Stock Investment Options: A Beginner's Guide

Stock investment options are a thrilling and sometimes scary path to financial growth. Knowing the options available can help you navigate the world of stock investment options. Choosing the right stock investment options can build your wealth, but it can also lead to substantial losses, especially for those without thorough planning. We must remember risk is a vital element of stock investment options.

Understanding Stock Investment Options

Stock investment options represent ownership in a company. When you buy a company's stock, you're becoming a shareholder, a partial owner. Understanding the nature of this ownership is a first step in any discussion about stock investment options. Stock investment options depend greatly on your personal tolerance to loss as it's a challenging, risky avenue to invest. What's often confusing is deciding where to put your funds into your chosen stock investment options. Companies often need a capital infusion and often times, that infusion comes from public offering or the private market.

Your approach toward your stock investment options should be thoughtful and focused. Think long-term if you want sustainable wealth building with your stock investment options. Remember, stock investment options are inherently connected to market fluctuations and these fluctuate as you know. There’s potential for quick gains, but also quick losses. The rewards from your stock investment options often hinge on shrewd, strategic, and thoughtful consideration,

Different elements can greatly affect your stock investment options choices, market trends, investor sentiment, overall economic environment. Always analyze different financial possibilities within the realm of stock investment options before committing.

Different Types of Stock Investment Options

Understanding various stock investment options will help. These investment options include;

- Common Stock: The most basic and familiar stock investment option. It offers voting rights at shareholder meetings.

- Preferred Stock: Typically offers higher dividends. Preferred stock investment options lack the voting power that is present with common stock.

- Dividends: These payments from profits that companies often issue to shareholders to make returns on investments in their stock investment options.

Your particular investment options might vary slightly, depending on individual needs or overall risk tolerance in a company's stock. You must understand your preferences, including risks and possible gains for your preferred type of stock investment options. The dividends alone often determine your final stock investment options decisions in many ways.

Top Stock Investment Options for Beginners

If you're starting out, focusing on the fundamentals of stock investment options will be useful to consider before getting started. For a novice, consider some initial strategies that could be ideal for your stock investment options:

- Low-Cost Index Funds: These funds are widely regarded to be straightforward, reliable tools within the sphere of stock investment options and generally easy to maintain. They mimic an entire market index like the S&P 500, effectively reducing risks and costs in your stock investment options, helping a beginner avoid the complexities.

- Exchange-Traded Funds (ETFs): Often tracking specific markets and investment sectors that are good options for novice investors into the world of stock investment options, giving them exposure across the board to companies. This diversified approach simplifies your stock investment options plan while promoting better market understanding in the broader sense.

Stock investment options require diligence, perseverance, and attention to financial news or industry specifics as needed. With your thorough analysis on hand, choose which route aligns best with your chosen stock investment options. The proper use of each is paramount and can sometimes determine the success or failure of your chosen stock investment options. This analysis could provide you an advantage, no matter how new your strategy may be.

Exploring Stock Investment Options in Detail

Source: website-files.com

Deciding which investment options will work is an individualized process within your stock investment options path. Here are a few further considerations;

- Due Diligence: It’s essential to assess companies and their prospects closely in your stock investment options planning. This goes way beyond just a catchy slogan or catchy marketing messages. Look for factors like management quality, financial stability, future prospects, risk factors. You must consider your current understanding of financial stability, which can impact your specific approach toward stock investment options.

- Investment Strategy: It is worthwhile to review financial professionals on specific stock investment options questions. A solid plan, aligned to personal finances and goals is helpful in the decision-making process regarding specific stock investment options to select, regardless of the experience. The better you analyze it all, the better you make it with respect to your stock investment options choices and financial goals.

You should consider seeking advice for all stock investment options queries. Be patient and persistent with your stock investment options endeavors. Success often depends on thorough evaluation of the entire investment journey for stock investment options. Every successful investment involves the commitment of thorough stock investment options evaluation. Remember the elements required to develop your unique strategy based on stock investment options choices. Consider what is necessary to achieve the desired level of competency and understand how this fits into your plan of stock investment options overall.

