Basic Financial Planning Questions

Effective financial planning starts with the right questions. These fundamental financial planning questions form the bedrock for successful strategies. Strong financial planning needs thorough foundational questions. Ask yourself these basic financial planning questions today and build a plan.

-

Where am I now? Review current income, expenses, savings, and debts. Analyze the real-world details behind the basic financial planning.

-

Where do I want to go? Define your short-term, medium-term, and long-term financial goals, be clear and concrete. Financial planning is all about creating a concrete path.

-

How will I get there? Map out detailed steps and actions toward goals. Explore realistic steps you will take for effective financial planning.

-

What are the risks and rewards? Identify and evaluate potential risks and benefits and find the right balance between them, find the way to your long-term success. The rewards might need effort, don't forget to plan how to get over obstacles in effective financial planning.

-

What resources will I use? Determine and find any assistance needed during the planning period to gain good control of the journey through planning, because every detail of your plan should be aligned perfectly to have good financial planning.

Financial planning is the way to secure a promising future and effective financial planning requires strong foundational steps and basic financial planning questions must always be asked. Financial planning should have proper detailed questions before getting to conclusions, be wise, detailed planning is effective.

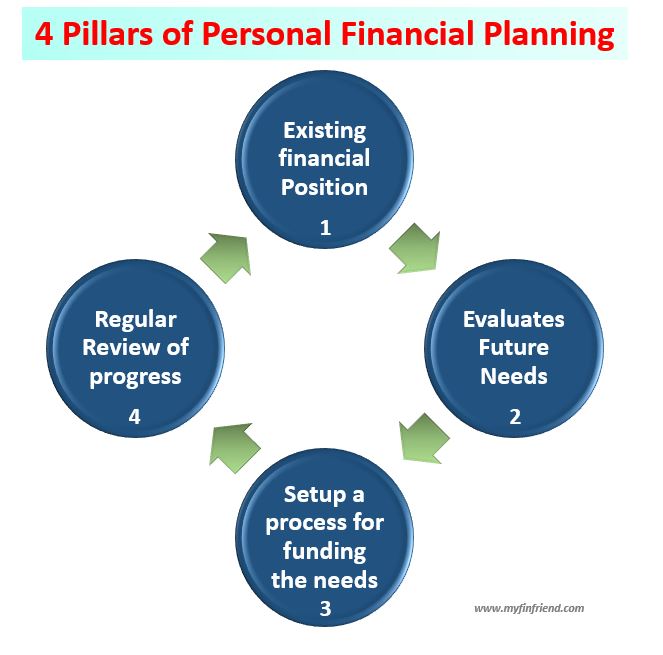

Essential Financial Planning Steps

Efficient financial planning follows specific steps, creating a robust approach towards building wealth and ensuring financial well-being.

-

Assess Current Financial Situation: A critical initial step for planning is recognizing your current status; look at every little detail and then get over that, get moving to a better life, your present finances affect future outcomes, keep in mind every factor of your financial planning before moving to the next.

-

Define Financial Goals: Having a good overview helps a lot. Be ambitious but realistic. Planning for these financial goals is crucial, be certain and be well aware, think wisely.

-

Develop a Budget: Tracking income and expenses. Be meticulous; make your own unique approach of financial planning.

-

Establish Savings and Emergency Fund: Build a safety net. Saving should be at the top of any list if you are wanting financial planning.

-

Manage Debt Strategically: Paying debts effectively, is crucial for any financial planning process. Find smart ways, find the correct information before implementing changes.

-

Invest Wisely: Diversify your financial investment choices; this should always be something that's included in the planning. Financial planning requires wise choices.

-

Regularly Review and Update Plan: Financial conditions and circumstances will evolve, requiring frequent check-ups for success in planning, your situation evolves; change your financial planning in due time, no need to rush into something before evaluating your progress for your best financial planning outcome. Financial planning and flexibility are directly related to long-term well being and security.

By focusing on these detailed steps of your financial planning journey, the effective financial planning experience will bring fruitful rewards over time. A solid base and concrete financial planning process leads to fulfilling results for effective long term gains.

