How to Buy Shares Online – A Beginner's Guide

Learning how to buy shares online is a crucial step for anyone wanting to participate in the stock market. Understanding the process is paramount. This guide on how to buy shares online is tailored to beginners and will walk you through each key aspect of the journey. Learning about how to buy shares online is easy when done in proper steps.

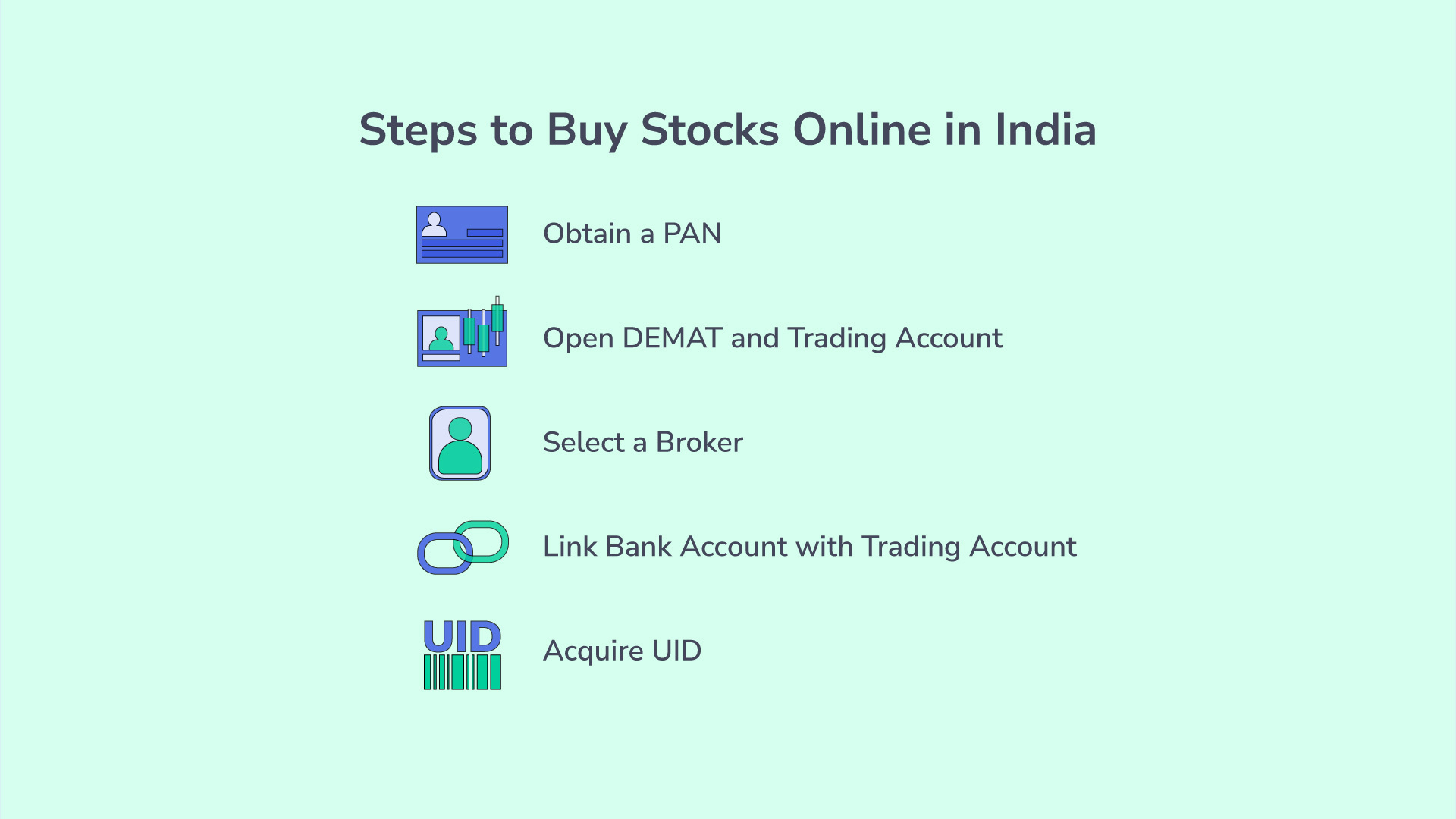

How to Buy Stocks Online: Step-by-Step

Source: angelone.in

How to buy shares online involves a sequence of actions, from creating an account to executing transactions. It’s like setting up a toolset for trading shares:

-

Account Setup: Open a brokerage account online with a reliable brokerage company. Your name, address, and social security number are essential for this process. Remember your financial and personal details must be secure, and how to buy shares online safely is one thing. Choose the brokerage account that’s perfect for you – think about the fee structure or if it matches your personal style for stock trading. Research fees; understanding the costs associated with brokerage services for buying stocks online helps a lot. A good start to learning how to buy shares online starts with understanding brokerage costs, along with other aspects. How to buy shares online involves thorough account management too.

-

Stock Research: How to buy shares online begins by understanding what stock or share you want to buy. Selecting a potential investment that fits your needs, preferences, and level of risk tolerance is essential. Look into past market trends and forecasts to decide whether to continue to hold a stock or shares and know what potential profits can be made. Thorough research before investing is extremely important in learning how to buy shares online. Look into company financial reports or consult with financial advisors for more guidance; and in most cases research is mandatory.

-

Trading: Once your stocks are in your account, choosing when and how to purchase them (buying order), then managing the account properly and responsibly in how to buy shares online is critical. Be aware that some shares could decline significantly. Knowing when to buy stocks online is essential before you commit any amount of funds to learning how to buy shares online, you must research the stock itself, the company itself. Using stop-loss orders is important – to help limit losses, and limit orders give the ability to enter the trades at your exact prices or below the current prices of the market or stock. Understanding risk tolerance helps determine what your investment goals are.

-

Ongoing Investment Management: Buying shares online also involves managing the ongoing growth. Don’t neglect investment planning. Your financial advisor could recommend ongoing strategies to diversify investments to offset risk associated with your stock investment, but remember diversify your investments, as per the best-case advice. Understand various tools and processes, to help manage how to buy shares online more efficiently. Learning to stay consistent over the long term is a key principle to consider for the next phase of learning how to buy shares online.

Buying Stocks Online: A Simple Explanation

Buying stocks online has simplified investing for millions. Understanding the process of how to buy shares online involves steps, research, strategy, and ongoing monitoring. Essentially, the platform enables direct investment by connecting buyers and sellers. This gives a buyer greater flexibility. Understand, by looking through the markets on a computer and placing a buy or sell order is crucial in the stock market and the knowledge of buying shares online.

5 Easy Steps to Buy Shares Online

Purchasing stocks or shares online should be made easy, follow these simple steps:

- Open an online account: Register for online brokerage accounts and open them; remember it's crucial to understand how the system operates and how your purchases, sales, and withdrawals will work through this account in relation to buying shares online. How to buy shares online may include specific features and tools based on individual brokerages.

- Explore stocks: Do thorough research about the stock that interests you. Understand the company’s standing, industry analysis, and your potential return on investment. How to buy shares online depends on understanding this. Analyze if the stock or the share is suitable for you. Consider past performance of shares and look for good indicators before starting investments.

- Decide the quantity to buy: Establish how many shares are in the purchase or quantity, determine the quantity (how many) you can invest in the market. Make decisions on investments after analyzing company situations. Use stop losses where needed to understand and limit loss risk if it’s your intention to purchase more. This should affect buying shares online choices

- Submit the buy order: Use a brokerage account to place orders after thorough consideration. Buy the share at a specific price or market price. This must also be included when you study and determine how to buy shares online, otherwise this purchase could become an unprofitable purchase. Know your limitations in how to buy shares online as you start trading and making purchases

- Track your shares: Regularly follow your stock investment choices. Regular reviews and monitoring help determine when to sell at the best price and whether the share you’re investing in is worthwhile. Use tracking platforms to monitor stock activity. Be familiar with brokerage services. How to buy shares online successfully includes tracking investments closely