5 Easy Steps to Choose Stock Investment Options

Picking the right stock investment options can feel overwhelming. But it doesn't have to be. These five simple steps will help you navigate the world of stock investment options, empowering you to make informed decisions. Smart stock investment options are a necessity for a fulfilling financial future.

-

Define Your Goals: What are you trying to achieve with your stock investment options? Retirement? A down payment? A new car? Knowing your financial goals helps narrow down suitable stock investment options.

-

Assess Your Risk Tolerance: Stock investment options can fluctuate wildly. How much risk are you willing to take? Low risk, low returns? High risk, potentially high rewards? Understanding your comfort level is paramount for selecting the appropriate stock investment options. Stock investment options come with risks.

-

Research Various Options: Different stock investment options exist. From individual stocks to stock exchange-traded funds (ETFs). This step involves studying investment strategies, comparing fees, assessing historical performance (but beware, past performance doesn't guarantee future results), considering available resources like brokers or financial advisors who provide insight into stock investment options and market analysis.

-

Create a Realistic Budget: Set aside a specific amount for stock investment options each month, a percentage or a set dollar figure that you can consistently fund in your stock investment options accounts. Sticking to this budget can prove very helpful and keep your spending and investing needs in mind with your stock investment options.

-

Monitor and Reassess Regularly: The stock market is ever-changing, so keep your stock investment options plans updated and relevant by revisiting them every few months, at least quarterly, examining results. A review and potential alteration are crucial to your success with stock investment options. Be open to pivoting your choices within your stock investment options.

7 Reasons to Consider Stock Investment Options

Stock investment options have a place in many financial plans. Why consider them? Investing in stocks comes with some potential drawbacks.

-

Potential for High Returns: Over the long haul, stock investment options offer the potential for substantially greater returns compared to some other options. Stock returns often overshadow other ways to manage money. Stock market success is achievable and stock investment options are great tools for attaining this.

-

Growth and Prosperity: Stock investments can foster significant growth in your money.

-

Diversification Potential: Stocks are often seen as valuable diversifiers within a well-constructed portfolio, mitigating risks while pursuing financial goals. This should include a broad scope and different stock investment options that meet personal priorities.

-

Financial Independence: Growing a substantial stock investment portfolio, for instance with index funds within your stock investment options choices, can potentially increase future financial freedom and independence.

-

Liquidity (often): Some stocks can be sold quickly if you have an emergency need for money (the quicker liquidity is, the better). Liquidity is part of a sound stock investment strategy.

-

Inflation Hedge: The value of stocks might increase to outpace rising inflation. The benefit in managing stock investment options against inflation is important for long-term gains.

-

Long-Term Appreciation (often): Stock investment options, in some cases, increase in value as companies do. Investing correctly helps manage growth within stock investment options strategies, keeping you focused on goals. Stock prices often depend on numerous market forces and financial happenings.

3 Common Mistakes in Stock Investment Options

Some mistakes can derail even experienced investors, even professionals that should know how stock investment options operate properly! Understanding where investors trip up will help newcomers build a sound stock investment options plan.

-

Lack of Patience: The stock market can experience extreme fluctuations and ups and downs. Waiting for an appropriate entry point (at the best rate and amount in stock investment options) in a slow market can help avoid potentially negative experiences with stocks.

-

Emotional Decision-Making: When emotions, fear and greed, dictate decisions, stock investment options can quickly go bad. Try to use rationale, data-based decision-making and analysis of the investment options. Avoid any emotional turmoil while building your stock investment options approach.

-

Ignoring Diversification: A huge mistake in handling your stock investment options involves putting everything into one thing, like a certain sector or a type of investment within stocks. Spread your stock investment options risk; consider multiple avenues of stock investment options in different sectors! A solid stock investment strategy should balance many stocks.

Top 10 Stock Investment Options to Watch

Choosing from various stock investment options can be challenging. Here are some choices of stock investment options:

-

Technology Sector (and innovation) stocks: Look for technological advancements within stocks.

