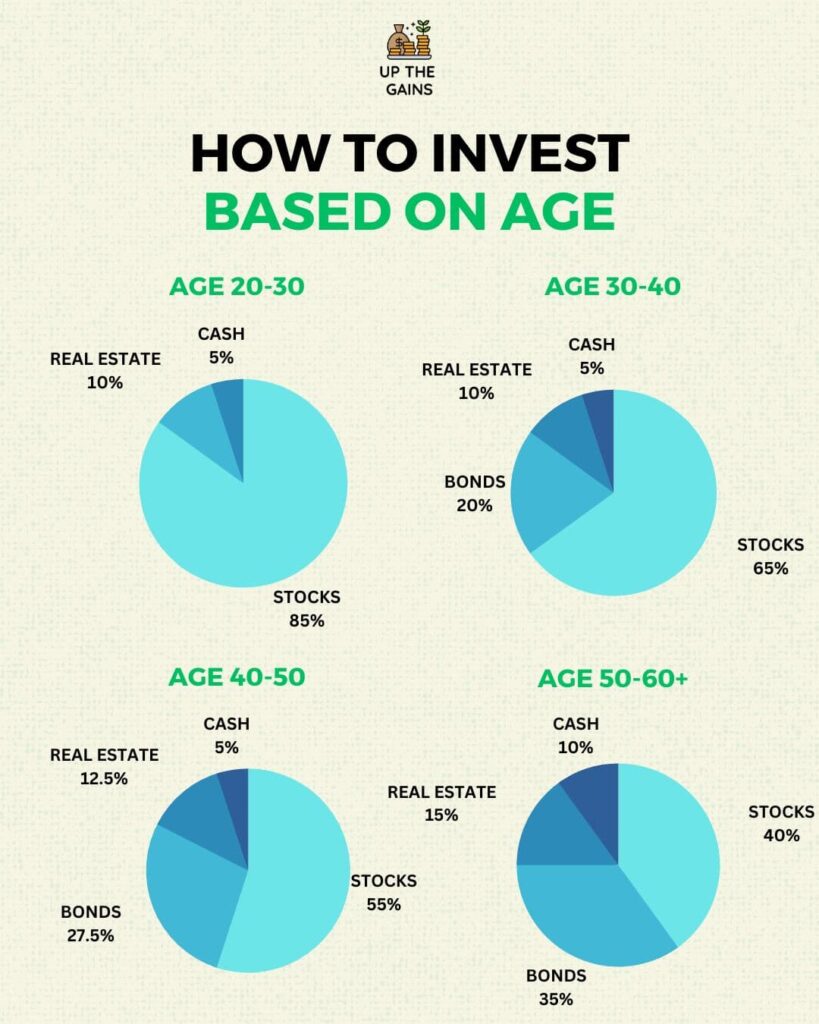

Exploring Different Investment Vehicles

Different avenues for investment exist. Stocks, bonds, real estate, and even precious metals provide diverse paths to growth. Choosing the right mixture is crucial for a well-balanced strategy, enabling a balanced view towards which vehicle for "best way to invest money" is suitable for your needs. The "best way to invest money" often entails an accurate mix of several investment methods for optimizing potential return on investment while also lowering the inherent risk involved.

Importance of Diversification

Finally, a well-rounded investment portfolio often involves diverse assets. Spreading investments across multiple categories protects your finances from potential losses in any particular segment. By choosing diverse vehicles you can achieve the optimal "best way to invest money," securing your financial interests in the most sustainable way possible. By spreading your risks and investing across several mediums you ensure you find the best investment solution. This provides the safest, secure and "best way to invest money," spreading out the possible consequences, lowering overall financial loss. A broad variety in types and strategies ensures successful results. Following an established and comprehensive plan while understanding various vehicles provides your "best way to invest money". You must explore various options before you can settle for one.

5 Ways to Invest Wisely

Smart investing is a journey, not a sprint. Picking the best way to invest money depends on your goals, tolerance for risk, and timeline. Forget fancy strategies; solid groundwork wins. This approach to investments should work for anyone. This is how you master your best way to invest money effectively.

-

Low-cost Index Funds: Easy to start, a fundamental building block of smart investing, it is among the best way to invest money. Mimics the market, keeps costs low, suitable for beginners who are looking at the best way to invest money.

-

Dividend Stocks: Consistent payouts, adds passive income to your returns and this proves one of the best way to invest money with little extra risk. Find dependable businesses in dividend-paying industries, crucial for reliable income. You know this is one best way to invest money and build stability.

