Personal Savings and Investment Plan: A Comprehensive Overview

A robust personal savings and investment plan is a must-have in today's world. It’s more than just saving; it's a strategic roadmap for securing your personal finances, your family's, and potentially future generations. Your personal savings and investment plan involves carefully managing all your income, spending, debts and setting future financial goals, big and small. A great personal savings and investment plan considers all aspects of your personal life, from paying off debts, purchasing a house, or retirement planning to maintaining a good credit score and minimizing risks in your investments.

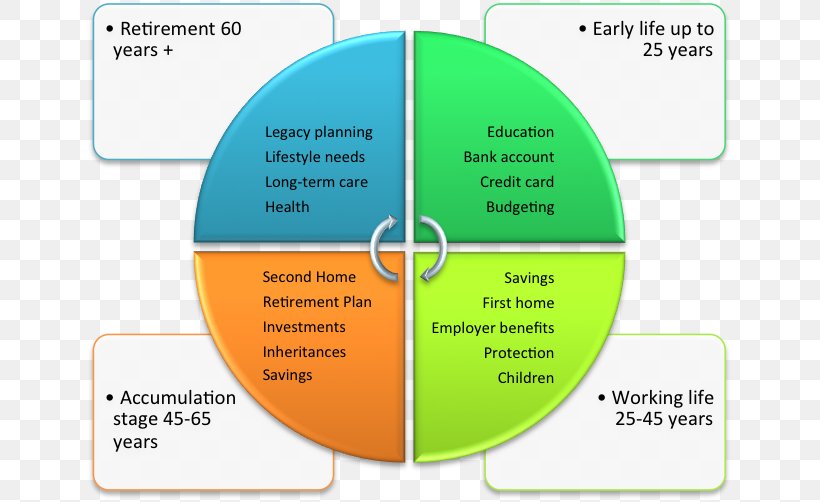

Key Elements of a Personal Savings and Investment Plan

Source: favpng.com

This personal savings and investment plan lays the foundation for your future. A clear personal savings and investment plan is a strong defense. Having a clear personal savings and investment plan will save your personal income and reduce financial burdens. The bedrock is comprehensive knowledge.

- Financial Assessment: Know your position. Understand your income, expenses, and debts. A thorough analysis is a necessary step towards effective savings strategies and building wealth through consistent, sustainable investment efforts for your personal savings and investment plan.

- Goal Setting: Determine clear, measurable, achievable, relevant, and time-bound goals. Whether a down payment on a house, early retirement, or a child’s education, having these clear objectives in your personal savings and investment plan is important to maintain motivation. Your personal savings and investment plan should also consider the type of risk each strategy poses.

- Budgeting: Create a budget. Track your income and expenses. Effective personal savings and investment plan means your money works for you, not against you, meaning detailed and strict budgeting. Knowing how you are spending and what is costing you. Tracking expenditures gives clarity on where your income is going so better allocation and investments. A proper budget makes sure that your personal savings and investment plan accounts for future expenses like taxes.

- Emergency Fund: Set aside emergency funds. Establish an account with 3-6 months of living expenses. An essential component of a solid personal savings and investment plan to meet unexpected life occurrences. Your personal savings and investment plan could get messed up by not having a clear emergency fund plan and it may lead to taking out expensive loans.

- Debt Management: Strategically address debts. Develop a plan to tackle high-interest debt first and keep costs under control, all while developing a more realistic view on your personal savings and investment plan and understanding your available funds. It may seem trivial to be mindful about debt but it is imperative for your personal savings and investment plan to keep track of and pay your dues and loans to keep your credit score from plummeting.

- Investment Strategy: Consider diverse investment options, from low-risk savings accounts to high-potential but potentially risky stocks, and everything in between for a good and solid personal savings and investment plan. Research different strategies and asset allocation for various situations like investment risks to develop and implement the best strategy for your individual profile. Different strategies might yield differing returns, making appropriate choice to fit your goals in your personal savings and investment plan.

