Live Stock Prediction: Introduction

Live stock prediction is a tricky business, isn't it? It's all about trying to guess future prices for livestock. People use various methods, and some even try complex mathematical formulas. This article will dig into live stock prediction, its accuracy, impacting factors, and essential strategies. We'll review some of the best tools for live stock prediction, too. Understanding the unpredictable nature of live stock prediction is important to manage risks. Live stock prediction methods involve multiple factors that analysts must consider, understand and analyze. Successful live stock prediction depends heavily on consistent research and attention to detail.

Is Live Stock Prediction Accurate?

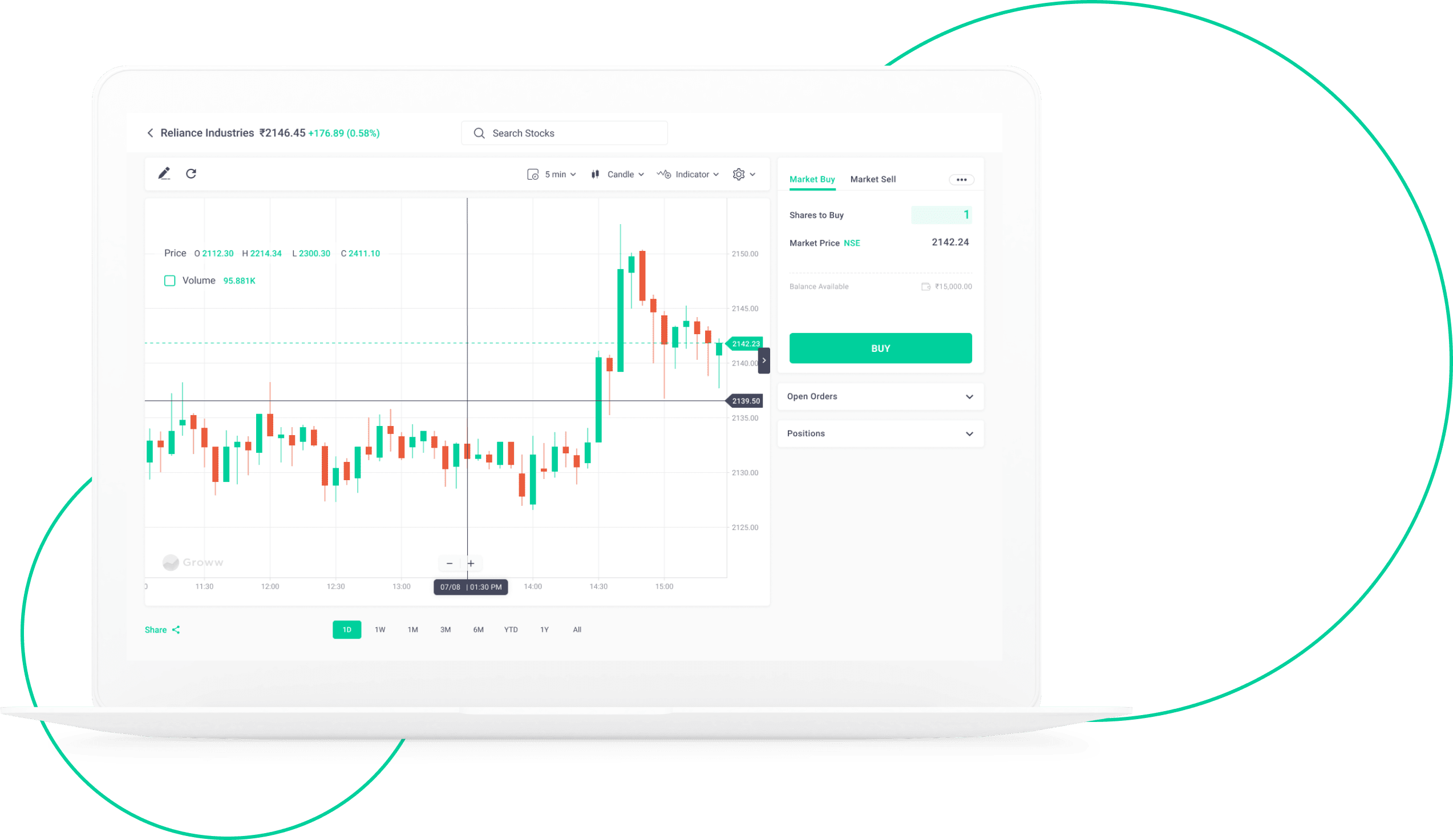

Source: groww.in

Honestly, the accuracy of live stock prediction is a tough one. There's no magic formula, is there? No guarantee of absolute accuracy. Results from live stock prediction efforts are mostly unpredictable and frequently change dramatically. Market forces and unforeseen events often greatly influence livestock price changes. Lots of live stock prediction tools, strategies, and methods can help but do not deliver assured predictions. A skilled expert might analyze past trends, present factors and upcoming conditions but never predict an absolutely accurate live stock outcome. Live stock prediction can't deliver definite answers; that's just the way it is. Factors outside the model and unanticipated situations will impact live stock predictions, thus accuracy isn't 100%.

Factors Affecting Live Stock Prices

Many factors greatly impact the price of live stock. Weather is huge. Supply and demand changes livestock price swings dramatically. Supply, weather, and disease all heavily affect the production of live stock. Demand shifts caused by trends in customer behavior can create immediate volatility in prices, making live stock prediction challenging. Governmental regulations, farm yield rate, changes in trading prices on the open market and various political or social factors add complexity to accurate live stock prediction models. Even seasonal events affect livestock markets considerably. Analyzing historical prices of live stock can highlight repeating patterns and seasonal influences. Understanding all those influencing factors makes effective live stock prediction very tricky, indeed.

Source: locanto.ae

Basic Strategies for Live Stock Prediction

Strategies in live stock prediction usually rely on gathering data to identify recurring trends and predict price movements based on past information and anticipated conditions. One helpful technique looks at price patterns from historical data and recent trends, like past fluctuations. Also consider studying news events and significant market analysis to spot emerging influences. Using market research and industry reports to learn more about trends in production or consumption is valuable too. Technical analysis often employs charts to observe price patterns. Another helpful strategy often employed involves recognizing significant data or past pricing events impacting supply. Finally, recognizing the possible effects from supply-demand dynamics to upcoming governmental policy changes and news impacting future conditions will support a robust prediction effort in the market of live stock prices. Effective strategies in live stock prediction will vary from person to person; hence a systematic analysis approach with suitable prediction mechanisms is crucial. Live stock predictions always vary.