Financial Planning Goals

Source: wp.com

Goals are vital elements for your long-term vision, motivating effective financial planning processes, and keep you going in the journey to better results. These plans motivate effective actions, create structure to your financial planning process. Set clear targets that excite you, motivate yourself, and develop detailed strategies in your financial planning process.

-

Short-Term Goals: Include monthly savings goals, paying down small debts, unexpected expenses to create a solid foundation for future decisions for any financial planning plan.

-

Mid-Term Goals: Such as purchasing a house, buying a car, significant renovations, vacations; they can involve longer planning to achieve effective and concrete actions.

-

Long-Term Goals: Focus on retirement planning, securing an estate or investment for long term sustainability and wealth, making decisions wisely with strong goals helps your financial planning strategies reach better and bigger goals. These detailed plans to achieve results must consider your planning process with great flexibility and flexibility and awareness is very much part of good financial planning strategies, think practically, no regrets!

Specific goals must be incorporated into detailed plans and effective implementation strategies for the entire journey of financial planning, to gain long-term gains in planning effectively. Financial planning means making sound financial decisions toward achieving set financial goals, make use of any resource or idea available.

5 Financial Planning Mistakes to Avoid

These mistakes can harm any efforts or gains from financial planning; avoid these financial errors in financial planning for long term security.

-

Ignoring Debt: Ignoring the critical and stressful nature of debts can make a difficult financial planning process even worse. Make paying down debt a high priority in your financial planning steps, debts make the journey rough, be cautious, think carefully!

-

Not Planning for Unexpected Events: Unexpected events can jeopardize all long term planning efforts in a matter of moments. Be practical and proactive in creating long term safety nets to deal with future unexpected conditions, unexpected events can create a hole, plan ahead for protection in case unexpected events may disrupt long-term goals.

-

Investing Heavily in One Asset Class: Spread out investments into different, multiple opportunities. Too much faith in any specific investment method in any financial planning journey can be very, very dangerous and affect returns negatively, and financial planning depends greatly on diversification, financial plans must be careful to avoid risk.

-

Not Having an Emergency Fund: Be sure to plan ahead, build that emergency fund with your effective plans and take every step with efficiency. Have a detailed strategy that has protection against emergencies; emergencies require ready cash flow and savings to navigate unexpected expenses and keep finances afloat, the most basic but critical element in strong financial planning.

-

Lack of Financial Planning Review: Make regular financial check ups a non-negotiable in any successful planning. Stay ahead of change, regular check ups guarantee successful plans and proper changes needed for the current financial conditions or market circumstances, keep on track in planning or else any effort you've spent will be in vain.

Avoid these pitfalls to achieve a smoother financial planning experience. Be aware, proactive and vigilant at every turn. Plan, track, adapt and make your plan work well for you to have a smooth, strong, long-term financial journey.

How to Start a Financial Planning Journey

Source: cloudfront.net

A step-by-step approach to establish a sustainable financial planning plan. Making solid financial plans, understanding these aspects helps you on the path to success, making wise, long-term financial decisions and to establish your foundation effectively.

-

Analyze your current financial state: Examine current financial accounts (bank, loans) and assets. Know your current condition accurately and detail every component, because any small oversight can have consequences that could cause financial difficulties or problems down the road, look thoroughly at every element of finances; get acquainted with current figures!

-

Outline short, mid- and long-term financial objectives: Be aware of realistic timelines and be able to follow any step to make any corrections to your planning efforts at any time, create timelines and milestones in every financial decision. Define both specific and broader ambitions; these create detailed and achievable short and medium-term financial planning goals that will act as stepping stones toward larger ambitions and create financial success.

-

Establish a robust budget: Outline income and expenses, ensuring accurate and honest estimations; no element must be ignored for good and sound financial planning practices to achieve results, and track your progress towards your financial targets.

-

Create savings goals: Create an actionable saving and investment strategy; develop realistic financial planning processes and consider every step, think out loud, what will I gain by these decisions?, evaluate any action from any perspective for successful financial decisions. Create strategies, a realistic savings and investment strategy will support financial goals efficiently.