- Regular Review and Adjustments: Don't abandon your personal savings and investment plan. It's not a one-time deal, your personal savings and investment plan. Periodic assessments of progress and necessary changes to suit unforeseen factors are key aspects of financial well-being, with your personal savings and investment plan. Life is not a straight line. This will determine if your personal savings and investment plan still meets your objectives and ensure you're on track. This personal savings and investment plan will allow you to meet financial needs over time.

Creating a SMART Savings Plan

Make your personal savings and investment plan clear, specific and to-the-point so that it’s straightforward. Using the SMART principle—Specific, Measurable, Achievable, Relevant, and Time-bound—your personal savings and investment plan will keep you motivated and directed for your individual goals. This will not be an automatic process that you can neglect and ignore if your personal savings and investment plan requires immediate attention, such as fixing major emergencies, then act on it immediately.

- Define Goals: Exactly what do you want to achieve in this savings goal? A clear statement of what your money is to accomplish in your personal savings and investment plan will keep you accountable to what it’s going for. Define, and refine, your personal savings and investment plan

- Quantify Your Goals: Establish precise benchmarks for success in your personal savings and investment plan, creating a system where your goals will become milestones for a measurable progress in personal savings and investment plan. Use real numbers like amounts, percentage rates, etc in your personal savings and investment plan.

Strategies for Managing Personal Finances

This section focuses on techniques to control expenses, grow savings and allocate resources efficiently.

- Track Your Spending: Be aware of how you're spending in this savings period. Tracking helps identify areas where to reduce expenditure and save more. In the long-term you’ll develop patterns and get a more complete view of spending habits through regular analysis.

- Cut Unnecessary Expenses: Scrutinize each expenditure with a discerning eye. Eliminate non-essential expenses—an active decision to take an initiative to reduce expense as much as possible.

- Automate Savings: Set up automatic transfers to your savings account on a regular schedule. Habit is key in financial progress.

- Establish Realistic Budgets: Allocate realistic limits for your expenses. Consider the need to cover all necessary aspects of everyday life and budget well to not have to face any difficult situations or emergency circumstances.

Essential Considerations for Investment Decisions

Personal savings and investment planning are important, and also choosing a suitable investment option requires careful consideration. The ideal choice can improve your personal savings and investment plan's long-term financial gains while maintaining financial wellness. This plan is part of making you have your desired outcome when the plan matures.

-

Diversify Investments: Consider different assets and low to moderate-risk investments to maintain funds within reasonable bounds. Balance the potential profits against possible losses, given any risk considerations. Your personal savings and investment plan will consider and account for diverse investments.

-

Understand Risk Tolerance: Are you risk-averse, or risk-tolerant? Invest based on individual and unique financial risks that can damage personal savings and investment plan, and do not be pressured or influenced when making investments. Understand your tolerance level. Diversify!

-

Seek Professional Guidance (if necessary): Contact a financial expert if needed and have support when making financial and investing decisions; or discuss this extensively to get proper advice to protect and develop your personal savings and investment plan, by having an additional pair of financial expert eyes to validate your financial objectives. Consult if you require extensive financial knowledge in personal savings and investment plan and are unable to properly establish it by yourself. Remember it is about making appropriate choices and developing financial safety for your plan's effectiveness.

Understanding Your Current Financial Position

Your personal savings and investment plan starts with a clear view of your current financial health. This isn't just about numbers; it's about understanding your entire financial picture. A solid foundation, based on a factual account, helps shape realistic personal savings and investment plan. This analysis forms the basis for setting realistic and achievable goals within the overall plan.

Understanding your present financial position is critical. The core aspect of this stage revolves around accurately defining your liquid assets (money you can quickly access) and your liabilities (debts). Honest assessment is crucial for a good personal savings and investment plan, including a review of existing accounts. This is the bedrock upon which sound personal savings and investment strategies are built.

Key elements include:

- Liquid Assets: Cash, checking accounts, savings accounts, money market accounts.

- Liabilities: Loans, credit card debt, outstanding bills.