Tools and Resources for Live Stock Prediction

Plenty of helpful tools aid in the complicated world of live stock prediction. Reliable market data analysis tools exist, which often feature complex calculation and display options. Utilizing those analysis tools and comparing prices across the board assists in identifying trending markets and predicting upcoming price changes in a comprehensive and holistic way. Some providers even provide real-time pricing data and various reports, and their reports aid experts in refining their strategies for future market fluctuations. Numerous sources provide market updates to assist in live stock prediction strategies. Understanding that price predictions change depending on data from the market and news and news outlets for daily pricing is crucial. Some sources will be much better for insights on specific, geographically relevant locations, impacting the pricing for specific types of live stock in different places in the world, than another source. Keeping your information varied from diverse reliable resources to validate live stock predictions is best. Experts frequently depend on live stock prediction platforms or dedicated data analytic solutions in this process. Live stock market updates also improve strategies for successful live stock prediction efforts, providing data from numerous credible and reputable sources to maintain strong live stock forecasting methods.

5 Ways to Approach Live Stock Prediction

Live stock prediction, a challenging endeavor, requires a multi-faceted approach. No single method guarantees success, but a blend of techniques can increase chances. Understanding these approaches to live stock prediction will give you more confidence.

- Fundamental Analysis: Delving deep into the factors that affect live stock pricing like weather conditions and food availability is critical to live stock prediction. This helps discover if these trends match market activity or price fluctuations. This is a thorough method, allowing for long-term views on live stock prediction trends.

- Technical Analysis: Reviewing price charts, volume figures, and candlestick patterns helps spot potential shifts in market activity which are very useful for making short-term and mid-range live stock prediction. By recognizing patterns, a good predictor can adjust trades and limit risks in their strategies related to live stock prediction.

- Sentiment Analysis: Examining public sentiment towards live stock often correlates with changes in the live stock markets. By scrutinizing news coverage or social media discussions to predict live stock, an expert can get a clear understanding and improve live stock prediction efficiency. Sentiment can be tricky, requiring good observation of live stock prediction.