-

Embrace financial planning review and adaptation: Review financial performance regularly. Adapt financial plans and create appropriate response strategies to keep ahead in the ever changing environment. Track performance, assess regularly for better control and understanding for future developments and changes for effective results for long-term goals for better results from your plans.

Financial planning, a fundamental tool for attaining personal economic well-being requires solid and strategic planning from start to end.

7 Reasons Why Financial Planning Is Important

Financial planning isn't just about managing money; it's a roadmap for your future. Proper financial planning provides direction, allowing you to navigate financial complexities and achieve significant life goals. Understanding financial planning is key to a more stable and secure tomorrow. Financial planning, strategically applied, becomes your most powerful asset.

-

Secure Your Future: Financial planning empowers you to plan for emergencies and long-term goals like retirement. It builds a safety net for unforeseen events and empowers you to save aggressively. Don't just dream about the future, build it now with solid financial planning strategies.

-

Achieve Your Dreams: Having a financial plan provides clarity and motivation for reaching aspirations—a dream vacation, buying a home, or sending children to college. With focused financial planning you have the power to translate dreams into tangible realities.

-

Reduce Stress: Planning can often ease anxiety about money worries, as every financial planning step clarifies and establishes expectations. Having a handle on finances prevents you from running in circles with concerns about future funding, which frees mental space for greater well-being.

-

Make Informed Decisions: Understanding financial planning means having information to avoid costly mistakes, making effective investments, and protecting what you have. It also offers practical financial strategies you can implement today to secure the future.

-

Protect Your Assets: A good financial plan helps create strong financial foundations to prevent potential financial losses. Your assets are important and protecting them requires a meticulous financial planning scheme.

-

Prepare for the Unexpected: The unpredictability of life is real. You don't need an accident or an illness to face a situation requiring quick cash access, like sudden house repairs or vehicle emergencies. Your financial planning must have reserves and plans for this type of eventuality.

-

Build Financial Literacy: Effective financial planning is about gaining insights into your own finances. This will significantly strengthen your overall financial awareness and empowerment. Financial literacy fuels your journey toward sound financial decisions and ensures a brighter future.

Source: truedata.in

Financial Planning for Beginners

Source: bridgepointconsulting.com

Beginners to financial planning may feel overwhelmed and wonder where to begin. Building a plan shouldn't be intimidating, start now and learn gradually. First, analyze your existing financial status; be honest with your own resources. Be certain about where your money currently goes, noting recurring payments, unexpected outgoings. Keep track. Make a realistic financial evaluation by accurately categorizing your current resources and expenditures. Set both short-term and long-term goals, considering lifestyle needs, priorities, and passions.

Next, decide on realistic steps and expectations and stick to those principles. Avoid impulsive decisions regarding investments or high-risk activities. Avoid pressure-based financial planning decisions.

Tips for Successful Financial Planning

For robust and successful financial planning, adhere to the following guidelines. Financial Planning should help establish stability and build momentum; remember those objectives always.

-

Create a Budget: Detailed and practical financial budgeting. Don't let expenditures exceed your income; be consistent, track your spendings scrupulously, establish accountability for those expenses.

-

Emergency Fund: An emergency fund for immediate requirements is a must in a well-structured financial plan, and in such a volatile economic climate an emergency fund is critical to ensure an excellent safety margin against setbacks or loss. Financial plans should consider unpredictable disruptions and develop contingency plans that incorporate a safety net.

-

Debt Management: Develop a detailed debt reduction plan, set realistic targets. This financial strategy and plan should help you attain zero debt faster than anticipated. Tackle high-interest debts first to minimize total debt service costs over time. Thorough management of debt, as an integral part of financial planning, plays a key role in financial independence.

-

Regular Savings: Maintain consistency in saving, however small the amount. Saving is crucial to financial planning—even small consistent deposits build up and accumulate over time, fostering wealth creation.

-

Track and Review Regularly: Keep careful records and review your progress regularly. This ensures flexibility and allows adjustment as circumstances evolve; regular review helps fine-tune financial strategy based on changing goals and evolving life.