-

Healthcare: Stocks focused on health advances are among the options, and important for many sectors.

-

Renewable Energy Stocks: Stock options and shares linked to green-energy options might well be interesting stocks in this age.

-

Consumer Discretionary Stocks: Products and services relevant to consumers’ preferences (this has strong implications on stocks).

-

Consumer Staples: Stocks focused on basic goods have stability in stock investment options plans.

-

Energy Stocks: Some energy stocks may generate positive gains during fluctuations in supply and demand. These have high price changes, so caution with these is crucial.

-

Financial Sector Stocks: Stocks that are important to finance industries and economies usually affect financial trends, market sentiment, and economic news directly; thus affecting investments (especially for long-term financial gains.) They influence the overall economic outlook which impacts stock prices, meaning that many stock options have significant importance in finance (e.g., investing via banks is usually a stable option)

-

Real Estate Investment Trusts (REITs): Exploring REITs within the stock investment options offers real estate holdings, a relatively low-risk, long-term alternative compared to many others (particularly the housing market.) REITs within investment options frequently are quite stable stock options; although it isn't immune from market fluctuations and market events.

-

Utility Stocks: Investing in energy utilities usually guarantees some returns since people need them (like a crucial public service; people depend on it.) Thus these provide fairly regular and ongoing profits in your stock investment options decisions.

-

Index Funds: Consider carefully the market performance in an index. Consider investing wisely in these stable funds which aim to match stock market performance, and often are stable stock investment options, although returns in certain stock investments depend highly on different factors!

Key Factors in Choosing Stock Investment Options

Ultimately, choosing the best stock investment options needs careful consideration. These factors play a critical role.

-

Your Personal Finances: What kind of returns and liquidity do your stock investment options options entail, given personal funds?

-

Financial Advice: Consult a financial expert for insight into options; it could possibly improve the returns with your stock investment options portfolio! A second opinion from a stock professional will never hurt.

-

Risks vs. Rewards: Evaluating risks of stock investment options is absolutely essential for long-term growth with stock investments; weigh what is possible from your stock investment options (and carefully weigh possible results of negative investment in stocks with your risk appetite in order to assess suitable stock investment options choices)

-

Growth Potential of the Options: Do possible outcomes for stock investments actually support anticipated future values?

-

Liquidity in different investment strategies: Will investment opportunities quickly provide enough funding (to handle short-term, emergency needs in funds)? Be well-informed to best know how well you might leverage this tool to effectively meet any short-term requirements or emergencies that arise.

-

Overall Financial Well-being: Stock investment options may play a major part in improving your overall financial life, potentially allowing better investment and growth of money in general! Be smart and wise.

Stock Investment Options: Risk Assessment

Stock investment options carry inherent risks. Understanding these risks is crucial for any investor. Every stock investment option, big or small, exposes you to potential downturns in value. This inherent risk demands careful consideration. Stock investment options are not risk-free; never forget this fact.

Potential pitfalls with stock investment options include:

- Market fluctuations

- Company-specific problems

- Economic downturns

- Mismanagement of the stock itself

Evaluating risks related to stock investment options requires understanding different market scenarios. Knowing market downturns are possible, a wise investor seeks diverse stock investment options to lower their losses. Don't forget the risks connected to these different options. Be wary of sudden price drops from seemingly solid stock options. The unpredictable market necessitates proactive strategies to assess potential dangers associated with stock investment options.

You should analyze potential stock investment options, and consider these variables during risk assessment. Think deeply before deciding what options are right for you.

Assessing stock investment options entails examining past performance, financial reports, and industry trends. This analysis helps forecast future stock performance and potential downsides in stock investment options. Remember, no investment is free of risk; especially with stock options. Understanding that is crucial before investing. Look for trends showing consistent profits. This can indicate that a certain investment will fare well and lead you to successful outcomes with your stock investment options.

Be aware of recent regulatory changes. Stock investment options might be subject to them; be ready for sudden shifts! Understanding these shifts lets you choose safer investments related to stock options and potential returns from your stocks. Look ahead for positive and negative patterns for long-term success in your stock investment options.