Your personal savings and investment plan should acknowledge that expenses must be accurately cataloged. Detailed monthly tracking of income and expenses gives the insight you need. Your budget's insights often reveal opportunities to save money while keeping lifestyle comfortable and manageable.

Consider the implications of each type of financial account (bank savings and investment, checking, etc.). This understanding plays a key role within your comprehensive personal savings and investment plan.

Setting Short-Term and Long-Term Goals

Source: researchgate.net

A powerful personal savings and investment plan should always consider goals in two main categories: immediate and future. Having short-term targets provides a strong driving force within a long-term plan.

Setting short-term financial goals gives a clearer understanding of your personal savings and investment plan's trajectory. This step can inspire you.

Short-Term Goals (within 1 year): These can focus on immediate needs like saving for a vacation, emergencies, home repairs, or minor financial obligations, etc.

Long-Term Goals (beyond 1 year): These encompass significant financial aims, including:

* Saving for a down payment on a home, a new car, wedding fund or retirement

* Managing or tackling substantial debt.

Effective personal savings and investment plans hinge on well-defined targets, whether short-term or long-term, because these serve as the main motivation for you. Establishing these types of goals fosters an understanding of how the individual personal savings and investment plan helps bring desired future financial stability.

Utilizing SMART Goals

A clear roadmap for personal savings and investment plan. Your individual financial strategy needs well-defined goals, leading you towards achievement.

A useful framework to help you is known as the "SMART" approach. Make your goals concrete, easy to measure, attainable, realistic, and time-bound to effectively build personal savings and investment plan success. This clarity and detailed plan empowers you.

The "SMART" framework involves creating objectives that are:

- Specific: Clearly define what you want to achieve.

- Measurable: Identify key metrics to track progress.

- Achievable: Set realistic, yet aspirational, targets, important to a comprehensive personal savings and investment plan.

- Relevant: Goals must directly relate to your personal circumstances and fit into a consistent and robust plan.

- Time-bound: Establish a clear timeline for reaching the goals to boost motivation and progress towards success, as part of an excellent personal savings and investment plan.

Analyzing Income and Expenses for Realistic Savings

Effective personal savings and investment plans necessitate analyzing the crucial factors involved. Understanding the flow of money within the current plan and budgeting appropriately often gives the best results when applied with accuracy.

Accurately calculating your income and expenses forms the cornerstone for a robust savings and investment plan. A detailed analysis is a fundamental part of planning. Detailed budgeting also is necessary to keep expenses in check, creating a financial balance and providing a clearer path. This clear perspective promotes progress and avoids financial missteps.

Review your current budgeting system (if one exists), listing each item of expense (including recurring and occasional costs, such as subscription services). Regular monitoring helps keep on top of personal savings and investment plans.

Categorizing income helps streamline a personal savings and investment plan. Categorizing expenses enhances transparency in personal savings and investment plan success and encourages smarter budgeting decisions to improve and create a strong strategy. Personal savings and investment plans benefit greatly from well-organized categorizations. An organized list should differentiate income and expenditure areas with each separate item classified.

Allocating Savings Toward Specific Goals

Now we've assessed our resources, set targets, and gained an understanding of income and expenses. Now it is necessary to allocate our accumulated savings toward achievable financial objectives and establish the right budgeting process for each need. A detailed personal savings and investment plan guides the effective allocation of resources.

Determine how much you'll set aside each month from income after costs and expenses.

Choose appropriate vehicles for savings and investment to align with these targets, maximizing your investment earnings and creating optimal results within a plan. Prioritization of short-term or long-term goals is pivotal. A sound personal savings and investment plan accounts for a multitude of details for effective allocation of personal savings and investment strategy, emphasizing detailed analyses and understanding for the financial goals desired. This detailed allocation and implementation of these detailed goals to the personal savings and investment plan supports achievement of targeted goals effectively and strengthens motivation and dedication to achieving the specific objectives, leading to the success of this type of plan.