Common Financial Planning Challenges

Some challenges common in financial planning can lead to financial frustrations and anxieties. Many struggle with consistent budget discipline or debt repayment, potentially overwhelming any personal financial plan.

-

Procrastination: Avoiding the process can postpone building a plan and reduce effective management of income and expenditures. Start early, establish momentum. Start financial planning today. Every bit of planning, no matter how modest, contributes significantly toward attaining objectives.

-

Lack of Motivation: Persistence can be challenging as personal life events create distractions; it's key to maintaining focus amidst lifestyle pressures, building positive habits around saving.

-

Emotional Decisions: Avoid making decisions influenced by feelings; use well-organized plans as guides and follow the plan and avoid any potentially destructive impulse-driven spending patterns. Decisions are best based on strategies, rather than instantaneous desires or emotions.

Financial Planning for Specific Goals

Financial planning is pivotal for attaining particular aims, tailored for your unique desires. For example, a mortgage or major home repairs would require specific strategies to get funding or allocate resources. Building your house would need specialized considerations for building the foundations of that plan, that would affect each stage of financial preparation.

-

Retirement Planning: Your plans should ideally anticipate a comfortable and secure future retirement. Understand the current economic and financial market landscape. Financial plans should assess different factors when aiming for your goals and objectives for retirement—the timeline, estimated costs, anticipated earnings. A robust retirement plan is more valuable than a simple financial planning exercise; retirement planning is absolutely essential. The proper financial planning will include both short-term and long-term plans that help accumulate enough capital during your working years.

-

Education Planning: Costs related to education can be considerable. Develop realistic plans based on income projections and savings capacity and anticipate fluctuating market prices. A child's future is among your priorities; the better and more effectively planned the plan, the brighter the outcomes. Effective financial planning supports securing their financial and personal success as future plans.

-

Buying a Home: Preparing to buy a home calls for extensive planning, determining affordability, saving for the down payment, evaluating interest rates, calculating the total cost of a mortgage. Detailed plans and consideration is required. Financial planning is integral for successful mortgage acquisition, considering not only immediate needs but also long-term implications, from renovations and improvements to resale value. Your planned savings must allow for anticipated expenses for acquisition, payments, and the costs required for house renovations. This detailed and considered approach to purchasing a home will assure a positive impact on personal life.

Long-Term Financial Planning Strategies

Long-term financial planning is key to achieving your goals. Good financial planning lays the foundation for your future success. It is a crucial aspect of your overall well-being and a long-term financial plan is a strategy. A long-term financial plan provides a roadmap for future financial security. It is about understanding where you are now, identifying your goals and ambitions, and strategically positioning yourself for long-term success. A well-structured long-term financial planning strategy is built on sound principles, giving you more options to improve your financial condition over a prolonged period.

Effective long-term financial planning hinges on a clear understanding of your objectives. Think about the goals you aspire to accomplish. A long-term financial planning approach must align with these personal goals and dreams. Determine a specific timeline, estimate the cost to accomplish your long-term goals. The detailed, practical long-term financial planning process considers both your current situation and future plans to ensure consistent growth. This detailed methodology should account for various scenarios to help mitigate risks and seize profitable opportunities over time.

Key Elements of Long-Term Financial Planning Strategies:

- Establishing Realistic Financial Goals: Set achievable goals for the future that include your short term plans

- Analyzing Your Current Financial Situation: Assess your income, expenses, and assets.

- Creating a Budget and Spending Plan: Develop a budget that considers your current and anticipated income. This detailed process allows you to identify ways to save or adjust spending behaviors, ultimately benefiting your financial planning strategies.

- Investing Strategically: Evaluate diverse investment avenues and establish an effective plan to potentially boost long-term wealth.

- Ensuring Adequate Savings and Investment: Determine realistic amounts you should save and put into financial investments based on current economic trends, expected returns, and possible loss of funds, as a crucial element of financial planning strategies.

Questions to Ask Yourself When Implementing Long-Term Financial Planning Strategies:

- What are your long-term financial goals, like early retirement? Strong financial planning must have clearly defined goals to remain focused and resilient on your pathway. Focus on practical measures when creating a long term financial plan that addresses your unique concerns

- How much money will your desired lifestyle require over the years, given inflation, expenses and investment performance? Successful financial planning anticipates changes over time, as the most valuable quality for financial planning is adaptable vision.