- Market Indicators: Following industry-wide reports, indices and macro-economic data aids live stock prediction. Understanding overall trends can lead to more successful approaches towards live stock prediction. Paying attention to these factors offers great scope for precise live stock prediction in many areas.

- Risk Management: Developing a robust strategy for risk management related to live stock is crucial for long-term stability. Implementing this is key in successful live stock prediction. Diversifying live stock holdings can lower your vulnerability in live stock prediction.

Source: analyticsvidhya.com

7 Common Mistakes in Live Stock Prediction

Inaccurate or untimely decisions are costly in live stock prediction. These traps need avoiding to succeed.

- Ignoring Risk Management: Overlooking risk management leads to catastrophic losses when it comes to live stock prediction strategies. Neglecting risk leads to potential harm with live stock prediction strategies. Never underestimate the potential hazards to live stock predictions.

- Over-reliance on Predictions: Relying blindly on live stock prediction can lead to errors when it comes to decision-making.

- Emotional Decisions: Letting emotions guide live stock predictions or your investments frequently leads to sub-par decisions.

- Insufficient Research: Lacking a comprehensive research approach leads to flawed and ineffective live stock predictions. Neglecting fundamental data leads to bad live stock predictions.

- Ignoring Macro-Factors: Overlooking economic and industry shifts related to live stock prediction will likely hurt investments.

- Unrealistic Expectations: Chasing unreasonable returns or hoping for short-term gains makes strategies related to live stock prediction less effective, harming outcomes.

- Poor Understanding of Stocks: Having inadequate market comprehension negatively impacts live stock prediction accuracy, influencing future trading results.

3 Key Metrics in Live Stock Prediction

Important insights can be found by scrutinizing certain live stock metrics, ensuring good live stock predictions.

- Price Volume: Analyzing price movements alongside trading volume gives clarity about trends' intensity related to live stock. High price movement with significant trading volume shows powerful investor activity and good chances of further prediction for live stock.

- Market Trends: Monitoring market behavior in real time and keeping up with all changes will help in accurate live stock prediction. Predicting any change requires an observant understanding of trends and patterns. Analyzing trends helps develop solid strategies towards successful live stock prediction.

- Market Volatility: Tracking and predicting fluctuations in live stock markets are necessary. Live stock price predictions depend heavily on the stability of markets and understanding any possible risk associated with price volatility helps create a comprehensive plan, which significantly contributes to effective live stock prediction.

Best Practices for Live Stock Prediction

For live stock predictions to succeed, a thorough method should be deployed. Following a tried and tested method improves successful chances.

- Maintain a Precise Calendar: Following an appropriate and consistent calendar is crucial to succeeding at live stock prediction. Having a record of activities assists you in developing effective predictions of live stock.

- Consistency in Approach: Following an effective strategy every time aids in getting more accurate results concerning live stock prediction strategies. This consistently refined and thorough strategy allows you to gain insights in live stock prediction.

- Documentation of Every Activity: This allows tracing mistakes and errors concerning your live stock predictions for continuous growth.

- Thorough Learning and Training: Training programs on live stock and markets is required, enabling consistent knowledge. Investing time and effort in continuous learning and live stock prediction training strengthens capabilities in your chosen area, like in the live stock market.

- Regular Evaluation: This provides insight to analyze trends to help determine future adjustments in prediction efforts. Evaluate your current processes, so predictions are adjusted and accurate in the long run concerning live stock.

Source: ytimg.com

The Role of Technology in Live Stock Prediction

Advanced technological solutions are significantly shaping approaches for successful live stock prediction. This approach provides more ways to look at markets, giving more accuracy for live stock prediction.

- Data Analytics: Harnessing vast datasets enables deeper live stock prediction insights to adjust to trends. AI algorithms can process this info which is necessary to provide powerful live stock prediction insights, in live stock prediction.

- Predictive Modeling: Algorithmic modelling improves the reliability of estimations. Strong methods increase accuracy in live stock prediction.

- Trading Platforms: Utilizing advanced platforms to follow market conditions and create strategies allows easier predictions and trade decisions when considering live stock. Automation assists prediction methods in the live stock sector and helps ensure precise actions for the best prediction outcome in live stock.