How to Purchase Stocks Online Safely

Ensuring safety in how to buy shares online depends on caution and appropriate steps, including the selection of trustworthy brokerages and investment platforms. Ensure all steps are executed as expected and with utmost care in selecting companies or organizations to invest your finances in, such as checking out companies on various trusted review sites and other sources or obtaining third-party advice if needed and using secure platforms with two-factor authentication to help secure accounts and avoid any potential security compromises or problems associated with purchasing and buying shares online or stocks online. Always scrutinize, if you do purchase stocks or shares online, review contracts thoroughly before starting.

How to Choose a Broker for Online Share Purchases

Selecting the right broker is crucial for smooth, successful online share purchases. Knowing how to buy shares online is not only about execution, but about choosing a trustworthy, reliable partner. How to buy shares online is a complex question that must be deeply understood, as different options will provide various advantages or disadvantages in specific situations. Finding the correct approach demands critical analysis of a number of factors, each essential to how to buy shares online safely and effectively. A dependable online brokerage firm can be the bedrock for successful online share investment, so choosing it right matters deeply for returns and protection.

How to buy shares online successfully starts by identifying reliable options, checking for specific tools for ease of purchase. Finding a good, helpful option for your needs to build your portfolio smoothly. Choosing a reputable broker for online share purchases directly affects returns and security. You must have a keen awareness of their commission structures, fee schedules, account types, trading platforms, and security measures before beginning to use their services. Understanding the full range of factors impacting your process will ultimately ensure positive results and long-term confidence when it comes to how to buy shares online securely. Different approaches to this will allow you to build portfolios effectively and profitably over time.

7 Reasons Why Online Share Buying is Preferred

How to buy shares online has clear advantages. Here's a breakdown of why this process has become incredibly popular:

- Accessibility: Buying shares online 24/7 allows immediate access, with easy purchasing at the click of a mouse.

- Convenience: Forget physical brokerage visits! Your investment life can remain flexible without limitations from traditional markets.

- Affordability: Online brokers usually offer competitive, often-lower costs compared to their brick-and-mortar counterparts, leading to considerable savings when compared to traditional approaches.

- Extensive research and tools: Extensive information and many analysis tools readily available on a computer or smartphone empower users greatly to assess the market landscape.

- Advanced portfolio tracking: Sophisticated reporting enables investment monitoring that's much easier, and faster. Getting informed about progress and decisions can quickly be completed.

- Customer Support: How to buy shares online smoothly and easily hinges largely upon efficient and prompt customer assistance options being available if necessary. Most platforms have user guides, FAQs, and frequently asked questions (FAQs) sections. These are quite helpful.

- Market insights and tools: Online brokerages often present significant features—powerful tools that make decision-making far easier for beginners to sophisticated investors, showing different trends in market forecasts to assess whether it aligns with individual goals.

Different Types of Online Stock Brokerage Accounts

Choosing the right account significantly impacts online share purchases. There are various options for brokerage accounts. Key elements for success often include fees for buying shares online and trading, which vary among different accounts and platforms.

Taxable accounts—basic, simple accounts—aren't subject to limitations, giving you broad flexibility when buying shares online. IRAs are advantageous due to possible tax implications and rules, though specific guidelines apply for these. Roth IRA and Traditional IRAs differ greatly, and knowing which one to open significantly impacts how to buy shares online with tax benefits and regulations fully grasped. Knowing your requirements helps select the right brokerage account that is in line with personal investment needs.

Online Brokerage Account Setup in Simple Steps

Setting up an online brokerage account, for many investors who want to learn how to buy shares online, requires several actions, which should all be followed.

-

Find and consider broker options: Search through online broker options with reputable ratings and feedback that offer the functions you want. Evaluate several different platforms to establish whether you wish to utilize them before taking a decision. The correct brokerage choice will affect trading and investment costs for many users and is a critical choice.

