Fixed Income Invest: A Comprehensive Guide

Understanding Fixed Income Invest

Source: ytimg.com

Fixed Income Invest, often bonds, are investments in which you loan money to a company or government. In return, they promise to pay you back the loan principal plus interest at a specified date, much like a promise to repay. It is an essential asset in modern portfolios, offering a crucial counterbalance to equities. Fixed Income Invest generally offer a stable return and are appreciated for their defensive capabilities and ability to mitigate risk. This strategy can yield stable returns by holding debt issued by established and credible entities. Comprehending Fixed Income Invest and the associated factors is key to successful financial planning. A strong understanding of Fixed Income Invest helps determine its significance in your portfolio.

Exploring Fixed Income Invest Options

Exploring various types of Fixed Income Invest options presents a range of choices tailored to individual investor needs and preferences. Understanding these different instruments allows investors to make informed selections based on risk tolerance and desired return profile. Each choice has advantages, disadvantages and factors such as maturity, interest rates, yield curves can shape how each category perform over time, giving individuals various means of adjusting Fixed Income Invest strategies accordingly. A deeper dive into specific options reveals that Fixed Income Invest includes options, such as Treasury bonds, corporate bonds, municipal bonds, and agency bonds, offering diverse options. Diversification across several of these can yield the best outcomes in investment strategy.

Source: swisslife-am.com

Benefits of Fixed Income Invest

Fixed Income Invest, also referred to as bonds, provides crucial advantages to investors aiming for a blend of stable income streams and risk mitigation. Interest Income: It yields stable and predictable income streams that provide dependable cash flows that can be crucial for sustaining lifestyle. Portfolio Diversification: Integrating Fixed Income Invest within portfolios significantly reduces the risk involved by lowering the volatility, making portfolios more resilient. Stability: Fixed Income Invest often exhibit stability compared to stock market movements, acting as a haven from volatility that results in minimizing market downturns and their impact. Inflation Hedging: Fixed Income Invest products often feature inflation-linked securities, designed to defend investment value against rising inflation and currency fluctuations. The best approach, however, often results from proper planning.

Fixed Income Invest Strategies

Managing Fixed Income Invest effectively requires understanding crucial strategies. Bond Selection: The ability to carefully and deliberately select the ideal bonds that offer appropriate yields, alongside fitting your portfolio and matching time frames. Portfolio Diversification: Including bonds from different sectors and maturity lengths mitigates risks that may appear to be common. The selection should be made thoughtfully, with particular regard to creditworthiness and anticipated maturity dates. This careful, measured diversification across the spectrum is crucial for balancing risk and potentially enhancing returns within portfolios. This strategy enhances your ability to handle market downturns while also helping build confidence during financial turbulence. Yield Curve Analysis: Examining yield curve data provides crucial information on the potential shifts that will change how fixed Income Invest strategies respond, allowing one to be agile and flexible. Assessing interest rate projections from reliable institutions often results in optimal allocation to minimize potential damage due to changing macroeconomic forces, ensuring optimal investment practices and success. This provides useful insights for adjusting portfolios in anticipation of rate changes and fluctuations that frequently disrupt market harmony and equity growth.

