Personal Investment Account Types

Personal investment accounts are critical for achieving financial goals. Understanding different types of personal investment accounts can significantly impact your future. This comprehensive guide dissects various personal investment account options. Choosing the right personal investment account type plays a huge role in your overall financial strategy. Properly utilized personal investment accounts help secure your financial future. This article explains five essential personal investment accounts crucial for building financial security.

5 Key Types of Personal Investment Accounts

-

Standard Brokerage Accounts: These are the most flexible type of personal investment account. You can purchase diverse assets like stocks, bonds, mutual funds, and ETFs. However, earnings are taxed in the year earned. These brokerage accounts provide substantial investment freedom and accommodate varied personal investment needs, allowing easy stock, bond, and fund purchases. A typical personal investment account of this type typically holds shares of different entities. This personal investment account design often requires minimal upkeep but carries substantial financial risk if not adequately supervised and monitored. This personal investment account format gives high maneuverability but limited tax advantages. A standard brokerage account is your go-to if stock trading is central to your personal investment strategy.

-

Retirement Accounts (IRAs): IRAs are meticulously designed for retirement savings, presenting a potent personal investment approach. These personal investment accounts facilitate pre-tax contributions and tax-advantaged growth. Contributions are pre-tax, potentially lowering your present income tax liability. Tax-free withdrawal access upon retirement further enhances this type of personal investment strategy's attractive feature. Retirement savings have enormous growth potential for those approaching retirement. Contributions must strictly follow age and income restrictions for various IRAs to avoid penalty risk. Ensure you closely review any legal stipulations, especially if involving retirement income as part of your personal investment goals. Retirement accounts act as a cornerstone for achieving financial stability in later years, with this type of personal investment strategy highly sought by people around the world. Retirement IRAs significantly ease income tax pressure by delaying tax liability until withdrawal in your senior years, providing potential future personal investment flexibility

-

Kids' Investment Accounts (Custodial Accounts): Designed for children's financial well-being. Parents act as legal custodians, maintaining account oversight. Earnings are not immediately taxable if held in an eligible account and kept in their name after reaching maturity. These kinds of accounts usually carry a limited duration before ownership fully shifts to the minor. They are important components of parental financial security plans and offer personalized educational investment programs and methods

-

Education Savings Accounts: These personal investment accounts are predominantly for future education costs (especially higher education). A well-structured investment approach like 529 savings accounts offer tax advantages regarding growth, but with restricted use and specific contribution rules. Withdrawing the investment income before educational use typically involves a financial penalty. Proper education plan usage through this kind of account allows for tax-free withdrawal usage toward eligible educational expenses. This helps families avoid undue financial burdens when funding education savings in this way. These education-centric plans are specifically aimed at long-term savings in order to provide personal financial investment freedom. This kind of personal investment account acts like a personal retirement approach

-

ABLE Accounts: Created for people with disabilities to support their financial stability. Money set aside in this account grows tax-advantaged. Benefits recipients with particular need and specific conditions find these personal investment approaches indispensable. If used correctly, and abiding by all state-specified rules regarding applicable plans, these plans avoid potential complications and maximize savings potential and accessibility for recipients of disability-related funds

Best Investment Account for Your Goals

Selecting the perfect personal investment account depends largely on your life stage, financial needs, and desired outcome. Evaluating income tax liabilities in the present and possible futures are fundamental elements for personal financial development. Thorough financial planning is crucial before settling upon one investment plan

Understanding Your Personal Investment Account Options

Your personal financial objectives drive your selection among numerous available options. Weigh tax implications, restrictions, and contribution limits when making your final choice regarding account usage. If you are unsure about how this can be beneficial, or you simply want a better personalized personal investment plan, seeking professional financial guidance and strategies would help a lot in achieving financial confidence and comfort. Investment advisors help individuals build their personal wealth and are adept at explaining this, providing support and offering valuable insights. A professional advisor is always an invaluable support to help define how to set your account up most strategically. This allows personal investment guidance while maintaining the correct path for future endeavors and endeavors

Which Personal Investment Account is Right For You

Selecting the most appropriate personal investment account relies on a multitude of factors. Consider income tax and tax planning for short- and long-term use in conjunction with a personal investment approach when evaluating accounts. Individual risk tolerance should always inform decisions related to how this can affect you as well. Understanding account limits helps to correctly identify the best strategy for achieving and meeting the financial needs outlined for personal gain. Carefully assess what makes the most sense given current financial circumstances. This process of evaluating, choosing, and properly utilizing financial plans, as well as the various different options available within personal investment accounts and their various specifications, are fundamental to successful financial maneuvering. When dealing with your personal finances, the best choices always come from well-calculated risk assessment, income, investment planning, and support for personalized personal investments