-

Select and create an account: Choose a broker and finalize a strategy to select an account. Use their online platforms for application or utilize options from their customer service departments. Make your choice based upon various factors of your financial circumstance and investments before choosing an account type, knowing the types is essential.

-

Supply personal and financial info: The platform will likely request documents to complete the onboarding. Prepare these forms or details thoroughly to enable account setup quickly. Many details on your financial information or private accounts, if requested, will allow for successful completion of all requests promptly.

-

Verify identity and financial info: You'll need to provide confirmation or identification, both to ensure the account is in compliance with security and to show details about financial records for tracking account progress.

-

Deposit Funds: You will now fund the new brokerage account in a number of different ways. The platform is designed to complete a variety of fund deposits. Following these methods efficiently, smoothly and without undue complications will quickly enable account access for use.

How to Open an Online Brokerage Account

Steps for initiating a new brokerage account online depend on broker options, regulations, and conditions established by specific firms. Each broker has specific requirements, forms, documentation processes for establishing an account. There may be varied requirements on various account types, so make certain this factor is well-understood and well-considered as part of how to buy shares online. You must do what is best for the financial situation, the potential goals or even expected timeline for those goals or purchases in mind as part of how to buy shares online safely and appropriately for your long-term security.

How to Buy Shares Online: Researching Your Stocks

Source: getmoneyrich.com

How to buy shares online is a vital skill for navigating the world of investing. Learning the fundamentals of stock research, analysis, and selection lays the foundation for sound decisions in how to buy shares online. Thorough research within reputable online brokerage platforms forms the key element to financial success in today's market, focusing on what works in "how to buy shares online."

Analyzing Stock Charts and Financial News for Better Choices

Deciphering stock charts and understanding financial news is paramount to your "how to buy shares online" journey. Charts provide historical trends and current performance, while news insights reveal possible future directions. Spotting trends – are they rising, falling, or oscillating – in the market offers vital context. Financial news pieces can offer immediate information. "How to buy shares online" entails utilizing both elements as tools.

Examine daily, weekly, and monthly chart patterns and look for repeated patterns. "How to buy shares online" requires a focus on charts. Identifying price actions in your selected stocks' past results in trends to forecast probable future changes in pricing. Be mindful of short-term vs. long-term trends. Study news directly regarding your chosen company or industry in context of financial health. Pay attention to how various events impact stocks; analyze any data relevant to market forces for your research in how to buy shares online.

Top Tips to Select Profitable Stocks for Purchase

Profitable stocks can be identified based on factors ranging from company value, future growth potential to your personal tolerance to risk and your needs within "how to buy shares online". Begin by identifying companies offering high potential dividends.

Identify industry trends with high potential, a strategy essential to picking winning stocks. Also, keep in mind your goals. "How to buy shares online" frequently depends on long-term, as well as short-term goals.

Select stocks in industries poised for expansion, for long-term growth. Analyze profit margins; if profit margin shows trends of continual growth within company profitability, your potential stocks selection aligns. "How to buy shares online" becomes a path of consistent research and analysis of trends and company history.

Identifying Potential Stocks Using Tools

Employing online tools designed for stock screening can narrow the pool of choices. "How to buy shares online" strategies heavily incorporate such tools. Focus on tools that give detailed analysis regarding each stock: market capital, past financials, company news, overall performance reviews. Utilizing such tools aids efficiency and speed in finding ideal candidates.

Scrutinize tools offering valuation metrics; they're vital to identifying a stock’s inherent worth in relationship to how to buy shares online. Check valuation ratio components – comparing company's financial metrics. "How to buy shares online" needs understanding tools and applications relevant to research.

Understanding Various Stock Investment Types

Numerous ways to invest using how to buy shares online – such as mutual funds, Exchange Traded Funds (ETFs), or individual stocks. Be well-versed in advantages and drawbacks for individual stocks vs. diversification offerings via funds and ETFs in how to buy shares online.

Analyze risks involved, carefully evaluating diverse elements; mutual funds and ETFs represent potential for risk mitigation. Learn "how to buy shares online," focusing on each investment.