Fixed Income Invest Basics

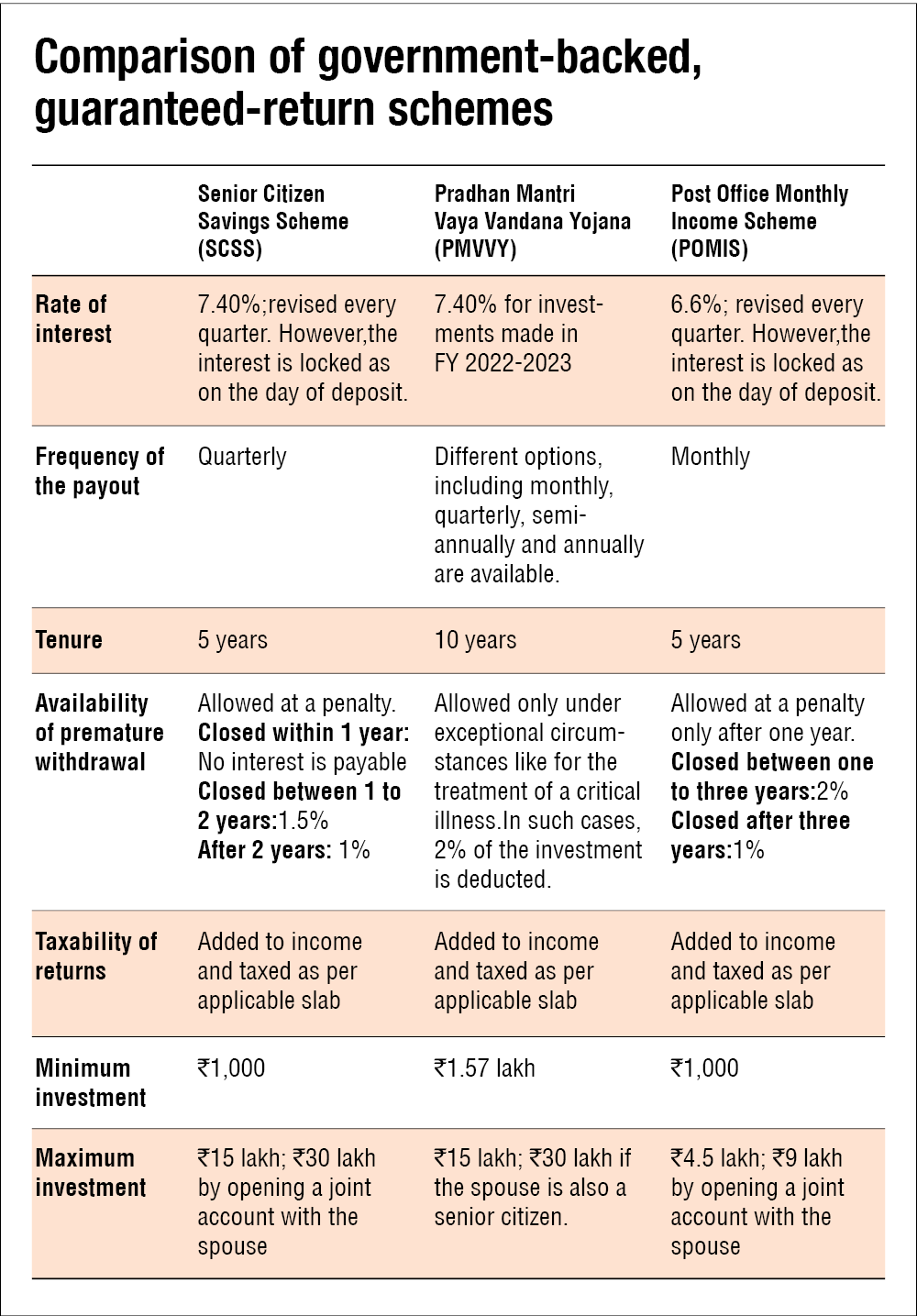

Source: valueresearchonline.com

Fixed Income Invest, a cornerstone of diversified portfolios, offers steady income streams and a hedge against market volatility. Understanding the fundamentals of Fixed Income Invest is key to effectively navigating this investment realm. This secure space presents stable returns for cautious investors. Comprehending Fixed Income Invest structures, types, risks, and selection methods allows better portfolio building. Understanding Fixed Income Invest provides a safer avenue for generating stable returns amidst financial instability.

Types of Fixed Income Invest

Various types of Fixed Income Invest cater to different risk tolerance levels and investment horizons. Government bonds, a risk-averse choice, carry the lowest risk among all Fixed Income Invest types. Corporate bonds, on the other hand, offer potentially higher yields. Corporate bonds hold the key to earning greater returns but face increased credit risk. Fixed Income Invest types vary, impacting portfolio risks and potential rewards. Knowing each Fixed Income Invest category helps shape an effective, strategic plan. Municipal bonds provide specific tax advantages for investors. Their relatively lower yield comes with limited tax benefits. Choosing the appropriate Fixed Income Invest type ensures proper risk allocation and optimal returns.