-

Real Estate Investment Trusts (REITs): A real estate route for people looking at the best way to invest money, with a portfolio diversification element to it. It offers professional management and diversification, crucial in maximizing profit. You have real estate assets.

-

Retirement Accounts: 401(k)s and IRAs: Best way to invest money with a defined contribution element is very beneficial. Take advantage of employer match programs and the time value of money. Helps save, while also gaining favorable tax treatment: these options offer significant perks, essential when looking at a best way to invest money.

-

High-Yield Savings Accounts/Certificates of Deposit (CDs): Suitable as a cash reserve; provides modest returns and liquidizes easily. These low-risk choices provide liquidity with less return fluctuation. If you want quick money back in a best way to invest money scenario, this approach offers a good chance.

7 Reasons Why Diversification Matters

Diversification: the cornerstone of smart investments and risk reduction. Minimizes losses. A wide range of portfolios guarantees profit for beginners, so this is a must if you choose to be a part of this method. This shows great advantages if done with care, this is the best way to invest money over time and minimize your risks! Why should you diversify in a good manner when considering a best way to invest money?

-

Minimizes Risk: Spreading capital across various asset classes limits portfolio vulnerability from poor outcomes in a single area and can be among the best way to invest money when dealing with fluctuations or markets going downwards, providing the least impact.

-

Protects against Market Fluctuations: Market downturns, especially when selecting your best way to invest money, impact certain sectors and sectors can decrease in a predictable way, however your returns are less impactful if well diversified, with less risk of heavy financial loss.

-

Enhance Long-Term Growth: Consistently high long term returns for any specific approach can make up a better way to invest your money across several areas and markets, maximizing your possible outcomes when dealing with longer periods of investments. This is proven one of the best ways to invest your money as a fundamental factor!

-

Reduces Impact of Individual Stock Performance: Every best way to invest your money or market comes with ups and downs in specific areas; this impacts your growth, however, good diversification guarantees against these individual decreases, making this your most promising approach for diversification in investments!

-

Improves Portfolio Stability: A stable performance over the long term, one of the best ways to invest money effectively is guaranteed when a diversified portfolio balances out performance across numerous areas.

-

Increase Profits from Returns Across Different Sectors: When considering different asset classes in terms of investment or your best way to invest money for different goals, diversification in terms of profit through varying assets and industries offers a great way to diversify returns and increase overall portfolio earnings

-

Provides Protection During Downturn and Upswings in Market: One key advantage of having various best ways to invest money options is its effectiveness for shielding your gains/loss impact during economic shifts in any particular asset class, such as if one has good/bad returns in particular situations that occur at certain moments of an industry

Top Investment Strategies for Beginners

Beginner investment should be about learning a way that does not cause unnecessary trouble for you! Beginner-friendly investments often involve low risk. Focus on the best ways to invest money rather than overcomplicated options to achieve higher returns, if that’s your goal.

-

Establish Financial Goals: Know the best way to invest money by defining clear financial aspirations, this is crucial. Consider your short-term and long-term goals before investing or selecting a financial asset and this should shape all subsequent aspects of investing for a better outcome, even more if your goal is maximizing your profits

-

Allocate Funds: Allocate a certain portion of your portfolio to different investments. This method guarantees stability and flexibility over the years and in this respect, is a great example of the best ways to invest your money.

-

Seek Financial Guidance: Expert opinion for building up a profitable portfolio in investing can offer insightful guidance, considering you need support in determining the best way to invest money if possible, so this option works in most situations

-

Research and Learn: Stay informed to increase your knowledge on markets; this approach should be beneficial when researching about new, promising ways to invest your money for an even better return over time and in this respect, can work greatly when investing

Exploring Different Asset Classes

Asset classes, part of investment strategies. The different classes provide better chances to maximize profits for many who adopt one or several methods among different approaches for achieving the best way to invest money. Consider diversification as well for all asset classes in most best investment situations.

-

Stocks: Stocks: Represents ownership of a part of a company; provide the possibility for high growth. Great risk-reward element in this method.

-

Bonds: Bonds: Borrow money from an entity like a company or the government; provide a fixed rate of return, offering greater certainty than a share option.

-

Real Estate: Offers diversified ownership; long term capital growth potential is among the most prominent benefits for such strategies.

-

Commodities: Include precious metals (gold, silver) or agricultural products (grains, etc); providing an investment mechanism.