Focus and prioritize on these details when allocating and reviewing how savings grow through a financial plan and what that means. Personal savings and investment plan must cover all elements including asset growth for maximizing potential returns from planned investment vehicles and account allocation. Allocate based on prioritized needs from short-term, to mid-term, to long-term plans; prioritize effectively for successful financial management and an efficient personal savings and investment plan. Carefully think about your needs and long term goals to maximize the positive aspects from a savings plan and make choices accordingly based on an allocated plan and clear process for managing savings and investment through various vehicles, to allocate accordingly from various available account types from banking accounts to investment strategies, emphasizing that investment plans should meet your target dates from planned goals using appropriate vehicle strategies from your personal savings and investment plan and plan well. Your savings, planned within a strong personal savings and investment plan, helps you accumulate a growing source of financial independence. Carefully allocate towards the long term goals and be organized within each portion of your financial and savings allocation in the comprehensive personal savings and investment plan for reaching all the aims, as well as creating financial growth, with all allocation procedures. This step of allocation of savings, well planned, is important in creating the personal savings and investment plan that one truly needs and one that one truly can be satisfied with given the thoroughness and consideration towards various factors involved.

Essential Steps in Your Financial Plan

Source: alamy.com

A personal savings and investment plan is the cornerstone of financial well-being. It's not just about numbers, it's about controlling your money's story. This personal savings and investment plan is not magic; it’s a roadmap that you create for yourself.

Crucial Initial Steps:

-

Honest Self-Assessment: A precise picture of your financial standing is essential. List all assets (what you own), and all liabilities (what you owe). This honest review guides the personal savings and investment plan.

-

Identify Financial Goals: Define precisely what you want to achieve. Are you saving for a house? Retirement? A child’s education? Clear, concrete goals in your personal savings and investment plan are essential for creating momentum.

-

Set Realistic Budget: Create a personal savings and investment plan budget. This shows how you allocate each incoming dollar, detailing every expenditure in your financial plan.

-

Prioritize Savings: Outline saving goals based on a realistic time frame, considering a personal savings and investment plan that takes into account emergencies and major life events. Aim to save, not just invest for later in your financial plan, immediately save from your income.

-

Insurance Protection: Analyze and procure needed insurance against health and other financial vulnerabilities, ensuring your personal savings and investment plan incorporates safeguards.

Different Savings and Investment Vehicles

Your personal savings and investment plan should consider various methods of putting away and building money.

-

Bank Accounts (Checking, Savings, Money Market): Essential foundation, for your everyday income and a starter for the personal savings and investment plan. They are easiest for most.

-

Certificates of Deposit (CDs): Secure short- or long-term saving, with fixed rates in a personal savings and investment plan.

-

Individual Retirement Accounts (IRAs): Tax-advantaged retirement vehicles that are important elements for most personal savings and investment plans.

-

Stocks and Bonds: Possible for personal savings and investment plan expansion, but always involve research before taking the step in your financial plan.

-

Mutual Funds and ETFs: Portfolio diversification opportunities. You need a personalized approach with any savings and investment plans involving them.

-

Real Estate: Tangible assets like apartments can generate significant income if planned properly for your personal savings and investment plan.

Importance of Emergency Funds

Your personal savings and investment plan is nothing without adequate emergency fund protection. Financial setbacks are unexpected. Emergency funds cushion shocks like job loss, serious illness or other sudden, urgent expenses in the financial plan.

-

Sufficient Amount: Set the financial savings amount for emergencies according to your current lifestyle; it should easily cover at least 3–6 months of living expenses in your personal savings and investment plan.

-

Strategic Placement: Maintain the emergency fund in a easily-accessed and stable account, in case your financial plan experiences hiccups.

-

Ongoing Refill: Do not just save once; make ongoing adjustments. Your plan’s emergency savings account may need further replenishing throughout life.

Strategies for Managing Debt

Effective personal savings and investment planning demands mindful debt management.

-

Debt Consolidation: Combines several debts into one. Important for personal savings and investment plans that involve dealing with overwhelming debts.

-

Debt Reduction Plans: Establish step-by-step schedules to eliminate specific debts to improve a personal savings and investment plan's success, paying the ones with highest interests first.