A good long-term financial plan will encompass all financial aspects, and will provide a plan to achieve your financial goals over the years. Effective long-term financial planning requires careful attention to all factors of long-term planning. Long-term financial planning requires meticulous analysis of economic factors, such as rate changes. Financial planning often demands detailed evaluation of future trends to adapt to future uncertainties and achieve financial success.

Short-Term Financial Planning Tips

Short-term financial planning requires swift decisions and precise action. Your short term financial plan must respond to immediate financial pressures and challenges. The approach should prioritize addressing current financial situations, maximizing resource allocation, and achieving tangible results rapidly. You need a specific timeframe to reach the short-term goals in your short term financial planning.

Quick Steps for Short-Term Financial Planning:

-

Recognize Current Financial Position: Assess your monthly income and expenses; prioritize pressing financial issues

-

Develop Short-Term Strategies: Establish budget strategies to control overspending, debts, savings or loans based on your income. This financial plan addresses specific issues affecting finances.

-

Prioritize Financial Needs: Determine immediate demands and develop corresponding action plans and create action steps to meet immediate financial objectives for your immediate well being.

-

Evaluate Emergency Funds: If you're experiencing unforeseen situations, implement necessary short-term financial planning actions and plan your response accordingly

By having a sound short term financial plan, you'll be more likely to accomplish your goals, manage risk better and create a favorable long term outlook on financial conditions. Short term financial planning ensures prompt action on money matters; this is an efficient process for managing personal finances. It's an essential aspect of good financial planning for handling immediate financial necessities.

Budgeting for Financial Planning

Budgeting for financial planning is fundamental. Without budgeting, effective financial planning is improbable. Budgeting creates a structured spending strategy based on planned revenue and estimated expenditures, creating a guide to control your personal finances. Budgeting offers clarity and transparency over your financial health. A good budget effectively coordinates and monitors how finances are managed. The cornerstone of good financial planning is effective budgeting for effective management of your funds.

Building Your Budget:

-

Tracking Income: Monitor income flow and estimate future revenues based on work situations, contracts, investments and your economic outlook to account for income fluctuation in your personal budget. A budgeting financial plan must reflect an honest view of incoming funds for accuracy.

-

Categorizing Expenses: Establish various expense categories such as essential utilities, discretionary purchases, and investments. Categorizing your expenses ensures financial accountability in order to develop a thorough budget for financial planning purposes.

-

Monitoring Financial Activity: Track your spending on various items for your short term financial planning purposes. Monitoring gives an informed view for your budgeting process.

A flexible budget plan is required as needs and conditions often evolve, and your budget needs regular review, adjustments or changes over time. Planning must take account of unforeseen events. Budgeting for financial planning ensures consistency, stability and peace of mind. A successful budget and sound financial planning usually provide clear visibility over how your resources are managed and how you are adapting. It ensures consistency for long-term stability.

Creating a Financial Plan for Retirement

Retirement financial planning involves meticulous strategizing, enabling you to effectively transition into your retirement years. Creating a financial plan for retirement is critical for your peace of mind as retirement approaches, because there are certain needs and anxieties you must address when preparing for this life-changing event. Your financial planning for retirement can make the difference between feeling secure in your retirement and feeling anxious, as successful financial planning has a large effect on your life quality, enjoyment and contentment as you plan for retirement.

Creating a Retirement Financial Plan:

- Calculate Estimated Needs: Anticipate daily life expenses during your retirement and plan to cover your essential living expenses, expenses based on your needs as your situation evolves.

- Calculate Expenses: Consider costs of medical care, other expenses and account for a variable estimate as factors will be unique to every retirement situation

- Explore Investments: Consider how investments should be positioned during your retirement for consistent income and sustainable levels of expenses. Successful long-term financial planning will help make this possible

- Planning for potential retirement issues: account for circumstances that will arise for unforeseen reasons

- Adjust Plan as Necessary: This is vital because a thorough and effective financial planning approach must consider and account for variable situations in your plan to account for changes and possible future concerns.