Fixed Income Invest Risks and Rewards

Fixed Income Invest decisions come with their risks. While boasting relatively lower volatility, there are downside risks to contemplate. Default risk—the chance the issuer fails to meet their payment obligations—is a prime concern in fixed income. Inflation's effect also warrants close scrutiny, as it may diminish a Fixed Income Invest’s real return if bond yields lag inflation. Understanding Fixed Income Invest’s inherent rewards requires a realistic assessment of the underlying risks.

Rewards of a strategically crafted Fixed Income Invest approach often include the prospect of predictable income and the stability to bolster a balanced portfolio against the uncertainties in the equities market.

How to Choose the Right Fixed Income Invest

Deciding on the optimal Fixed Income Invest strategy depends on individual factors. First, define your financial objectives; it directs you towards the best types. Your risk tolerance influences the level of investment risk appropriate to your profile. Considering time horizon, another essential aspect, provides valuable insight. Longer-term investments permit the absorption of slight price fluctuations compared with shorter-term choices. Fixed Income Invest is all about thoughtful selection to align with investment strategies. Consider investing in Treasury bonds or similar securities if aiming for secure capital preservation in Fixed Income Invest. Comparing yield rates between bonds provides vital information for making knowledgeable choices. Evaluate current market trends to discern trends affecting future market positions. Assess the historical trends associated with the fixed income's selected sectors or assets to refine the best investments.

Fixed Income Invest for Beginners

Starting a fixed income journey demands cautious and strategic action. Understand investment choices are available before beginning. First, learn about the differences among varying investment categories for clarity on how investments operate and provide a better understanding. Research carefully by learning from expert insights or joining investment clubs to gather knowledge about how fixed income performs. Be prudent about aligning with an investment advisor and carefully reviewing Fixed Income Invest recommendations. Always follow a precise process for portfolio evaluation and tracking, as Fixed Income Invest’s evolution impacts future predictions and strategy alterations. Fixed Income Invest, as a valuable investment tool, can bolster personal financial security when approached with diligence.

Source: tapinvest.in

5 Reasons to Consider Fixed Income Invest

Fixed Income Invest is a cornerstone for stable portfolios. Its predictable nature offers a cushion against market swings. Fixed Income Invest can provide essential diversification for your investment mix. It can also yield a steady income stream. Understanding Fixed Income Invest is key to building a comprehensive investment strategy.

-

Safety and Predictability: Fixed Income Invest usually carries less risk than stocks. Bonds often offer a set repayment schedule, so the returns are predictable.

-

Income Generation: Many Fixed Income Invest options, like bonds, pay interest regularly. This consistent income stream can be helpful in building your long term financial plan. This is a fantastic source for extra cash flow.

-

Portfolio Diversification: Combining Fixed Income Invest with stocks or other assets creates a balanced investment approach. This diversification lowers your portfolio's overall volatility. The impact of losing out of investments on stocks is heavily offset in a diversified Fixed Income Invest.

-

Stability during market fluctuations: During market downturns, Fixed Income Invest often acts as a stable element within your portfolio. A lot of fixed-income securities tend to fare well when equities are doing poorly. It gives peace of mind and stability during these rocky market fluctuations.

-

Protecting Against Inflation: In some situations, especially where there is high inflation, fixed income investments that account for inflation, such as inflation-linked bonds, can offer protection from erosion of purchasing power.

7 Ways Fixed Income Invest Can Benefit Your Portfolio

Fixed Income Invest presents a lot of opportunities to maximize your portfolio. Fixed Income Invest, often underrated, plays a significant role. You should know the role Fixed Income Invest is capable of playing in diversifying your investment plan.

-

Stability in a volatile market: Fixed Income Invest is less susceptible to fluctuations in the stock market compared to stocks.

-

Steady Income Stream: Many fixed-income products generate income that could give you a significant return stream for yourself and financial well-being. It could be through periodic interest payments from bonds or a return on maturity date for specific financial products.

-

Protection of Capital: Investing in some types of Fixed Income Invest, for instance, government bonds, often preserves the capital you invested compared to fluctuating stock market positions.