-

Cash Equivalents: Offer safe harbor; an excellent option for protecting liquidity in the long run.

Long-Term vs. Short-Term Investing

Understanding timeframes helps with determining how you should approach an investment and, based on that, one should then determine what strategy the best way to invest money offers in these specific contexts.

-

Long-term investing typically aligns with longer financial horizons like retirement or buying a home in several years' time. This method prioritizes investments aimed at stability.

-

Short-term investing, generally focused on achieving particular aims such as purchasing goods, tends to include shorter-term horizons, like funding immediate needs and financial decisions. This investment method usually maximizes returns quickly. Focuses on higher possible returns but could pose a higher risk compared with other options in terms of investment strategy.

Best Way to Invest Money: Questions to Ask Yourself

Source: rates.fm

Finding the best way to invest money isn't a one-size-fits-all thing. Your personal situation matters a lot when picking investments. Many factors determine the best way to invest money, so get specific about these. Understanding these crucial points helps find the perfect investment for you. The best way to invest money is about being smart and tailoring it to your needs.

What is Your Investment Timeline?

Short-term needs? Long-term gains? Knowing your investment timeframe dramatically changes things. A 5-year goal? A 30-year retirement? Time is a factor in calculating your risk tolerance, investment choice, best way to invest money, the level of returns needed for your personal financial goal and in calculating the best returns, the expected period to reach them, time in investing best investments.

How Much Risk Are You Willing to Take?

Risk and reward often go hand in hand. A high-risk investment could bring big returns, but also potential loss. Understanding risk levels helps determine how much exposure best suits the individual investor for a profitable path. Investment risks include the potential to lose all or a large amount of investment money, thus needing careful evaluation of potential gains. Evaluate all factors in picking an investment path to get the most profitable return for the best investment decisions in this stage and time. Knowing your tolerance level is essential when talking about investing best. Risk vs. return are linked to the investment's success rate, which significantly impacts decision-making in this field.

What Are Your Financial Goals?

Source: co.uk

Are you saving for a house? Retirement? Knowing your goals makes figuring out the best way to invest money easier. Specific goals provide guidance on where to invest your money efficiently and profitably, whether saving for a short-term or long-term financial target or achieving better returns in less time. Best investments always factor your life plan to deliver returns at the highest possible returns while safeguarding your initial capital investment for profitable use in the next stage of planning. The path taken and best investments will vary depending on how they'll best support and improve long-term strategies, short-term needs and best investments that provide the desired return according to goals and expectations, that match expectations with profits and desired best results. Investments must meet these conditions for consideration as a worthwhile return investment. Short term, long term, medium term, goals play a role in choosing the right kind of investments that fit best to obtain your targets in a profitable, smart, easy and efficient method and best strategy available in investments that matter in the financial world today.

What Is Your Budget For Investing?

Large sums of money? Small amounts? Your budget limits possible investments. Even a small amount can earn decent returns when you approach it strategically. Best strategies, smart allocation, appropriate use of funds best tailored to one’s financial circumstances will determine one’s success and growth of personal finances. Investing needs careful budget allocation; knowing how much is available is important. The choice of best investments hinges on your budget; this makes an immense difference in best returns, considering your finances carefully. Considering budget implications helps create the best possible best investment strategy for an optimal return and helps allocate investments appropriately according to financial ability, determining investments according to funds and needs available in a profitable and beneficial way that will support investment decisions appropriately, securing future capital best allocation accordingly with expected returns. Budget allocations for different needs at different times should align, thus needing close planning and implementation. Investing strategically, within means available, brings profit in best results and planning.

Best Way to Invest Money: Choosing a Financial Advisor

Finding the best way to invest money is a crucial step in securing your future. A solid financial plan is essential. A financial advisor can help, and finding the right one is key to successful investments. It is essential in a world filled with so many confusing financial choices. Choosing the best way to invest money wisely involves researching advisors' expertise, services, and track record. A well-structured process is your first step towards building your investment success story. Finding a trustworthy advisor who knows you and your goals for the best way to invest money makes a massive difference in financial stability and happiness.

Importance of Research and Due Diligence

Thorough research is paramount to picking the best way to invest money. Analyze credentials carefully. Assess the advisor's expertise in diverse investment areas. Experience matters significantly in choosing the best way to invest money, showing competence and capability. Do background checks. This deep dive gives a critical look at possible issues before committing. The aim is identifying and managing financial dangers before you become a casualty. Thorough review can be challenging at times. The time you spend investigating thoroughly will dramatically improve outcomes in the long run when looking for the best way to invest money. Digging deep prevents common pitfalls and errors in investing. Evaluating the advisor's methodology, the track record is significant for understanding the best way to invest money.