Standard Brokerage Accounts Explained

A Standard Brokerage Account is a fundamental building block of any personal investment account strategy. It provides significant flexibility to manage various assets, from stocks and bonds to mutual funds and ETFs. This article dives deep into the specifics, providing essential insights. Understanding your personal investment account choices is vital to your financial journey. This is the starting point of a personal investment account setup, and essential for achieving financial growth. Every type of personal investment account works a bit differently, therefore knowing them is essential for personal finance success.

Personal Investment Account: Cash vs. Margin Accounts

Source: amuni.com

Personal investment accounts are offered with several options for transactions, each with its tradeoffs. A cash account is simple; transactions happen strictly from funds available in the account. Margin accounts allow you to leverage by borrowing funds from the brokerage firm to amplify your investments. But be prepared for added risk because a margin account can amplify losses exponentially, often resulting in costly debt issues.

Standard brokerage accounts can operate with cash accounts to initiate the process; this usually doesn't present immediate complexity or challenge for any level of investor. Your personal investment account strategy needs a fundamental structure to start with. A Margin account for your personal investment account exposes a new degree of leverage that's essential to explore further. This approach carries significant risks; losses are magnified along with the rewards. Therefore, meticulous planning is essential before applying a margin account to a personal investment account.

Standard Brokerage Accounts Pros and Cons

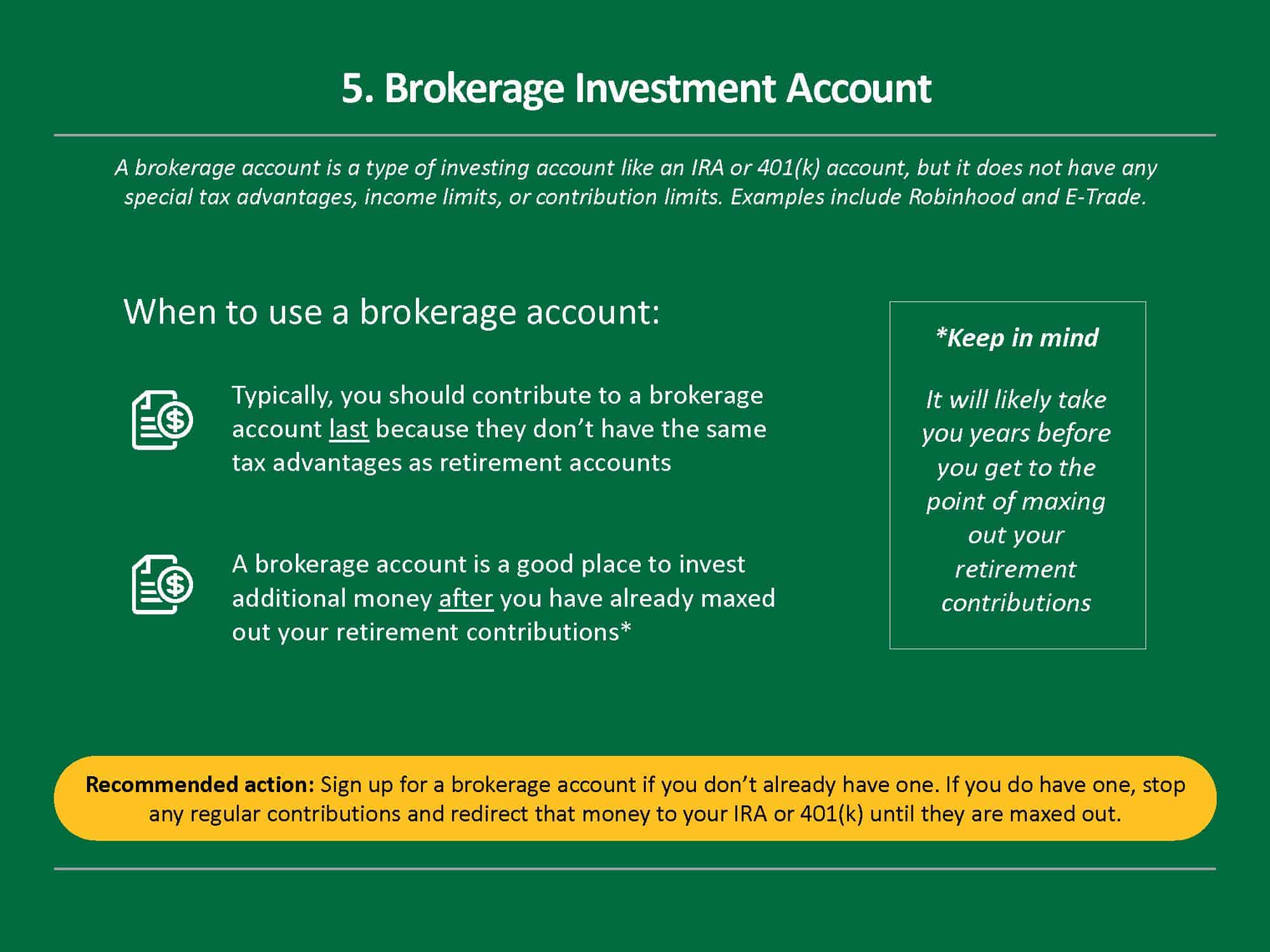

Source: stepwisewealth.com

Pros of standard brokerage accounts include diverse asset selection (from stocks to bonds) and flexibility to buy, sell, and modify investments. It's a highly personalized, adjustable platform designed for individual control.

Cons: Unlike retirement accounts, no tax advantages for your personal investment account (that should be stated clearly) will mean gains and dividends will usually have a tax hit as ordinary income.

Many factors influence choosing the best approach for your personal investment account.

Maximizing Flexibility with Standard Brokerage Accounts

The best approach for maximizing your personal investment account is in designing a highly customizable and flexible personal finance platform, such as a Standard Brokerage Account. There are numerous features of this method and it provides significant choices and possibilities.

Source: thecollegeinvestor.com

A strong advantage for a personal investment account with standard brokerage options is you decide the approach, timeframe and direction of your holdings. This also carries the responsibility of needing proper knowledge and planning. You can adapt investments and personal finance situations with your personal investment account structure in ways others don't allow.

Important Details on Standard Brokerage Accounts