The development of a detailed plan for financial planning for retirement demands accurate estimations of expenses over various situations in your life and the years after retirement. This process requires patience to reach the successful plan you desire, which demands realistic budgeting. Financial planning must take your desires, limitations, circumstances and outlook into account. A detailed plan that focuses on your life, and realistic plans are key to developing a sound plan and the process. This will guarantee success as retirement begins.

Financial Planning and Investing

Effective financial planning goes hand-in-hand with sound investment strategies, a very important area for successful wealth building. Combining investment techniques and approaches with financial planning is crucial for long-term success. Financial planning and investing demand careful coordination. This strategic integration allows a comprehensive strategy to work together. Understanding your financial needs in retirement is paramount when incorporating investments with your long-term financial planning approach, especially to fund retirement savings. Successful investing plays a role in maximizing your future well-being and freedom. A wise financial planning approach blends a good financial plan with well-chosen investments.

Investing and Financial Planning Considerations:

- Assessing Risk Tolerance: Analyze your willingness to accept financial risks, to define how to invest, and match your strategy to align with these conditions, for an ideal balance. Understanding these concepts for your financial planning strategy is critical to developing a strategy that considers these essential aspects

- Goal-Oriented Investment Selection: Match your objectives with a diverse and balanced portfolio of investments designed to serve specific short or long-term objectives in line with financial planning expectations. Your financial planning strategy should always align with investment strategies.

- Investment Tracking and Adaptation: Consistently monitor investment performance to respond effectively to market fluctuations. Successful financial planning necessitates consistent effort and timely adjustments, to ensure continued investment success and stability

Successful financial planning blends comprehensive approaches to maximize financial results. Careful review and assessment is essential. Long term planning that blends investments will significantly impact your long-term wealth accumulation potential. A combination of smart investments, with a thoughtful financial planning methodology will ultimately guide you towards consistent improvement over time. Understanding how these different approaches relate, for your personal needs is paramount for success, ensuring effective outcomes through financial planning and successful investments.

Key Elements of a Financial Plan

Financial planning is a roadmap to financial security. Understanding the key elements is crucial for crafting a robust strategy. A strong financial plan considers all aspects of personal finance. The foundation of sound financial planning is based on an individualized plan, reflecting individual priorities.

A comprehensive financial plan must meticulously address essential components. Careful consideration of these core elements paves the path towards a thriving financial future.

- Income Sources: Thoroughly list every source, including salary, investments, side hustles, etc.

- Expenses: Track and categorize living costs, debt repayments, and variable costs (like dining out). Budget meticulously.

- Asset Management: This involves stocks, bonds, real estate. Properly understand asset classes.

- Debt Management: Strategize for optimal repayment. Understanding interest rates matters for efficient financial planning.

- Emergency Fund: Ensure a cash reserve for unforeseen circumstances, ideally, a few months' living expenses in a highly liquid savings account.

Realistic projections help fine-tune your plan and improve long-term outcomes. Understanding tax implications during financial planning will keep your future fiscal landscape safe.

Different Types of Financial Planning

Different financial plans cater to diverse needs and aspirations.

- Retirement Planning: Saving for your golden years requires a comprehensive plan that reflects realistic savings and investment needs.

- Investment Planning: Selecting appropriate investment options like stocks, bonds, and real estate for long-term gains is paramount to your long term goals through effective financial planning. Diversification is an important part of financial planning in investments.

- Education Planning: Financial planning plays a crucial role in structuring funding for future education expenses. Financial plans for education need attention for today’s realities.

- Estate Planning: Establishing a sound legal framework to preserve assets, guide their distribution is an essential financial planning strategy. Careful financial planning can prevent disputes later.

Choosing a financial planning method reflects current priorities and circumstances, thus individual approaches. Flexibility is an integral part of effective financial planning, because your circumstances will likely change and you must stay fluid as needed in any financial plan. Your goals evolve over time; effective financial planning always accounts for those changes.

Important Considerations in Financial Planning

Successful financial planning requires careful attention to several pivotal considerations. A balanced plan, reflecting a balance of priorities, leads to lasting success.