Analyzing Investment Portfolio Performance

Analyzing portfolio performance is vital for gauging the efficiency and effectiveness of the best way to invest money. Carefully monitor returns, diversification of investment options, expenses, and consistency to assess how investments perform over time. Understand potential risks. Don't simply glance over it—take the time to truly delve into the performance data when looking for the best way to invest money. Use charts and graphs, historical information, market updates. Understanding these helps optimize your overall approach to investment to get the best results for the best way to invest money. Examine consistent patterns, changes, and areas of growth over time. Look at both the positives and the negatives while deciding the best way to invest your money, that will result in smart decision-making to make future earnings smoother and profitable. This constant monitoring for the best way to invest money helps adjust your portfolio regularly to remain adaptable and progressive. Knowing these strategies gives a precise and detailed understanding, crucial for the best way to invest money wisely.

Source: familyfinancemom.com

Strategies for Maximizing Returns

Strategies for maximizing returns in investment choices can drastically improve returns. Research strategies, consider growth-focused models, and explore dynamic methods while picking the best way to invest money. Consider low-cost investment options while evaluating methods to generate a healthy income while investing in the best way to invest your money. Analyze potential growth and losses in comparison with alternatives for the best way to invest money in investments that seem profitable.

Managing Your Investments Effectively

Active investment management is pivotal when considering the best way to invest money. Track, record, and review your investment progress regularly while analyzing your personal finances. Consistent portfolio management helps to maximize returns. Create your personalized strategies, goals, and needs while managing funds to find the best way to invest your money, especially when you are involved in long-term investing. Use tools for automated savings while managing funds and maximizing profits while using different ways of investing for the best results. Managing investments and money involves understanding the financial market trends for the best results when following the best way to invest money. Continual monitoring is an essential piece to ensure a steady and dependable flow of cash when considering different investment choices to improve future profits with the best way to invest your money.

Best Way to Invest Money: Checking In And Making Adjustments

The best way to invest money hinges on a continuous process of observation and adaptation. It's not about a single, perfect strategy. Understanding the evolving market, keeping an eye on your own investment plan, and altering your course when necessary are crucial for sustainable financial success, aligning with the "best way to invest money." A fixed, rigid approach will often prove far less profitable in the long run. This flexible approach to investment will show huge return when needed and keep it secured, it's the most consistent method to do best way to invest money. Real returns involve these key actions and frequent check-ins. Your investment goals shape your approach—a good plan considers this too. This all falls under the best way to invest money.

How to Stay Informed and Up-to-Date

Staying informed in the ever-changing world of investing demands constant effort. Following reputable financial news sources—articles that you trust, this part helps understand and follow up better, and keep abreast of significant happenings. This is necessary to implement the "best way to invest money." Pay attention to the trends affecting different sectors and, when needed, adjust accordingly. Don't rely solely on short-term, flashy trends; look for longer-term patterns in these and you have improved potential of the best way to invest money. Also research sector-specific, niche news for an insightful view to succeed in "best way to invest money" plan.

Importance of Regular Portfolio Reviews

Scheduled reviews of your investment portfolio are essential. They give insights to adjust, ensuring you are still pursuing your financial goals. These reviews act as checks to your "best way to invest money". This proactive review provides timely course corrections. A lack of these steps means you lose out on potential improvements, missing chances you could make when adjusting the best way to invest money.

Understanding Market Fluctuations

Market fluctuations are a given; this is why a fixed approach to best way to invest money seldom yields high returns. Learning to navigate these peaks and troughs through market analysis is crucial for "best way to invest money" that works in the long-term. Be realistic about the market risks to the best way to invest money; if possible diversify. If possible then spread, but the main point is understand.

Source: ytimg.com

Handling Unexpected Circumstances

Life throws unexpected curveballs. A major loss or unexpected income affects an individual, and an adjusted financial plan. Make sure your best way to invest money plan accounts for unexpected events so you can get a good grip of things. Assess what can go wrong; the "best way to invest money" always includes this factor. Develop solutions beforehand to limit surprises in investments. Be mentally prepared and adjust based on circumstances for an adaptable method and success related to best way to invest money.