Investment decisions related to "how to buy shares online" often are complex, necessitating knowledge and skills related to evaluating potential and understanding financial realities, encompassing varied tools and factors. Remember "how to buy shares online," in conjunction with this context, builds crucial long-term financial health in the evolving stock market and the practical aspects of investment choices within a "how to buy shares online" perspective.

How to Buy Shares Online: Placing and Managing Orders

Source: groww.in

How to buy shares online? It's a crucial question for anyone wanting to enter the investment world. Online brokerage platforms are incredibly popular now. Learning the ropes of how to buy shares online is crucial for managing your finances effectively.

The online platforms act as a bridge connecting you to the vast world of shares, helping you execute buy orders with ease. It's also crucial to properly manage those orders once placed.

Essential Steps:

- Open a brokerage account: Selecting a trustworthy online broker is a significant first step in this journey. Do your homework. Reputation matters significantly.

- Conduct Research: Find the right shares, or you could get burned quickly. The key is in-depth research, to know your choices in advance, before investing real money!

- Place buy orders: Understand the order types and set parameters precisely. Choose a buy method that works well for your situation and resources, even consider fractional shares!

- Monitor positions: Keep an eye on the trades. Use the online brokerage platform's resources and understand how to modify or cancel orders!

- Understand taxes and wash sales rules: These legal factors play a role. Understand and address any questions related to taxes regarding profits and avoid unnecessary hassles when selling or buying the shares.

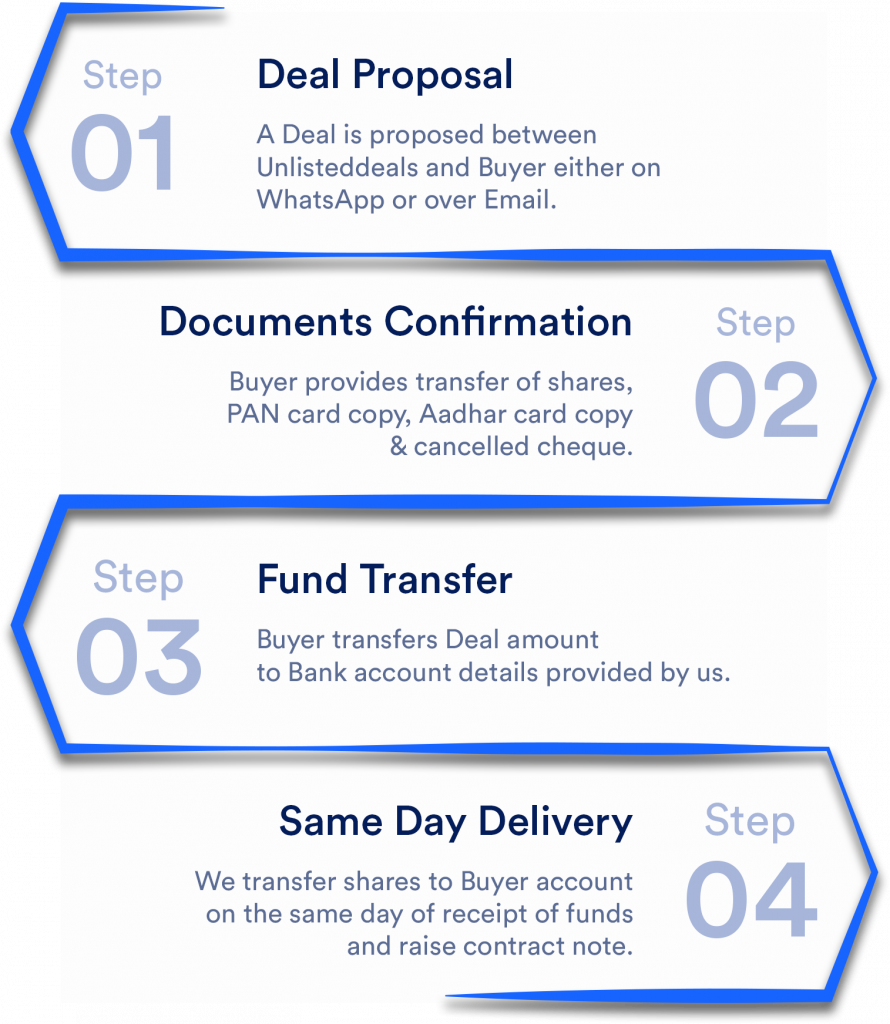

Source: unlisteddeal.com

Difference between Market Orders and Limit Orders in Online Trading

Market orders and limit orders are two main choices you'll come across while executing share transactions using online trading. Choosing between the two is critical in online trading.