Key features of a standard brokerage account may differ by brokerage firms. Understand your platform and access available features (like investing apps and trading platforms). Fees are a crucial aspect—commission charges and other expenses (especially important for high-volume or frequent traders for your personal investment account. It is imperative that these aspects are investigated fully to prevent costly or unexpected financial situations. Your financial choices require the appropriate diligence to achieve any desired outcome with a personal investment account. Carefully plan for personal investment situations and look at how accounts will work with potential expenses, fees, and commissions before fully setting them up for your specific goals for the personal investment account.

Standard Brokerage Accounts offer high-level personalization, unlike specific types that offer pre-set rules, limitations, or advantages.

Retirement Accounts (e.g., IRAs) for Personal Investment

Personal investment account options for retirement offer valuable tax breaks. These are prime examples of smart personal investment accounts, securing future financial freedom. Understanding IRA and other retirement account strategies is crucial. A structured approach maximizes personal investment potential. Mastering personal investment account knowledge can enhance long-term prosperity.

7 Reasons to Consider Retirement Accounts

-

Tax Advantages: Contributions and earnings accumulate tax-free, minimizing immediate tax burdens.

-

Long-Term Growth: Consistent investing fosters substantial long-term growth.

-

Compounded Returns: Consistent savings enable powerful compounding, magnifying your personal investment returns.

-

Financial Security: Planning ensures a secure and worry-free retirement by accumulating money specifically for later life.

-

Early Savings Benefits: Initiating retirement savings early harnesses the strength of compounding and accelerates the path to a fulfilling retirement.

-

Retirement Planning Structure: The plan fosters methodical savings.

-

Protection from Inflation: Protecting personal investment from inflation by increasing saved money through compounded return. Personal investment strategy requires strategic thinking.

Personal Investment Accounts: IRA Types and Contribution Limits

IRAs are core personal investment accounts. Knowing the differences in types is vital for making the right decisions regarding your personal investment account strategy. The tax consequences shape your strategy when determining which personal investment account type. Key categories within personal investment accounts involve individual retirement account types. Several IRA types exist, including:

-

Traditional IRA: Contributions are tax-deductible; withdrawals in retirement are taxed.

-

Roth IRA: Contributions are after-tax; withdrawals in retirement are tax-free. The selection of a personal investment account will determine whether returns are immediate or later, post-retirement. Personal investment decisions heavily rely on projected expenses for each stage of life.

Contribution Limits (2024-2025):

-

$7,000 for those under 50 years old.

-

$8,000 for those 50 or older.

