Stocks After Hours: A Quick Overview

Stocks after hours trading is a vital aspect of the market. Understanding the nuances of Stocks after hours trading is key to making informed decisions. Stocks after hours offer a different outlook, impacting many factors. Stocks after hours, unlike regular market hours, provides distinct avenues for trading.

What are Stocks After Hours?

Stocks after hours are, simply put, trading sessions outside the usual hours of the official market. This gives you more hours for your Stocks after hours decisions. A period where stock prices can move dramatically due to various market forces and outside news. The specifics of hours and dates differ based on the region or marketplace, crucial information for participating.

Why is Stock Trading After Hours Important?

This phase isn't about the quantity traded, it is crucial to analyze and react to important financial developments happening during non-market hours, news affecting the market greatly impacting Stocks after hours trading activities. These developments include press releases, corporate announcements, and economic reports. This can profoundly influence pricing, a valuable asset during Stocks after hours. Stocks after hours activity gives vital clues to upcoming developments and sentiment, a window to view real trends.

What are the Different Ways to Trade Stocks After Hours?

Several avenues exist for trading Stocks after hours, such as trading platforms, and different investment types affect choices in Stocks after hours trading. Understanding available tools is necessary for the right investment choices and suitable trades. Individual trading is a huge part of Stocks after hours. Your investment firm often holds specific parameters that may dictate the exact actions of your account. Different brokers offer different options, a key fact about participating.

Common Factors Influencing Stocks After Hours

Source: cnbcfm.com

Several key factors directly influence Stocks after hours prices and market activities.

- News Releases: This is often a major determinant. Significant news impacting the sector or the specific stock or overall markets usually influence how the Shares of stocks after hours are traded.

- Analyst Reports: Key market analysis directly affects trading trends and activity in the Stocks after hours.

- Earnings Announcements: Earnings results usually are major market influences; Stocks after hours sees heightened activity before these reports come out. A key insight into stocks performance, a valuable indicator to those using stocks after hours.

- Economic Indicators: Big economic developments influence the entire marketplace, leading to crucial Stock after hours trading decisions. This impacts many financial markets around the world.

Overall, understanding and utilizing the nuances of Stocks after hours trading is crucial for today's investor to fully understand the broader scope of the financial market. Every action taken in Stocks after hours holds potential, influenced by market sentiments, market performance and other elements involved in the activity of Stock after hours markets, all needing consideration to succeed within that particular space, Stocks after hours. A vital element for active investors. Stocks after hours provide access to this market sentiment in significant, actionable ways. These various types of trades available influence how the markets and specific companies do well. Knowing these differences within Stocks after hours market trends greatly assists making better, more suitable choices. A considerable asset for market-focused investors.

Top 5 After-Hours Stock Trading Strategies

Stocks after hours trading presents unique opportunities, but also risks. Mastering the right strategies is crucial for success. Here are five tried-and-true strategies, born from my years of intense stock analysis.

-

News-Driven Trading: Proactively tracking the most important news is a must. Major market movement happens when news hits. Watch crucial announcements, company results, market indexes; any such events may change Stocks after hours' sentiment drastically.

-

Technical Analysis Focus: Use charts to evaluate technical indicators. Watch volume, momentum, key support and resistance levels and how Stocks after hours react.

-

Order Flow Awareness: Understanding how market participants place orders can yield profit opportunities during Stocks after hours activity. Observe changes in order volume and see if this change has an impact.

-

Earnings Season Sensitivity: This time period creates strong Stock after hours momentum. Evaluate upcoming company results; adjust Stocks after hours investment strategies accordingly, by following their trends for stocks after hours.

-

High-Frequency Trading: Leveraging automated systems for Stock after hours is quite effective. Stocks after hours opportunities require sharp eyes and very fast responses for accurate reactions to new events, as trading happens exceptionally quickly.

7 Key Reasons for Stock Activity After Hours

Stocks after hours' behavior is intriguing, driven by several reasons.

-

Market Reaction to News: Overnight news developments are significant; stocks after hours respond instantly. Major announcements are reflected by how quickly investors adjust during Stocks after hours trades.

-

Earnings Releases: Huge impact on Stock after hours price swings. Traders and investors need a look at reported numbers and interpret trends for stocks after hours.