Understanding Market Orders: A market order demands the broker buy at the existing, lowest price (current) that exists for the stock right away! This order gets your shares when the opportunity presents itself.

Knowing Limit Orders: These orders establish your highest price threshold you'll be paying. This is very useful. If the price doesn't meet your desired threshold, your share transaction will not go through.

-

Market orders are best for stocks showing rapid price changes. This may expose you to immediate price adjustments when you execute your trade; it is important to acknowledge these risk points when choosing. Market orders do provide instant action but you might miss on an opportunity with limit order.

-

A limit order is crucial for those who prefer precise control. If the exact prices needed to finalize your share purchases aren't meeting expectations yet, you do have this feature available through online brokers. It can keep you from paying more for a stock if the share market experiences short-term instability or volatility!

Buy Low Sell High – Practical Strategy

The buy low sell high concept in stock investing is as simple as it sounds. Find shares available below a set amount, purchase them, wait and re-evaluate prices at intervals that work well for your strategy and profit margin expectation when market is positive!

The catch is implementing this approach successfully. Consistency in patience, research, risk management, and adaptability within a dynamic market are crucial to making profits consistently.

The most important part about this strategy is patience; it does take a good bit of patience!

Best Ways to Manage and Execute Online Share Trades

Managing your share transactions is like operating any aspect in a business; one mistake could affect how efficiently resources are employed or result in huge losses, and is an imperative practice to develop as you are executing trades within an online trading environment.

Strategies:

- Establish your budget! It sets clear financial limits and you need to evaluate whether you are using these amounts consistently throughout the trading cycle

- Review transactions promptly! Maintain an accurate transaction log; noting purchase and sales and ensuring any discrepancy does not go un-noted!

- Stick to your trading plan; establish routines and adhere to time management methods as you work through your trading cycle. This includes creating lists and using apps or planners and also including factors about time allocated per stock investment, per type of strategy, which markets to focus on and the associated risks and timelines involved

- Understand market trends, and utilize analytics! Don't trade on just one metric!

- Know when to pause; some investments require time, sometimes several weeks before you know how they'll play out. Assess where your investments are.

7 Questions to Ask Yourself Before Buying Stocks

Deciding to purchase stocks often comes down to these important considerations. These questions may differ per user, and there's no single answer to which type of investment makes more sense or is more 'logical', because some decisions will make more sense and some won't, and often what does makes sense differs drastically per investor/ individual!

- What are my financial goals, short term, long term, which aspects relate most to a need that makes sense in how these stocks fit into the larger picture, that I personally can track easily. Do any elements impact that affect this that could make those goals potentially invalidated in future.

- Can I tolerate potential share value losses if stock performance underperforms expectations? There may also be reasons why performance would not make sense if something else was influencing the financial market that didn't quite fit your own circumstances.

- Do I have enough risk tolerance to handle uncertainty and stock fluctuations, both small and large, both within expected and unexpected conditions?

- What factors make shares more appealing/interesting, not just current, recent numbers, are those things reliable for the kind of timeframe I'm looking for, do those factors potentially change or even break over certain long time durations, like a decade or so? Are there even significant time spans for your goals to possibly change drastically?

- What type of investment options should you use for your trading style; be transparent, identify whether the investments used should follow any other set metrics.