Careful tracking of personal investment account growth in various investment account types is advised.

Understanding Tax Advantages of Retirement Accounts

Retirement accounts, including IRAs, offer valuable tax advantages. They defer taxes until withdrawal in retirement, allowing individuals to use funds today for personal investments and benefit from growth during those years. Deferring taxes creates a substantial benefit. This can substantially lower your current tax bill, boosting personal investment capabilities. Personal investment accounts have substantial advantages, offering flexibility to invest as needed.

Employer-Sponsored Retirement Plans vs. Personal IRAs

Employer-sponsored plans, like 401(k)s, often include employer matching contributions. If these employer matches are possible, these options are your primary means of personal investment for a given personal investment plan.

Personal IRAs can be suitable if employer matching isn't available or inadequate. Taking advantage of both avenues maximizes your personal investment potential. Carefully comparing both approaches will benefit a given investor’s portfolio.

Maximizing benefits is crucial to securing financial stability for later years, especially regarding employer-sponsored retirement accounts vs. personal investment accounts for retirement.

Prioritize employer matches. Contributions to a personal IRA may not have employer-related financial boosts like contributions from a matching retirement program.

This comprehensive view of personal investment account options helps understand available choices and craft personal investment plans. An IRA is just one choice; explore various personal investment account structures. Every personal investment strategy can influence current spending. Investing is one path toward wealth.

Kids' Investment Accounts (Custodial Accounts): Personal Investment Guide

Personal investment accounts are crucial for future financial security, regardless of age. Custodial accounts for kids are special types of personal investment accounts, enabling parents to secure financial futures for their children. Understanding the intricacies of these accounts, particularly the tax implications and flexibility, is vital for successful implementation.

Tax Implications and Flexibility of Custodial Accounts

Custodial accounts are a potent tool for building financial literacy and providing a strong financial foundation, but don't forget the crucial tax implications. This type of account usually does not offer significant tax advantages, unlike retirement plans. Crucially, capital gains and distributions from the invested money in personal investment accounts are taxed based on the child's income.

- Gains are taxed according to the child's income bracket; it will impact tax liability in future. It can significantly influence your child's financial future

- Withdrawals for personal use, rather than education, aren't tax-free

- These types of investment strategies are non-deductible from income

However, a key advantage of these accounts is flexibility. The funds can potentially be used for various needs; it's an adaptable investment. Unlike retirement accounts with stringent rules about when you can access your money, this approach enables use for any desired purpose without additional limitations, beyond age and location requirements for investments.

5 Things to Know About Kids' Investment Accounts

Kids' investment accounts, also known as custodial accounts, serve as powerful avenues for building wealth. Here are crucial insights:

- Control & Management: An adult acts as a guardian, ensuring investment choices are prudent.

- Ownership Transition: Accounts transfer ownership to the minor when they reach the designated age (usually 18 or 21). Your actions and strategy impact the overall portfolio strategy, making this an important investment tool.

- Investment Variety: These accounts can invest in various financial products. It's essential to diversify in such investments

- Flexibility (beyond tax benefits): While tax advantages are usually minimal, they offer substantial flexibility in use for other purposes and non-tax-advantage accounts.

- Long-term Planning: This type of account helps start long-term investment patterns for personal use, which is critical.

How to Choose the Right Custodial Account

Choosing the right custodial account involves careful considerations.

- Explore Options: Research various custodians for kids’ investment accounts to fully appreciate their terms and policies. This can prove valuable.

- Compare Fees: Account management fees differ greatly across providers. Look into which fees and plans may benefit your portfolio. Be wary of exorbitant fees which impact your child’s future portfolio management and potentially hurt investment return in this account. Fees charged at differing account rates directly impact portfolio health

- Investment Choices: Consider different investment types based on the investment goals. Ensure your selection allows variety and flexibility for any future changes, this will impact return percentages and growth greatly over time.

- Review Legal Stipulations: Understand your state’s laws regarding minors and accounts to ensure adherence to regulatory practices; consider if your personal investment accounts are managed adequately in terms of future expectations

What Parents Need To Know About Kid's Investment Accounts

Navigating the world of kids’ investment accounts, or personal investment accounts in general, involves many factors and important insights.

-

Financial Literacy: Establishing healthy financial habits, such as managing personal investment accounts from the start, significantly affects future financial success, so proper and effective educational practices are vital. It is crucial to consider factors influencing the successful growth of personal investment accounts.