- Real-time Monitoring: Continuous tracking and insights about live stock from the market help evaluate risk and enhance prediction methods, leading to more precise outcomes about live stock markets. Using modern technologies improves the real time accuracy of predictions for live stock markets.

Live Stock Prediction: A Beginner's Guide

Live stock prediction is a tricky game, lots of unknowns. Understanding market movements, making informed guesses about future prices – that's live stock prediction. Learning this crucial area of finance is no walk in the park. Live stock prediction has so many different strategies, each with their own chances for good or bad outcomes. Live stock prediction is always a high-risk area.

Understanding Live Stock Market Trends

Live stock market trends – they move, they change, they have an unexpected power over prices. Market movements can be scary. Trends help explain why a specific price is what it is today. Learning the live stock market trends helps determine your likelihood for good and bad fortune in the field. Many traders focus heavily on short-term or long-term trends, looking for patterns they feel have significant meaning and predictability for the market direction of live stock prediction. Look closely at economic forecasts – even small changes can mean a large shift in live stock market values, creating winners and losers.

Long-Term vs. Short-Term Live Stock Predictions

Long-term live stock prediction views the forest; short-term, the trees. Long-term, look at broader economic conditions and predict future growth and value. Short-term, react to quick events. Both require unique sets of information and careful analysis to properly judge live stock. Live stock predictions over a few days might change dramatically compared to years. It depends a lot on the specific circumstances. Short-term or long-term, it's never perfect! Accuracy in live stock prediction varies wildly, and understanding those variables is vital. Every type of prediction should always involve realistic expectations about possible losses in your investment of live stock.

Analyzing Historical Data in Live Stock Prediction

Live stock history gives hints about probable trends, providing insights. Looking back can uncover important patterns or surprises. Look for historical data for live stock prediction. Analyzing past patterns shows hints that could repeat. Use past performance, or lack thereof, to help inform choices. Carefully watch for outliers in the trend – big increases or drops which can provide crucial information when creating live stock predictions. Analyzing data correctly means looking for trends, making a well-defined argument from the information you see in history of live stock predictions. Historical performance should inform, but not totally determine investment strategies, as many outside factors are difficult to quantify in live stock prediction.

Important Considerations for Live Stock Investment Decisions

Live stock predictions need much careful thought and action. Before investing, have you considered these possibilities: unexpected price drops; significant and unforeseen events impacting specific industries? Be honest with your realistic chances of potential loss. If losses and unexpected events concern you, maybe this strategy isn't a great idea for live stock prediction. Your unique needs must shape every financial investment decision – both live stock prediction, and other choices. Live stock prediction relies strongly on informed financial planning and decisions. Factors such as the nature of the investment – the expected profitability, risks involved, and possible timeline can change quickly. Keep realistic and attainable goals for your investment approach, considering the potential for both gains and losses, and understand what works well and not so well. Live stock prediction accuracy differs significantly in the outcomes between individual strategies. Always manage the level of financial risk that suits you! Understand how these factors directly or indirectly influence potential future live stock prices when making your live stock investment decisions. Don't overlook the unexpected events that impact your prediction results when it comes to live stock investments. Realize every prediction in the area of live stock is at risk for inaccuracies! Review your personal tolerance of risks before investing live stock. There are many complex aspects to keep track of during live stock predictions. Evaluate and reconsider regularly as your life changes.

Live Stock Prediction Techniques

Live stock prediction is a tricky business. Many methods exist for trying to guess the future of livestock prices, but guarantees are nonexistent. Market fluctuations make absolute prediction almost impossible. Knowing the variables affecting live stock prices helps tremendously in attempting prediction. Live stock prediction has intrigued humans for decades and today is no different.

Fundamental Analysis for Live Stock Prediction

Fundamental analysis for live stock prediction dives into factors influencing the industry, from crop yields to disease outbreaks. Detailed examinations are vital for success.

- Crop yields have a massive impact on live stock prices. Lower crops equal less food for animals.

- Disease outbreaks in the animal population quickly change supply and demand and, accordingly, alter live stock prices.

Source: ytimg.com

Assessing market dynamics, such as competition, the global supply of the animal type, and industry-specific statistics are key parts of understanding market price fluctuation.

Historical performance helps predict, but be ready for unexpected events that shatter projections and demand analysis for successful live stock prediction. Understanding global supply chains plays a pivotal role. Predicting correctly often depends on predicting supply chain snags or problems.