-

Diversification for a more balanced approach: Diversifying investments means investing in a variety of asset classes which includes fixed Income Invest. This reduced risk by lowering your dependence on stock investments for profitability

-

Yield Enhancement: For a more balanced return stream across your portfolio, Fixed Income Invest might provide complementary income stream compared to high-growth investments. This helps in better wealth building

-

Long-Term Financial Security: Fixed Income Invest plays a major role in creating the long term structure that brings overall financial well-being

-

Protection Against Inflation: Investing in inflation-protected securities can help preserve purchasing power during periods of rising inflation.

Fixed Income Invest: Diversification and Stability

Fixed Income Invest provides critical balance to portfolios in any investment environment, a key principle for success is proper diversification. Fixed Income Invest's diversification plays a major role.

Fixed Income Invest provides the stable structure needed for successful wealth-building, which includes creating opportunities, and building opportunities. Many types of fixed income instruments act as valuable additions, often acting as an insurance policy when things go bad or volatility increases within your investment plan

Diversifying your portfolio using Fixed Income Invest, provides stability which means that during a sudden market downturn or major economic event, it buffers potential risks, in which fixed-income investments tend to perform differently or maintain their value or continue returning income even when the market or economic fluctuations take a dip

Fixed Income Invest contributes substantially to risk management. This diversifies investments in ways that mitigate market volatility, risk and provides needed stability during difficult economic times. Fixed income strategies often work when market prices in stocks go down or when interest rate is on the decline

Managing Risk with Fixed Income Invest

Managing risks within your investment portfolio should always be one of your top priorities. Properly investing in different financial instruments is part of managing those risks appropriately, while strategically understanding which investments will work during market crashes.

A sound investment plan requires a diverse set of financial assets, a balance that must include fixed income securities as well. By having the proper fixed income investment diversification in place, managing risks gets easier as stability is provided when things in the market go haywire.

Fixed income investments act as a safeguard when stock markets tumble. Properly structured, these provide predictable cash flow and returns when there are severe economic crises or fluctuations in interest rates in a recession or inflationary period

Fixed Income Invest in a Changing Economy

Fixed income strategies often adapt very well to changes within an ever-changing economy. Its diverse instruments adapt as the markets change or when inflation varies.

Fixed Income Invest provides essential stability when dealing with unexpected market volatility or change within a fluctuating or ever-changing economic environment. Understanding Fixed Income Invest in today's ever changing and diverse investment environment is essential. Understanding your available options within Fixed Income Invest allows one to diversify assets and lower potential risks. Fixed Income Invest are suitable, predictable ways to navigate a complex investment world and ever-shifting economies. They adapt to diverse environments.

Fixed Income Invest: Latest Trends

Fixed Income Invest, a cornerstone of portfolio diversification, is experiencing intriguing shifts. Inflation's persistent grip and evolving market conditions are forcing significant adjustments in strategies. Bond yields are fluctuating wildly, creating both opportunities and challenges for investors. The pursuit of higher yields, coupled with broader economic uncertainties, are transforming the Fixed Income Invest landscape. This volatile mix mandates diligent analysis from anyone making Fixed Income Invest choices.

The Future of Fixed Income Invest

Source: columbiathreadneedleus.com

The future of Fixed Income Invest is murky. Rising interest rates, combined with market anxieties, are throwing a wrench in typical patterns. Adaptability will be key to navigating this complex landscape. Fixed Income Invest strategies that account for yield fluctuations are paramount. Investors need a solid, informed approach, to confidently position Fixed Income Invest assets within portfolios for anticipated, possibly longer-term volatility. Analyzing macroeconomic forces will prove vital for strategic choices.

Fixed Income Invest in the Current Market

The current Fixed Income Invest market is highly sensitive. Inflation and potential recessions significantly influence pricing. The delicate balance of supply and demand ripples through various Fixed Income Invest categories. Bond prices are moving dynamically, impacting yields. In this constantly changing tide, informed investment decisions hinge on the investor's thorough research and due diligence. Fixed Income Invest requires vigilance amidst shifts in the global economic scenario.