-

Investment Selection: Understanding investment options within such accounts is necessary; it plays a crucial role in maximizing the benefits in your child's personal investment account, and is of profound impact when setting a growth trajectory and return projections, in contrast with portfolio strategies

-

Long-Term Implications: Remember, your child's financial journey may well encompass the child’s personal investment accounts and long-term savings. Understanding the details regarding kids’ investment accounts, or personal investment accounts in general, can provide a foundation of success.

These personal investment accounts are vital to establish future success. Understanding various elements of kids' personal investment accounts, including those focusing on the specific factors impacting growth projections, or simply how these kinds of accounts work, and ensuring long-term financial success are profoundly beneficial in building confidence in one’s investments, ensuring growth and financial freedom in future endeavors for your child or for yourself, with effective investment strategies impacting both accounts.

Education Savings Accounts: Investing for Education

Personal investment account strategies are vital for securing the financial future of your loved ones, especially your children's educational needs. Smart personal investment account choices offer opportunities to significantly influence a child's education. Many strategies involve understanding various types of accounts, each with specific regulations, and implications for financial returns. Investing early provides compound returns.

Maximizing Investment Returns with Education Accounts

Strategies to maximize returns are crucial for personal investment accounts earmarked for education. Researching diverse investment options within personal investment account platforms is key to a smart plan. Understanding various account types, their tax implications, and associated rules can lead to smart planning choices. Proper due diligence when choosing specific personal investment account strategies maximizes gains, minimizes losses.

Diversification is an important element for maximizing personal investment returns on educational accounts. Spreading your investments across various investment types inside these accounts can mitigate risk, maximizing return potential in various market environments. Researching the diverse types of investments available through personal investment account platforms can be vital for finding optimal choices to fund education.

Personal Investment Accounts: 5 Ways to Plan for Education

Planning ahead and implementing a smart personal investment strategy are important for education-related goals. Several actionable steps make personal investment account plans for education more effective.

-

Estimate Education Costs: Project the total estimated costs for education, accounting for both tuition and other associated expenses. Research recent and expected tuition fee rates and projected costs of living during a child's studies and make educated calculations. Personal investment account plans should consider how to maximize investments, minimizing long-term costs of education.

-

Select Investment Options: Analyze different investment types within your chosen personal investment accounts for high yields and lower risks. Explore diverse investment tools through various personal investment account services to tailor plans effectively for future needs. Understanding a personal investment account strategy enables optimized gains, better returns over time, lowering long-term costs for a child’s education.

-

Establish Investment Timelines: Project the investment timeline considering factors like desired yield and available funding. Understanding how the account growth and personal investment choices affects timelines, and plan a timeline to account for unexpected situations, unexpected educational cost fluctuations. Investing in education from an early age helps accumulate resources for future costs using optimal strategies of your personal investment account.

-

Implement Continuous Monitoring: Evaluate your investment strategies using a consistent timeline, understanding their potential risks and returns using diverse data across your personal investment account portfolio, with a specific strategy designed for an educational purpose. This active oversight enables you to make necessary adjustments, maximizing growth opportunities over the years for higher educational returns for a child's education and plan based on personal investment account choices, helping minimize costs over time.

-

Manage Personal Finances Wisely: Managing personal finances involves multiple steps for efficient planning toward funding a child’s education using an effectively strategized personal investment account to minimize financial gaps over time. Budgeting wisely maximizes efficiency. Track your account regularly within your personal investment account plan. Understand risks associated with funding these plans early on within your personal investment accounts.