-

Negotiation and Repayment Alternatives: Reach out for interest rate cuts or repayment schedules on particular debt and loan products. Use these for a plan and always look into whether these will affect your credit scores when in doubt. Always confirm whether these modifications impact the credit report for personal savings and investment plans, so be sure to use careful research on available options for debts.

Planning for Major Life Events

Personal savings and investment plans should adapt as circumstances evolve.

-

Marriage and Family: Financial plans require reviewing and adjusting expectations, such as sharing personal expenses or including new family-specific investments and expenses when married, as you should for personal savings and investment plans with new kids in their lives or new families in their plan.

-

Buying a Home: Factor home purchases into the long-term goals of the personal savings and investment plan, planning the associated fees and financial requirements carefully before even starting to look at a home or real estate as an investment, such as assessing down payment needs in advance and ensuring budget aligns for the real estate purchases.

-

Retirement: It’s vital to formulate specific retirement strategies within the context of personal savings and investment plans, setting out strategies at the outset. Your personal savings and investment plan need long-term attention to prepare for it!

The Role of Liability Insurance

Personal savings and investment plan often overlook a crucial aspect: liability insurance. It's a vital component of your financial strategy. Comprehending the extent of protection it provides is critical. Understanding insurance policy limits is paramount in your personal savings and investment plan. Minimum coverage is mandated by your state but goes way beyond basic safety net for a balanced personal savings and investment plan.

Liability insurance protects you from financial hardship due to accidents that may damage someone else or their property. Without insurance, that damage may become your financial responsibility. Knowing exactly what's covered in a comprehensive personal savings and investment plan and the policy's specific coverage is absolutely vital.

What Liability Insurance Covers (Generally):

- Bodily injury liability: Covers injuries to others in accidents.

- Property damage liability: Pays for damages to others' property resulting from an incident.

Beyond Basic Coverage:

- Umbrella insurance: Offers extra protection exceeding your typical limits of basic policy. Crucial in your comprehensive personal savings and investment plan. This often protects against huge judgments that can obliterate personal savings and investment plans if one is uninsured.

A savvy investor recognizes the critical link between liability insurance and financial safety. Your personal savings and investment plan should prioritize such risk assessment to protect your future.

Utilizing Online Banking and Mobile Apps

Online banking and mobile apps are indispensable tools in your modern personal savings and investment plan. Embrace their seamless accessibility, speed and safety. In a dynamic financial environment, this technology has significantly elevated its efficacy. Gone are the days of physical forms; today's digital solutions simplify daily financial transactions within your personal savings and investment plan.

Key Advantages of Mobile Banking:

- Easy account access from anywhere, any time (integral to personal savings and investment plans).

- Real-time updates on balance and transaction history. A seamless part of modern personal savings and investment plans.

- Budgeting apps: Tailored to manage money flows efficiently. Integrated well into the structure of modern personal savings and investment plans.

- Investment tracking apps: Allowing real-time performance checks for personalized plans. An invaluable element in personal savings and investment planning in this technologically-driven era.

Online banking provides critical safety measures; with encryption, access protection, and frequent updates for added assurance within your personal savings and investment plan. The ongoing advancement in technology ensures ever-increasing security. A strong internet connection and regular updates should be mandatory in a personal savings and investment plan using technology-based banking tools.

Digital financial solutions: an integral part of any modern personal savings and investment plan.

Utilizing Wire Transfers

Wire transfers facilitate large transactions with security features exceeding alternative payment methods (like ACH). It's faster, and often perceived to be more secure for sensitive payments that can be implemented smoothly as a part of the personal savings and investment plan.

Features Making Wire Transfers Prominent:

- Enhanced security protocols help mitigate risk factors for personal financial planning.

- Usually more costly than standard transfers, but generally suitable for considerable transactions for more sophisticated personal savings and investment strategies.

- Extensive tracking and monitoring for both sender and recipient for a transparent workflow. The features ensure increased transparency that significantly supports your personal savings and investment plan, making transactions reliable and secure for the recipient's side too.