Top Fixed Income Invest Opportunities

Source: amazonaws.com

Finding lucrative Fixed Income Invest opportunities demands shrewd discernment. Certain segments like inflation-protected securities, or high-yielding corporate bonds could present potential gains. Analyzing yield curves, considering different issuer risks and adjusting Fixed Income Invest strategies to capitalize on shifting markets are paramount in identifying those worthwhile Fixed Income Invest opportunities.

Fixed Income Invest vs. Other Investments

Fixed Income Invest often contrasts with the volatility of equities. This relative stability, however, doesn't negate its intricacies. Compared to other investments, fixed income often provides more predictability and steadiness. Assessing Fixed Income Invest alongside alternatives—like stocks, real estate, or commodities—is important to ensure a diversified, well-balanced portfolio. Choosing the right Fixed Income Invest choices in tandem with other financial resources and tools should remain a thoughtful, planned decision for better results.

Analyzing Fixed Income Invest Performance

Fixed Income Invest performance is a crucial element of successful financial planning. Understanding how these investments perform helps individuals make well-informed decisions, maximizing returns, and securing future financial goals. Analyzing the historical data, present market conditions, and anticipated outcomes is fundamental to Fixed Income Invest strategy. Key indicators to analyze include: interest rates, market volatility, economic climate, and current Fixed Income Invest portfolio performance. This critical analysis is instrumental for maximizing overall portfolio performance and maintaining long-term financial stability. Fixed Income Invest provides an essential foundation.

Maximizing Returns with Fixed Income Invest

Source: co.ug

Maximizing returns in Fixed Income Invest is a journey, not a destination. Strategic implementation requires consistent evaluation and readjustment based on prevailing conditions. The art lies in aligning your Fixed Income Invest goals with market trends and economic conditions. This requires thorough investigation of numerous Fixed Income Invest strategies and portfolio constructions. Comparing various investment vehicles like treasury notes, municipal bonds, and corporate bonds is crucial to securing ideal returns and diversification. Research on yield curves and their indicators can yield profound insights into anticipated performance outcomes, optimizing current Fixed Income Invest placements for enhanced long-term outcomes.

Fixed Income Invest: Long-Term Growth

Long-term growth through Fixed Income Invest depends greatly on the strategic planning of fixed income portfolios, diversified investment selection, and an understanding of fluctuating financial market factors. Diversification within Fixed Income Invest is paramount. Spreading assets across different instruments, sectors, and geographies diminishes vulnerability to adverse events and encourages long-term expansion. This strategy for Fixed Income Invest growth requires continuous vigilance in following trends, modifying portfolios, and adjusting allocations based on shifting market dynamics. Regular portfolio analysis and fine-tuning to meet evolving financial targets ensures successful implementation. This understanding will guide you in navigating long-term trends and challenges. Fixed Income Invest often plays a key role in achieving stability within a diversified investment strategy.

Fixed Income Invest and Your Financial Goals

Fixed Income Invest and financial objectives intertwine, defining investment strategies. A critical aspect to evaluate for alignment is identifying long-term goals and suitable strategies, carefully choosing investment strategies in the field of Fixed Income Invest to align with individual objectives and personal priorities, ensuring successful realization of goals. Fixed Income Invest has a significant role in most financial strategies because of its crucial contributions toward portfolio stability, wealth generation, and meeting financial targets over a longer duration. Fixed Income Invest should carefully consider financial objectives when planning investment strategies. Factors like risk tolerance and income requirements are critical components when establishing your Fixed Income Invest goals.

Expert Advice on Fixed Income Invest

Expert insights play a significant role in developing effective Fixed Income Invest strategies and portfolios. Considering industry analysis and historical data provides clarity and insight into possible scenarios within the Fixed Income Invest arena. Expert counsel, along with thorough research on current conditions and trends, enhances success when implementing investment decisions, leading to maximum gains within the Fixed Income Invest industry. Evaluating past performance, understanding the different approaches within Fixed Income Invest, and applying relevant industry benchmarks ensures smart decision-making. A strong understanding of both risk tolerance and required investment duration are essential for optimal decision-making in this sphere of Fixed Income Invest. Expert guidance will assist you in successfully navigating Fixed Income Invest's often complex market fluctuations.