Stock Investment Options and Diversification

Diversifying your stock investment options is a powerful risk-management technique. It protects you if one stock investment option struggles; this often helps even the numbers, but sometimes can be more complex with diverse stock investment options. Diversifying means investing in various categories of companies. Look at how each category of stock performs and adjust if needed with different stock investment options.

Diversification, as the term implies, helps lessen potential losses when one area underperforms with stock investment options. This is a necessary move with most options. Look for trends where stock investment options perform exceptionally well in diverse environments.

Strategies for Diversification of Stock Investment Options:

- Different sectors

- International stocks

- Various stock investment options within these

- Market-cap weights

Diversification with stock investment options can improve overall returns and lower portfolio volatility. Aiming for consistent growth from various sectors within stock investment options is desirable, but can also add complexities.

Diversify across market caps—large-cap, mid-cap, and small-cap—and sector, with stock investment options, because they often perform differently. Don't pick based only on high returns. Analyze overall market performance as it impacts each category of stock options. Analyze for overall long-term trends of stock options.

Think carefully when considering different stock options! Avoid too-small selections for diversification! Large stocks, though potentially less volatile, provide some stock investment options which might perform best, if their categories perform better overall. With good stock options diversifying, you increase your chances of avoiding the negative outcomes and maximize your returns over time when used in different contexts. Different stock investment options can deliver high returns if chosen right, this demands effort in researching suitable stock investment options.

Understanding Stock Investment Options Fees

Investment fees related to stock options are not just some added charges; they impact total returns. Many stock options have multiple fees. A clear understanding is important to prevent surprising hits. A simple calculator can make estimations related to stock options, helping to assess potential losses due to stock options fees and manage expectations. Fees associated with your stock investment options directly influence the amount you keep. Keep in mind different fees!

The Different Fees Connected with Stock Investment Options

- Brokerage commissions

- Management fees

- Taxes

- Trading fees

Know each expense connected to stock investment options fees for proper budget planning. These costs reduce profits from your options choices. Stock options related fees influence success in terms of both short-term and long-term profits and losses from these investments! Calculating fees helps ensure sufficient funds to reach financial goals with stock options; remember fees connected with options. Stock investment options always have hidden expenses, sometimes overlooked, if you analyze everything carefully, you can control the fees for stock investment options! Understanding how stock investment options fees are calculated, allows for managing finances effectively.

Fees affect investment return with stock investment options and therefore should be fully understood by everyone choosing to invest with options. Always consider the real-life expenses for different stock investment options; be proactive in determining related costs associated with any choices made with stock options and investment options.

Benefits of Stock Investment Options

The most visible advantage is the opportunity for potentially high returns—if you do it correctly and analyze properly the stock investment options you choose. Growth potential in stock investment options is attractive and appealing.

Key benefits of investing in stock investment options include potential long-term growth, the diversity stock options have and participation in the prosperity of different businesses via stock investments. Diversification within your strategy allows one to access diverse economic categories with these stock investment options. Some stock options have potential long-term profit opportunities, especially in high-growth sectors. This may mean you are actively part of different areas. Your stock options might change sectors to profit if this appears to be an option that will yield high profits and benefit you greatly.

Factors Driving the Attractive Benefits:

- Profit Potential

- Influence on businesses (sometimes in sectors you previously were not part of)

Evaluating a suitable investment in terms of your desired portfolio involves more than simply returns with these stock investment options, your risk tolerance, current finances, future plans, and financial responsibilities will need to be examined with stock investment options, making well-rounded and informed investment decisions regarding your goals.

Stock investment options involve different benefits in many ways, including increased net worth if managed carefully! Be aware, in reality there is a level of danger with different stock options you could use! Stock investment options are meant to make gains over time. The market does fluctuate. The fluctuations present in many categories and choices are inevitable with many stock investment options.