-

Risk Tolerance: Evaluating personal risk appetite dictates appropriate investment choices and asset allocation during your financial planning process. Assessing one’s personal financial plan needs helps build resilience into your personal budget.

-

Time Horizon: Long-term goals, whether retirement or large purchases, necessitate different approaches, each reflected and evaluated properly when constructing your financial plan. The time horizon plays a vital part in planning

-

Personal Values and Goals: Defining financial priorities through your goals establishes your guiding principles in the planning stage of personal finance, allowing adjustments based on evolving circumstances in financial planning,

-

Contingency Planning: Setting up for unforeseen circumstances is equally crucial and should be clearly reflected in effective financial planning for maximum stability. Financial planning should acknowledge uncertainty.

-

Professional Advice: Seeking guidance from financial advisors adds a vital layer of objectivity to a successful personal financial plan, understanding potential limitations. Your personal circumstances vary greatly when financial planning for life's events.

Managing Debt in Financial Planning

Debt management is a core element of financial planning, demanding decisive steps. Controlling debt impacts personal wealth.

-

Prioritizing Debt Repayment: Develop a strategy targeting high-interest debt and paying that off expeditiously. Understand the debt that needs highest attention when designing any effective plan. This helps prioritize your plan to gain more effective control of your finances.

-

Creating a Debt Reduction Plan: Setting up a fixed, reasonable budget helps establish and maintain a debt repayment schedule in financial planning. A plan is not very good without some budgeting strategy for better financial planning

-

Consolidating Debt: Look for options to simplify the debt load if multiple lenders/types are used, saving costs associated with debt in financial planning. Financial planning considerations involve the total burden of various kinds of debt to gain a larger view and assess realistic outcomes for various goals.

-

Budgeting Effectively: Managing spending is pivotal, controlling expenses with precise budgeting is central to your debt reduction plan, optimizing how you spend

-

Monitoring Progress: Regularly review progress; staying updated and adjusting is essential in financial planning and ensuring the repayment goals stay firmly aligned and well-structured in your overall strategy. Staying tuned into your budget, plan, and current finances provides strong decision-making for the plan in question.

Protecting Your Finances Through Planning

Effective financial planning protects your present and future well-being. Creating financial safety nets is imperative.

- Insurance Planning: Evaluate adequate coverage (health, life, home, car) ensuring peace of mind for sudden financial uncertainties. Financial security starts with the essential safeguards in your overall plan.

- Estate Planning Considerations: Outline how you wish to manage assets after passing; safeguarding future inheritances requires a carefully worded and meticulously maintained financial plan for all to be aware of. Your financial plans provide guidelines for your assets' ultimate disposition.

- Investment Protection Strategies: A strategy to lessen any portfolio risk will help minimize any portfolio damage through intelligent investment choices and diversified options for your money to grow steadily. Strong protection means looking for diverse strategies during periods of economic change.

- Risk Management through planning: Anticipating potential risks and formulating contingencies reduces unforeseen difficulties that could derail your goals when devising a sound financial plan for growth and development of finances.

- Legal Guidance during financial planning: Consult qualified advisors and/or legal professionals ensures clear, effective financial planning measures. Proper planning also means knowing what your limitations are during different stages of your financial planning timeline.

Source: theinvestorsbook.com

Financial Planning for Families

Solid financial planning is a cornerstone for a secure family future. Family financial planning involves a strategic approach to managing your family's money effectively. Thorough financial planning is not only about saving, it's also about how to make your money work for you, in multiple ways, through multiple channels. Effective financial planning for families involves taking steps toward stability and abundance.

Prioritizing needs, creating a budget that addresses those needs and developing a realistic spending plan are central to sound financial planning. A key step is to develop short-term and long-term financial goals, and understanding the steps required to reach those goals.

Crucially, regular monitoring and adjustments are critical in successful family financial planning. Unexpected events can and will happen, which demand a nimble and versatile strategy. Financial planning provides the toolkit and support for making necessary adjustments as circumstances evolve. Good financial planning must remain flexible in today's climate, whether personal or societal events unfold unexpectedly or otherwise.