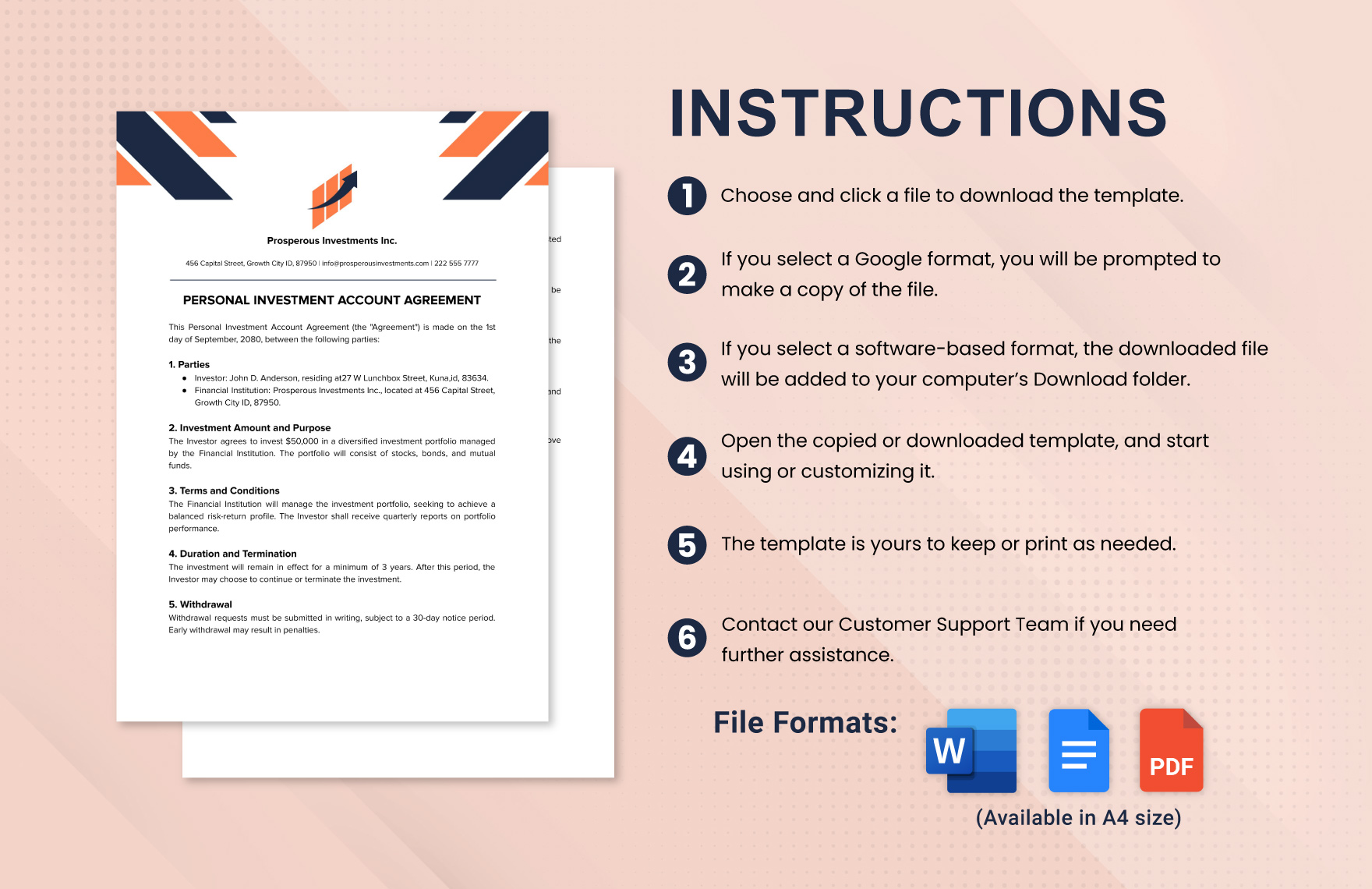

Understanding 529 Plans & Coverdell ESAs

529 plans and Coverdell ESAs offer distinct methods for investing in a child's education, tailored to various situations. Understanding both types is crucial. They often utilize personal investment accounts for a higher education fund. Understanding your individual personal investment accounts choice maximizes financial efficiency in education.

529 plans generally hold high return potential because of their ability to grow with returns over a certain timeframe. Both utilize personal investment account platforms for their transactions. Consider the long-term implications when investing using both Coverdell ESAs and 529 plans within personal investment accounts. The financial flexibility available using these various investment methods under personal investment account umbrella will enable individuals to meet financial needs, and offer diversified investments to minimize losses or maximizes profits. Your individual financial status and family resources, and the nature of specific personal investment accounts are factors in selecting either type of education investment plan.

Source: template.net

Planning for the Future of Children Education

Ensuring financial security and optimized return for children's education requires careful, comprehensive planning. Long-term personal investment accounts that generate good return are extremely important. Implementing a thorough plan early enables children to reach their academic goals financially.

Long-term financial planning is a vital step toward effectively handling educational needs and various unforeseen factors throughout time. Understand your personal investment account strategies, and what types of returns to expect from these specific investments, accounting for the long-term future costs of education. Effective plans will consider both present needs and potential long-term future challenges associated with higher education. A well-planned, diverse personal investment account platform, used appropriately, can lead to smart strategies enabling your children to focus on learning and developing essential academic skills while handling their education funds without worry or unexpected challenges or pitfalls. Consider and track returns with an effective personal investment account and financial investment strategies as factors, when calculating a plan over time and for all situations associated with higher education planning for your children.