Exploring Stock Investment Options for Different Goals

Understanding your financial goals before starting stock investment options choices will aid in making more sound judgments; when choosing options it is helpful to make sure your selections and financial decisions work effectively toward a well defined goal, while simultaneously taking risk tolerance in the same proportion into account. Personal investment objectives for stock options must align with stock option selections made.

Types of Goals Supported by Stock Options

- Retirement planning

- College fund for a child

- Investment accumulation over time

- Specific major life milestones

Investing for various personal milestones, such as down-payments or financial growth of assets should ideally, not solely consider expected returns. Carefully analyze the suitability of the option or stock selection based on personal, financial and specific, stock investment goals. This way, investors ensure effective use of their capital and investments align appropriately for your choices, goals and personal investment objectives for stock options in mind. A detailed evaluation ensures realistic estimations when choosing stock investment options. This should also lead investors to feel confident. Stock investment options may potentially suit some types of portfolios better than others. Carefully choosing an appropriate strategy when dealing with investment portfolios or choices for investments, regarding stocks is key to success with options in various markets and circumstances.

How to Get Started with Stock Investment Options

Stock investment options are a popular way to build wealth. Getting started involves a few key steps. First, understand the basics of stock investment options, research different companies and markets, choose your strategy and set a budget for your investment goals. Learning about stock market indexes is key for proper risk assessment with stock investment options. Your research into stock investment options should examine historical trends and economic indicators to determine which sector may provide the greatest chance for growth. The more information gathered, the more reliable investment decisions will be possible. Understanding how stock prices fluctuate and various market factors like inflation can be useful, leading to confident choices regarding your stock investment options. Do some paper trading to get hands-on experience.

- Research: Deep dive into stock market knowledge. Explore historical data, understand trends. Assess risk factors when investing.

- Set Goals: Decide why you are interested in investing, short-term or long-term. Understand your goals with stock investment options, be realistic about the time it will take.

- Build a Budget: Allocate a specific amount you can invest comfortably and manage losses to increase profits with your stock investment options. Avoid making impulsive choices based on market volatility.

Learning how to approach different types of stock investment options are vital. Your knowledge, understanding and willingness to keep educating yourself with your chosen options are key factors in growing your portfolio, leading to long-term success. Be diligent with researching stock investment options and set realistic expectations. Be ready to adjust strategies if conditions change or with different types of stock investment options. Make well-informed, thought out choices to give yourself an upper hand with your chosen stock investment options. Consider the time horizon for your stock investment options.

Tips for Choosing the Right Stock Investment Options

Source: chakorventures.com

Several factors come into play when deciding which stock investment options to invest in. Start by studying individual companies. What makes them special? Their products, or services may show promise or give a boost for future earnings and profit in your chosen stock investment options. Are there upcoming significant projects that impact earnings? How stable is their business model when considering stock investment options? Be thorough, analyze thoroughly all that's included with various stock investment options, and use multiple resources. You should identify and research your needs concerning different stock investment options, as many of them present differing investment types with different rewards, and pitfalls.

- Analyze financial performance: Previous and expected earnings are vital for assessing potential gains or pitfalls when examining your stock investment options. Compare company results to their sector averages and competitor performance when picking stock investment options.

- Evaluate industry trends: A dynamic industry can often make or break profits for those interested in stock investment options. Examine the specific business environments of possible candidates for the portfolio for the various stock investment options, looking for clear directions and opportunities when investing. Consider your goals for each stock investment options, understand which ones can contribute. Evaluate and carefully consider market and company trends and stock market outlook when considering any particular option within stock investment options.

- Consider your investment risk tolerance: Every stock investment option has different potential downsides. Consider factors in picking appropriate options. Identify stock investment options suitable for your long term financial well-being, to mitigate investment risk and protect wealth gains with well thought stock investment options. If the stock investment option sounds high risk, step away, as profits can rapidly dwindle and disappear. Carefully select. Don't gamble. Know your limitations in choosing your appropriate stock investment options.