Technical Analysis for Live Stock Prediction

Technical analysis for live stock prediction focuses on historical price movements and patterns to forecast the market. Chart analysis is critical.

- Looking for patterns (e.g., trends) is paramount in understanding market reactions to external pressures and market news for any given sector like cattle prices or livestock commodity futures.

The trick is interpreting technical indicators that signal a particular direction for any given time. High volume signals could imply that prices might significantly shift in the immediate future. This type of understanding often works in real-time live stock prediction in trading. Technical analysis frequently identifies important price levels (like support and resistance), influencing a stock's live stock prediction and the related future. Live stock predictions hinge often on this technique of following price patterns and predicting changes in momentum.

Predicting Live Stock Prices Based on News

News significantly influences live stock prices, though news in this context is far more than market reports, even news around general commodity futures and economics can profoundly impact predictions. Understanding these nuances of live stock prediction via the influence of global events on agricultural markets requires a keen eye. Tracking new regulations, political tensions (both national and international) in relevant agricultural sectors helps accurately assess and evaluate predictions about the future movement of livestock prices. This affects consumer purchasing patterns directly; impacting the price dynamics significantly.

- Specific agricultural events in regions around the globe affect commodity futures prices that may then affect the future trajectory for the livestock sector overall. This is pivotal to successfully predicting future prices for live stock in any sector of live stock prices. These kinds of evaluations and assessments help analysts create a better strategy for effective live stock price prediction models.

The goal of successfully evaluating the news influence and adapting the strategy of prediction and then applying it to a market model for future prices and supply and demand scenarios for the entire sector can allow better results. Live stock price prediction strategies often include evaluation of political relations. Political relations, when understood well and then adapted, give much insight into successfully predicting livestock future movements and costs.

Combining Different Prediction Methods in Live Stock Prediction

A successful live stock prediction strategy blends various techniques. Using a combination of fundamental, technical, and news analysis significantly elevates the chances of achieving accurate forecasts for price trends. Many analysts choose the right mix of models to form their personal techniques of predicting and predicting trends. A key factor is considering which approach works best for different livestock categories like swine or cattle, depending on the prediction, depending on whether a trend prediction, an event analysis or a combination is best used. Successfully predicting livestock prices often needs the application of combined techniques, depending on the target asset.

- Live stock price movements are determined by multiple and sometimes complicated elements, so diverse techniques create a stronger insight, leading to better forecasts, creating models from a combination of diverse sources helps assess the live stock prediction better. Live stock predictions, if done this way, can create successful and meaningful strategies.

These predictive approaches have shown to improve insights on predicting fluctuations for a more accurate and thorough strategy overall for your target in live stock predictions for your livestock prediction method. By combining and assessing different prediction techniques, you understand how various influences on a broader landscape affect pricing decisions within that specific live stock sector for livestock. In order for successful live stock predictions to come true, and become valid approaches for prediction strategies in the livestock prediction market and pricing industry and sector. You will understand these methods much better by seeing all facets and methodologies used in this live stock industry for better accuracy in price predictions.

7 Reasons Why Live Stock Prediction Is Difficult

Live stock prediction is a tricky game. Many factors influence the prices and trends. Market analysts constantly face hurdles.

-

Volatility of the Market: Fluctuations in prices are intense. Unexpected events instantly alter the trajectory. Predicting such rapid changes is tough. Live stock prediction involves forecasting volatile markets, increasing the complexity and decreasing the predictability.

-

External Factors: Things outside the livestock market powerfully affect prices. Weather patterns, disease outbreaks, global economic trends – all play major roles in influencing livestock prices and impacting live stock prediction accuracy. The difficulty of live stock prediction often stems from these exterior conditions.

-

Data Gaps: Accurate, up-to-date data isn't always readily available. Reliable information often takes time to assemble and evaluate. Gathering and processing pertinent information in the timely fashion required for successful live stock prediction often requires resources that simply do not exist or are difficult to find, complicating any effort. Getting trustworthy information that enables effective live stock prediction proves challenging in practice.

-

Predictability Limits: Past performance isn't always an indication of future results. Even meticulous analysis struggles against market chaos. This lack of predictable consistency causes issues with achieving precision in live stock prediction.