While fees might be associated, wire transfers' convenience makes them worth considering for major personal financial transactions and an efficient step towards investment and planning goals. Review fees and any conditions meticulously for seamless handling. These features make them suitable and manageable in comprehensive personal savings and investment plan.

Creating a Personal Financial Statement

A well-structured personal financial statement summarizes your assets and liabilities and is integral in achieving your financial goals. A valuable snapshot of your personal standing for effective long-term investment planning in your personal savings and investment plan.

What It Covers (Crucially):

- Listing assets, and all financial instruments that you own for your personal savings and investment plans.

- Identifying liabilities: showing all outstanding debts. An accurate measure of your financial status essential for a robust personal savings and investment plan.

- Calculation of net worth. Crucial element to estimate overall personal wealth; fundamental for your overall financial plans and important to effectively support and direct personal savings and investment plan.

The statement also helps to:

- Gauge progress. A critical assessment to understand the impact of various strategies in your plan.

- Aid in loan applications (like mortgages and even some small-scale investments): Demonstrating creditworthiness or personal financial well-being which are core elements for many components of a solid personal savings and investment plan.

Use the financial statement for effective planning of your personal savings and investment plan.

Maximizing Your Financial Well-Being

Maximizing your financial well-being is a dynamic and evolving process, not a fixed one. Continuously reviewing and improving personal savings and investment plans are critical factors to understand. Your individual financial plans will evolve based on various criteria and individual scenarios in different cases.

Steps towards Financial Well-Being:

- Precise financial assessment: a critical analysis of personal income and expenditures in personal savings and investment plans.

- Setting clear short-term and long-term objectives: well-structured strategies to navigate financial hurdles for your personal savings and investment plans.

- Smart planning: incorporating the concept of specific, measurable, achievable, relevant and time-bound financial targets that are integrated to build a personal savings and investment plan for success.

- Investment diversification: understanding the range of options within a portfolio for maximum yield. It will likely become a permanent facet of effective personal savings and investment plans.

- Regular plan evaluation: a vital feedback mechanism that adapts well in evolving personal savings and investment plans.

Understanding these core concepts can elevate your investment planning, paving the way for achieving optimal financial health through well-considered personal savings and investment plans. Consistent review for your specific financial objectives with accurate projections through your specific personal savings and investment plan.

Personal Savings Rate and Budget Management

Personal savings and investment plan is crucial for future security. Your personal savings and investment plan needs a meticulous approach to building financial stability. This personal savings and investment plan needs attention to debt management, as well as saving and budgeting practices. Effective financial plans also account for likely emergencies. A sound personal savings and investment plan is essential for achieving long-term financial goals, such as purchasing a house or retirement. A comprehensive personal savings and investment plan covers numerous aspects of financial security, ranging from day-to-day expenditures to long-term financial objectives.

A robust personal savings and investment plan starts with honest evaluation of your finances. This often necessitates creating a personal budget outlining your income, all expenditures, and creating your personal savings plan. What's needed here is a thorough review of your spending habits. This may include several specific personal financial goals, or several steps that will allow you to meet a number of your personal objectives.

Personal savings rate is often a concern. Most personal savings plans frequently fail due to various reasons including, improper analysis, unrealistic budgets, and procrastination. Personal saving is critical part of your personal savings and investment plan, so this part deserves more thoughtfulness.

A comprehensive review of current finances is the cornerstone of personal savings and investment plan success. A critical component for the plan is managing the potential impact of unplanned expenditures that are a crucial part of a good personal financial plan, and keeping some savings and emergency funds for any emergency circumstances and financial shock. Effective personal savings plans will give you flexibility to maneuver through market uncertainties. A healthy personal savings rate is very important in your personal savings and investment plan.

Source: shoonya.com

Investment Considerations in Times of Market Downturn

Market downturns are often an opportunity for strategic investments. In turbulent markets, your personal savings and investment plan may be put into question. Don't be fearful of your personal savings plan during market downturns! Assess how to maneuver through challenges in the market using the personal savings and investment plan to guide decisions. This means evaluating and adapting a long-term savings strategy if the market experiences a setback. A well-defined personal savings plan enables calculated decision making during a market downturn.