- What does it mean when using such large, and fast paced share investment strategies? Some stocks and/or industries or financial market segments move faster or with more potential sudden changes. It is critical to develop this sensitivity as this awareness might potentially indicate when it makes sense or when it would be prudent to consider alternative options to investments, and when possible identify which are valid, versus just potentially creating more issues or uncertainties. Are there other potential options within the stock market you could use instead, and should they follow an overall business framework.

- Have I identified a reliable financial institution/brokerage that aligns with my individual values, to work with. Online brokerage accounts provide these advantages and many more features in these new modern systems that traditional financial models would not even be able to imagine a few decades ago! Have a way to measure your progress with your investments and with online brokerages or any other types of similar options as the case may be.

How to Buy Shares Online – Understanding the Risks and Rewards

How to buy shares online? This method has revolutionized investing, giving everyday individuals access to global markets. Learning how to buy shares online is important because this pathway offers immense potential. But, alongside reward lies risk. How to buy shares online effectively and minimizing potential drawbacks is crucial for anyone navigating this space.

How to Protect Yourself from Online Investment Fraud

Investment scams are rampant, disguising themselves as legitimate avenues for wealth-building. To avoid such traps, remain vigilant. Online scammers use deceptive marketing and manipulation. Identifying potential fraudsters' tricks requires shrewd analysis, caution, and education about prevalent scams. Do not trust unrealistic promises; verify every entity and offer through reputable sources. How to buy shares online must involve diligence, not impulsiveness.

5 Key Risks to Be Aware Of When Buying Stocks Online

How to buy shares online, step by step. Be mindful of inherent dangers associated with the process.

-

Market Volatility: Stock prices swing widely. Losses can be substantial, influenced by economic events and trends. High-growth potential also entails heightened risk.

-

Overconfidence: Emotions can cloud sound judgment when buying shares online. Greed can drive excessive investments or irrational decisions.

-

Information Overload: The sheer volume of information surrounding investments can cause difficulty distinguishing true analysis from unfounded promotion or misinformation.

-

Brokerage Fees and Taxes: Understand the fees associated with your chosen platform (some brokerage services charge commissions per trade, while others do not) and associated costs that could diminish potential profits.

-

Complexity of Market Mechanisms: Investment dynamics are incredibly intricate, influencing decision-making significantly. How to buy shares online effectively often requires continuous education. How to buy shares online takes sustained, careful effort, as opposed to luck alone. Learning fundamental strategies is part of minimizing the complexities.

Strategies for Effective Online Portfolio Management

Source: ytimg.com

Effective portfolio management necessitates proactive decisions. Balancing risk and potential profit while sticking to personal strategies will help optimize your outcomes. Your strategy is essential. Create a comprehensive financial plan. Understanding the potential upside of investment against inherent risk is key.

-

Set Clear Financial Goals: Before deciding to how to buy shares online, ascertain what your goals for the investment are – short-term goals such as college savings versus long-term investment gains. This is a vital component for navigating the process properly.

-

Risk Tolerance Analysis: Assess personal risk tolerance. Aggressive investors accept greater fluctuations in market values. Risk assessment is crucial to choosing an optimal approach to buy shares online.

-

Diversify: Don't place all your assets in one sector, like technology. This minimizes the overall market risk significantly; remember this critical rule regarding buying shares online.

-

Re-evaluate and Re-adjust: Economic climates and market conditions are prone to change, which forces the re-evaluation of investment strategies and portfolios as a function of conditions and their expected duration.

-

Track Portfolio Progress Regularly: Tracking your progress towards goals helps monitor investments' success, and understand whether adjusting strategies based on market volatility will be beneficial.

How to Buy Shares Online with Fractional Investing

How to buy shares online often involves starting small with this system, fractional investing. Access to smaller market shares makes investment easier with smaller initial funds.

-

Reduced Entry Barrier: Access stocks, before unobtainable with smaller budgets, through fractional investments. This strategy often results in gaining larger dividends, through diversified stock choices.

-

Cost-Effective Investments: Lowering your entry costs facilitates investment, often making it much simpler to follow how to buy shares online in step-by-step ways.

-

Wider Asset Selection: Greater investment possibilities; access a broad spectrum of opportunities in investing.