Essential Questions to Ask Before Investing in Stock Investment Options

Making sound decisions when selecting and employing stock investment options, requires thoughtful inquiries. How stable is the investment option regarding future performance? Don't get influenced by quick wins; this isn't a race, consider your patience. Before investing in a particular option, know its risks and rewards. How frequently do these fluctuate? Will the chosen option generate sustainable and predictable profits and return within your timeframe, particularly for those long-term stock investment options? Do your homework to properly manage the selected options under consideration for stock investment options.

- What are the potential returns? Don't just chase high-yielding investments.

- What are the risks involved? The nature of stock investment options includes risks. Learn to identify them, avoid overly optimistic assumptions when evaluating various options. Research fully, consider thoroughly each stock investment option you look at before deciding, to mitigate risk as much as possible in relation to your chosen stock investment option.

- What is the company's financial health? Assess performance with different and realistic expectations for different time periods for a variety of stock investment options, such as quarterly, yearly or long term forecasts when looking at prospective investment options for any stock.

- What is the long-term outlook for the industry? How are similar ventures doing? Is it expected to expand or contract in the coming time periods for stock investment options? A deep dive into different businesses allows for more insight in selecting the correct investment choices from various options.

- Can I afford the potential losses? A deep study is key when examining diverse options. You should consider risks when committing to different stock investment options. Research each before investing and understand their unique potentials to give an educated insight into stock investment options

:max_bytes(150000):strip_icc()/Option-fe0c0ee9204c4a50a281e728fb4c7cab-c571c7af929e4b8587c5a28ad9905f53.jpg)

Source: investopedia.com

Stock Investment Options: Short-term vs. Long-term Investing

Choosing the right timeframe with stock investment options depends on personal needs. Short-term stock investment options often prioritize high volatility or profits for stock investment options. Evaluate various methods of short-term stock investment options with potential benefits in mind for choosing particular investments. Compare it to other potential options to decide on your choice of stock investment options. Your choices can result in potential high earnings; these also include significant risks and dangers when considering options in short-term investing with stock investment options. You will encounter market fluctuations often and you may incur significant losses if market declines occur with your stock investment options strategy. The market changes quickly; you need to watch these shifts to avoid huge losses if you select the wrong options.

Long-term stock investment options are typically linked to less riskier opportunities, seeking a smooth growth with stock investment options. Focus on consistent results and sustained success.

Short-Term: Higher risk, potential higher returns in a shorter period of time. Focus on market fluctuations and specific news within the chosen investment options for stock investment. Expect daily adjustments.

Long-Term: Lower risk, gradual increase, focus on sustained returns in time. Aim for diversified investment choices with strong foundations. A great way to grow investments in a steady way, that allows patience and consistent results, within the stock investment options available. Consider stock market volatility when thinking about this approach.

Stock Investment Options and Portfolio Management

Creating a good stock portfolio needs strategic planning for managing stock investment options. Create a balance within different asset classes with diverse stock investment options. Your choices need to reflect your tolerance to risk, ensuring appropriate portfolio allocations within a broader investment framework, and examining your different stock investment options carefully. Understanding your investing strategy from start to finish and its benefits or disadvantages is critical when handling various stock investment options. Different time periods demand varying approaches with your stock investment options, with some adjustments required with changes in strategy for stock investment options over longer time spans.

Diversify across different market segments.

Be ready to modify investment strategy if needed when looking at the best stock investment options and choosing specific types of stock investments, especially when unexpected circumstances occur. Be watchful for trends or other influences which might drastically change your decisions. Monitor investments and markets constantly. You are managing stock investment options in the markets. Your choices will help develop well-considered and informed decisions that fit with your time horizons. Ensure these chosen strategies of stock investment options remain beneficial. Review performance periodically and readjust accordingly when examining investment outcomes for your stock investment options and overall portfolio management for those investments. Don't hold onto stock investment options indefinitely. A consistent evaluation and review of your overall performance is recommended when you utilize various stock investment options and when constructing and managing portfolios. This may sometimes include making difficult decisions but ensures sustainability within stock investment options. Stock portfolio management for various stock investment options depends heavily on continuous monitoring and evaluation of diverse stock investment option types.