-

Global Events Influence: International or global political/economic events frequently make the markets move, impacting Stocks after hours' prices directly. Stocks after hours are usually very reactive to news regarding political or global economic circumstances,

-

Institutional Investor Activity: Major players, such as large asset managers or mutual funds make their moves impacting stocks after hours heavily; their trades alter market sentiment, triggering shifts in Stocks after hours trends.

-

Sentiment Changes: Changes in general mood regarding investments alter how the markets respond after the official markets close, leading to Stock after hours price shifts, including high frequency traders actions.

-

Analyst Reports/Forecasts: Analysis by industry experts can drastically affect investors and traders outlook toward stocks after hours and make prices change in Stock after hours trading hours.

-

Speculative Trades: Investors' anticipations of market changes lead to price fluctuations and impact how Stocks after hours prices are reacted to by different buyers.

The Impact of News on Stocks After Hours

Major news significantly alters the Stocks after hours climate. Even a tiny tidbit from the headlines might cause ripples and big swings for certain Stocks after hours, sometimes for an extremely long time. Negative information can be much more influential in this period.

Positive news about company strategy can attract huge demand; that influences the direction of stock market movements. Major international news also dramatically shifts Stocks after hours market prices and traders should be extra alert during these situations.

Essential Tools for Analyzing Stocks After Hours

Source: speedtrader.com

To succeed in analyzing Stock after hours, the correct instruments and methods are vital.

-

Real-Time Stock Quotes: Monitoring live Stock after hours prices, ensuring up-to-date info about Stocks after hours behavior and changes.

-

Technical Charting Platforms: Help you gauge price movements and trading volumes for better Stock after hours market assessments.

-

Financial News Aggregators: Keep up with breaking headlines for critical Stock after hours market news or trends. This information gives clues about upcoming prices for various Stocks after hours.

-

Fundamental Analysis Resources: Evaluate the company's strengths and potential risks before Stocks after hours activity. Knowing about a company's background can guide analysis when trading in Stock after hours markets.

-

Order Book Insights: Understanding trading interest and the buying/selling dynamics can reveal important information affecting Stock after hours.

Potential Risks and Pitfalls in After-Hours Trading

Stocks after hours trading involves inherent perils; traders need to be ready for them.

-

Lack of Liquidity: Lower volume compared to standard market hours raises substantial liquidity risks for Stocks after hours trading. Small changes can dramatically alter how Stocks after hours prices are affected.

-

News-Driven Volatility: Stocks after hours prices react swiftly to significant news; this sudden volatility often requires an extra awareness from the trader in anticipation of stocks after hours activity.

-

Missed Opportunities/Unforeseen Price Action: Some Stock after hours's trends are really unexpected and hard to track for beginners. Quick price swings may lead to missing out on profitable chances; experienced traders adapt quicker for potential Stock after hours deals, though even professionals can miss unexpected price action.

-

Analyst Opinion Discrepancy: A difference in viewpoints on analysts may result in wrong decision for stocks after hours analysis; making Stocks after hours investors and traders susceptible to unexpected outcomes due to varied interpretations of trends in Stocks after hours.

-

High-Frequency Trading Competition: Stocks after hours often face a lot of algorithmic trading activity, impacting both chances to buy Stocks after hours and how well an algorithm can make profit in a competitive environment.