-

Unforeseen Events: Sudden changes, from wars to weather events, wreak havoc on markets. Calculating and taking all those unforeseen, extreme variables into live stock prediction is impossible, as unpredictable happenings regularly disrupt calculations in live stock prediction.

-

Human Emotion: Investor sentiment strongly influences live stock prediction. Greed, fear, speculation, and manipulation can drive drastic, unexpected changes in markets. These often destabilizing factors make consistent live stock prediction almost impossible to achieve, because of human elements.

-

Lack of Transparency: Often hidden forces affect prices. Complex chains of cause and effect aren't easy to track and identify. This opacity can lead to misunderstandings. The lack of complete transparency negatively impacts live stock prediction analysis in practice.

Top 5 Questions About Live Stock Prediction

-

How Accurate Are Predictions?: Historical success rates are a valuable piece of the puzzle, yet the difficulty of live stock prediction limits its dependability.

-

What Factors Determine Prices?: Market conditions, weather conditions, public opinions influence live stock prediction. All affect livestock prices and subsequent market actions

-

Are Past Trends Useful?: Historical price patterns occasionally give insights, but other events can derail those expectations. To understand past behaviors, is the ultimate aim of live stock prediction.

-

How Can Predictions Be Improved?: Enhanced research and refined statistical analysis techniques may increase the quality and efficiency of live stock prediction models.

-

What is the Role of Technology?: Can data science and algorithms enhance accuracy in live stock prediction and decision-making, impacting market responses.

The Future of Live Stock Prediction

Sophisticated technology promises advancements in live stock prediction. Live stock prediction methods constantly evolve.

-

Big Data Analysis: Extensive data sets may unlock patterns otherwise missed, but careful analysis is required to interpret correctly. Effective data utilization in live stock prediction strategies are critical.

-

AI and Machine Learning: Machine learning tools are gaining popularity and efficiency for forecasting and market trend determination. Modern trends are leading towards use of AI and ML algorithms to further strengthen insights, providing tools for future strategies to improve accuracy, allowing efficient live stock prediction modeling, increasing decision speed and certainty.

-

Predictive Modeling: Advanced forecasting techniques will be better equipped for complex conditions and will be critical for improved accuracy of live stock prediction, forecasting potentially with better outcome. Live stock prediction accuracy is in an exponential path with better insight analysis with this approach.

Is Live Stock Prediction Ethical?

Many debates occur surrounding ethics of live stock prediction. Transparency in methodologies plays a role in decision making regarding ethical concerns for live stock prediction strategies

-

Transparency is key. Honest analysis avoids causing unwarranted financial damages. To prevent unethical and problematic actions from emerging, open and consistent information sharing are required, including all possible future events, from all possible angles.

-

Market Manipulation. Intentional manipulation is a substantial ethical challenge in live stock prediction. Unethical actors use such techniques in financial environments. Techniques in avoiding fraud and market manipulations is required in future live stock prediction development strategies. Live stock prediction relies on the quality of market behavior to yield successful conclusions and insights for its future.

-

Responsible Data Use. Fair use of market information protects individuals, encouraging accurate predictions through good methods and accurate information sources

Responsible Investment Strategies When Predicting Live Stock

Reliable live stock prediction should guide careful decisions and risk management plans. Proper risk assessments and capital budgeting ensure financial stability and appropriate decisions about stock investments, regardless of risk assessments in practice for any specific market, such as for agricultural live stock and financial livestock investments, should lead the decision making processes.

-

Diversification. Spreads investments, balancing risks through live stock prediction of future conditions.

-

Stop-Loss Orders: Sets specific loss thresholds, safeguarding capital to enhance future profitability with calculated steps when possible for live stock predictions. This critical protection element in live stock prediction strategies is a prudent way to help maintain profits.

-

Risk Tolerance Assessment: Personal risk tolerance shapes decisions in live stock predictions, affecting investments through a transparent risk-benefit evaluation model, improving reliability. Predicting potential stock price drops to develop safe investments is critical in developing a secure methodology with proper forecasting through thorough live stock predictions analysis.

-

Education. Proper understanding reduces decision errors. Investors in livestock should thoroughly analyze the possibilities and expected returns using all relevant knowledge for educated choices for live stock prediction success. Effective investment processes with live stock prediction can offer better guidance regarding market positioning and possible outcomes.