Stock Investment Options: Comparing Platforms

Stock investment options offer diverse platforms, each with unique strengths and weaknesses. Understanding these options is crucial for any investor. Different platforms cater to varying needs, from basic investors to experienced traders. Compare available platforms based on factors like fees, available tools, research resources and customer service. Compare stock investment options carefully. Accessibility matters. Ease of use should also be key.

Analyzing Stock Investment Options Performance

Performance is a vital aspect when choosing stock investment options. Analyze the past performance history of various stock investment options, comparing their returns. Study performance metrics for different periods (weeks, months, years) to understand trends, especially before taking a major position in the investment world.

Key metrics include:

- Average returns

- Risk metrics

- Market share data

Tracking performance trends will allow better risk management with stock investment options. Be ready to make changes accordingly as markets evolve, keeping an eagle eye on their performance.

Tracking Your Stock Investment Options

Maintaining a diligent track of stock investment options involves more than just looking at profit. The real deal is constantly reviewing stock investment options, examining current valuations.

Track using:

- Dedicated spreadsheets

- Charting platforms

- Investment management tools

- Daily reviews

Thorough, frequent tracking of stock investment options can prevent missed opportunities. Staying in tune and alert to price changes in your stock investment options, and more, will give your trading skills an upper edge and enhance profit forecasts.

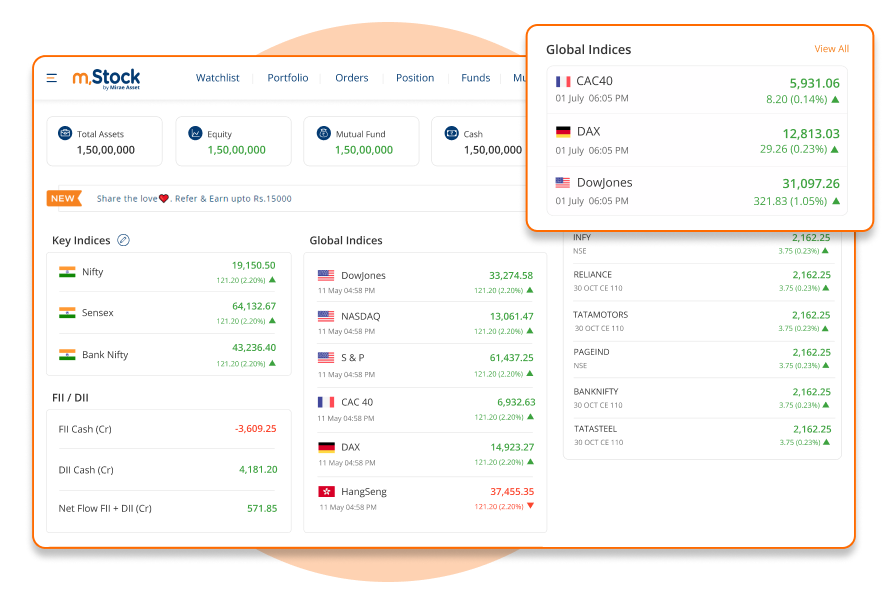

Source: mstock.com

Protecting Your Stock Investment Options

Protecting stock investment options requires strong vigilance. Understand potential risks (market volatility). Secure and safe transactions should also be prioritized with the use of strong passwords and encryption systems. Review trading statements regularly, keeping track of stock investment options, for security. Stay abreast of changes in regulation related to your chosen stock investment options to maintain a safe stance.

Stock Investment Options and Tax Implications

Understanding tax implications when you engage with stock investment options is critical. Consult tax advisors or research online tools for specific guidance. Tax implications differ significantly by stock investment option, making detailed research mandatory. Tax rules around stock investment options often include, but aren't limited to:

- Capital gains/losses

- Dividends

- Brokerage fees

Research each stock investment option’s tax implications. Paying the right taxes, and promptly at that, in conjunction with your stock investment options, will keep you ahead. Thoroughness matters. Staying informed of recent tax updates surrounding your specific stock investment options will help your long-term growth.