Family financial planning considerations include education savings for children, funding future goals such as buying a home, college tuition and even future medical needs and expenses. The goal of good financial planning isn't about simply managing, it's also about how to build wealth generation that's sustainable over time.

Financial Planning for Businesses

Financial planning for businesses isn't just about numbers; it's about building a strong, sustainable future. A sound business financial plan is a comprehensive roadmap that encompasses many aspects of a business’ operation, outlining strategic decisions toward a goal. Every business's needs and timelines are unique. It's important that your financial plan isn't stagnant.

Understanding financial data is a fundamental element of this type of financial planning. This data, for example, will highlight revenue, expenditure, debts and cash flows. Strong financial planning is absolutely necessary, enabling an ability to effectively project performance, while at the same time recognizing any possible short-term or long-term financial challenges. This enables businesses to adjust swiftly, ensuring business continuity and potential for growth. This should be analyzed with detailed attention to business type.

Critical elements for success in financial planning include defining the goals, analyzing cash flow requirements and understanding what financial planning can provide in support of those plans, including understanding of different types of financial statements and what they can offer your company.

Financial planning involves developing various scenarios and examining projections of potential outcomes, from high performance to pessimistic results and determining the responses your business will need to take under such diverse situations. Strong business financial planning considers external factors that can affect your plan and what variables you have the ability to change, even slightly. A versatile financial planning strategy helps identify how to manage any challenge.

Financial Planning Tools

Various tools can assist your financial planning endeavors and elevate their effectiveness. Technology empowers our ability to control expenses effectively and accurately track performance in ways previous generations could only dream of. There are specialized software programs that provide specific advantages. Some of the best financial planning tools are designed specifically for both families and businesses, although their use may look a bit different in practice.

Financial planning tools aren't simply for wealthy, savvy individuals, however; many accessible options cater to different needs and income levels. Many excellent tools cater specifically for beginners as well as those experienced with personal finances, tailoring to experience. Financial planning software should incorporate intuitive, helpful features.

Tools can be further sorted in this manner:

- Budgeting apps

- Investment calculators

- Goal trackers

- Loan simulators

- Expense tracking tools

Seeking Financial Planning Advice

Finding and receiving helpful financial advice is a key aspect of effective financial planning. Obtaining the advice of qualified experts provides invaluable insight into making well-informed choices for both family and business scenarios. Don't get discouraged if you get push-back. You have a goal in mind and financial advice is important toward accomplishing those goals and financial objectives.

Getting good financial advice will also help avoid significant errors when considering financial plans and choices. Seeking help doesn’t diminish you, on the contrary, gaining this knowledge and support enhances your capability to deal with finances effectively. Don't delay getting financial advice; doing so proactively will reduce potential setbacks when it matters most, in the most crucial situations. It is best to obtain this advice at the right time.

Important questions for individuals who are seeking sound advice often concern short term or long term strategies to accomplish an objective. You should never assume you have perfect knowledge; you should always seek further information. It's critical to recognize the potential benefits, but more importantly, understand the costs, of making a wrong choice and to assess the need of professional support, with your own awareness, along the way.

Financial Planning Resources

Reliable financial resources for planning both personal finances and company ones are absolutely key.

Understanding available tools for obtaining excellent financial information is central to any effective financial planning method. Understanding different sources for financial information and strategies empowers people and corporations to gain actionable, trustworthy insight in support of future planning. For effective financial planning, choosing reliable financial resources should be high on the priority list for families as well as organizations.

Good financial planning sources could come from personal advisors or online courses designed specifically to cover the topics at hand. You can identify helpful, accessible guides or manuals dedicated to families, but similarly for small or medium-sized businesses (SMBs), who want a different methodology or style. Be sure you look around, because quality is extremely important in such a subject. Reliable, specific guides should assist you toward your objective; not merely vague promises about general improvements!

The world is moving, and to avoid being outpaced and falling behind is essential! It's critical to consider the implications, advantages and benefits and how you can leverage that data to inform financial decisions toward building your financial health for years and years. Be willing to utilize and rely upon trusted guides.