A market downturn demands specific adjustments to a personal savings and investment plan. This adjustment involves reevaluating the current assets allocation in a personal savings and investment plan and evaluating alternatives for the investment allocation. Analyze possible investment risks during downturn, using available resources such as online and other informative sources for current and historic market conditions in making well-thought out decision. Reassess investment timelines according to the revised plan. Diversification strategies should remain a core part of personal savings plans in these moments, but strategies need to be reassessed accordingly for a downturn.

Thorough preparation helps with any market shift and should form the base of your personal savings and investment plan. Diversification should still be a core aspect. Carefully evaluate each investment to understand its short- and long-term performance potential.

A thoughtful personal savings and investment plan helps one make the right decisions. Review past investment patterns using this personal savings and investment plan to identify potential risks. Your plan must adjust strategies according to the needs of a personal savings plan that adapts to changing economic scenarios. A strategic, cautious approach during downturns enhances long-term financial stability and protects a successful personal savings plan.

Tips for Improving Financial Success

Improving financial success is an ongoing process that starts with setting practical personal savings goals, then involves taking steps, not merely thinking. Start now! Financial success is about diligent and continuous improvement. A solid foundation will be vital for consistent growth and improving your personal savings plan's efficacy. A realistic and specific goal must guide every part of your personal savings and investment plan, step by step. It must include long-term objectives. Set SMART goals – Specific, Measurable, Achievable, Realistic, Time-bound – within a detailed personal savings plan for your personal needs and situation. Consistent steps will lead to positive outcomes and must always be adapted.

Consistency in your approach to saving, investing and your personal financial strategy can influence the speed of attainment of a positive financial outcome, according to financial professionals.

Budgeting wisely and meticulously, cutting unnecessary spending habits, creating an effective personal savings plan is essential to building positive financial habits, will form a concrete step towards positive improvements. Implement your new financial skills into all your future personal savings plans, constantly looking for improvements. Your personal savings and investment plan should always be flexible and adaptive to the realities around you. Effective communication with your financial advisor will significantly help to adjust and improve your personal financial goals within the personal savings and investment plan.

Long-Term Savings Goals Planning

Long-term financial goals require systematic saving and investment. Effective long-term goals are vital to developing the personal savings and investment plan, from start to finish. Plan for the long term to increase your potential gains. Be persistent and strategic and develop and improve personal savings plans according to each objective. Specific savings and investment targets must guide the design of your personal savings and investment plan.

Planning long-term savings needs clear objectives. It is a long process but needs methodical planning for success, so a great plan must include an investment and personal saving goal component that has clear criteria. Defining measurable goals should be a key aspect of any personal financial strategy. Set specific milestones with timelines and measurable markers, ensuring you stay focused to increase chances of personal savings success.

Investing for a long-term goal requires considerable patience and discipline and consistent personal savings strategies must maintain the flexibility needed for long-term success within a personal savings plan. Personal financial strategy for long-term goals must factor in several possible scenarios and market shifts as well.

Navigating the Financial Market

Navigating the financial market demands staying informed about the market dynamics, keeping your strategy well diversified, making necessary changes and adaptations and following the detailed framework your personal savings plan lays out. In the face of volatile markets, a carefully crafted and updated personal savings and investment plan is crucial for consistent, good decision-making. Review investment allocation within your personal savings plan according to emerging market conditions and market factors, frequently and consistently!

Regular assessments and adaptations of a plan are necessary to navigate shifting market dynamics and potential losses, keeping your personal savings plan current, accurate, and relevant, is critical, if it has been appropriately designed and planned for these dynamics.

Using suitable market analysis tools in assessing potential financial performance, and understanding financial risk factors is vital and the success of your plan is determined by how quickly your plan will respond to change in market situations to prevent loss and potential decline, your personal savings plan should respond well. Effective management and guidance should improve your ability to adapt your plan.