Source: scanz.com

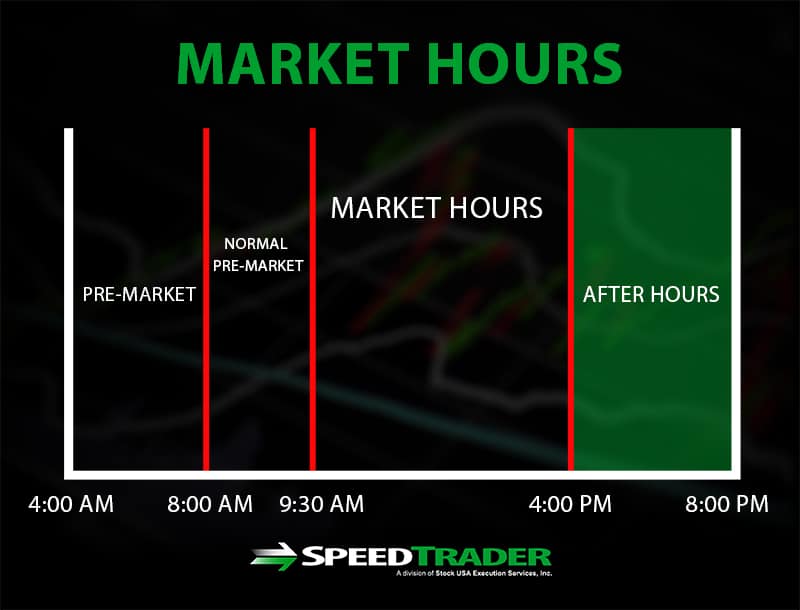

Understanding After-Hours Stock Trading Hours

Stocks after hours trading, a dynamic realm beyond the typical market hours, presents unique characteristics. It's a period for subtle price adjustments, a different game compared to regular trading sessions. This time window influences traders, demands particular attention. Understanding this distinct part of the market helps navigate its complexities and opportunities. After-hours stocks trading operates with different rules, influencing individual stocks and investors alike.

Knowing after-hours trading hours is fundamental. These specific hours are set. It is often distinct from the regular session times, requiring research for each particular marketplace. Knowing these precise times avoids mistakes during trades in stocks after hours. Be vigilant – hours for stocks after hours trading differ across exchanges and marketplaces. Be aware; times can vary greatly. Precise scheduling is key, preventing losses due to poor timing. This unique time frame is key in this special area of the stocks after hours trading realm.

Best Practices for Stocks After Hours Trading

Executing trades during stocks after hours requires precision. Several best practices elevate chances of success and profits.

Prioritize strong research. Detailed information on individual stocks after hours should be your foundation, ensuring investments are based on concrete, verified facts and forecasts. Evaluate patterns before engaging. Examining price movements before investing is imperative. Research before engaging in any trades involving stocks after hours. Look at previous prices, trends in recent hours to prepare for stocks after hours trades. Check fundamental analysis for additional inputs into stocks after hours.

Carefully evaluate liquidity – the ability to buy and sell stocks after hours. Reduced liquidity leads to greater price volatility in stocks after hours. If liquidity is uncertain, a trader in stocks after hours can run the risk of bad outcomes in the after-hours stock trading arena. Assess your own financial risk tolerance – no single investment suits everyone; assess this, whether regarding individual stocks or after-hour activity, or any aspect of stocks after hours trades. Consider all factors that matter.

Risks Associated with After-Hours Stock Trading

After-hours stock trading comes with a significant set of risks. The market often experiences significant shifts and fluctuations. The volatility of stocks after hours markets is unpredictable. Factors not influencing the market during standard session times frequently play significant roles in stocks after hours.

Liquidity issues are prevalent during stocks after hours trading sessions. A surprising volume of transactions occur during stocks after hours, potentially disrupting normal trading activity. High volatility in stocks after hours can trigger unexpected market changes. These unexpected events in the market, not just stocks after hours, are often unpredictable and sometimes cause massive problems in individual investor portfolios. Many experienced traders use alternative approaches to mitigating or avoiding risks in the stock market in general and in stocks after hours in particular. Always consider risks in the stock market in the case of any specific after hours stock trades.

Factors Affecting the Price of Stocks After Hours

Several dynamic factors shape the prices of stocks after hours. Market sentiment and investor psychology significantly alter the price during the stocks after hours window. News updates, events or economic trends in the time after standard trading, or even during the day often significantly impact prices for stocks after hours.

These influences often play significant parts in the movements of stock prices during the trading after-hours session. These unpredictable moments often cause sudden swings in stocks after hours pricing. Volatility, due to varying events, presents uncertainty regarding stocks after hours investment options. Other influences of stocks after hours on the pricing include individual company-specific developments (updates), announcements from companies (stock issuers).

Is it Profitable to Trade Stocks After Hours?

Profits in stocks after hours aren't guaranteed. While possibilities exist, profits aren't assured in any trade arena including after-hour sessions for stocks. Profitability in stocks after hours heavily depends on an investor’s skill, research, understanding of the market forces affecting individual stocks during these trading windows, as well as timeliness and a degree of luck. Trading stocks after hours isn't for the faint of heart! Consider risks. Some studies show that the rate of success of these strategies can be fairly high, in certain special stocks and certain cases. This makes it an interesting niche market to dive into if prepared and with care. This isn’t magic; hard work and expertise help achieve better returns. Stocks after hours, even with these favorable numbers in your research for individual stocks during trading hours after hours, often don't ensure profits in a stable, consistent, or automatic manner. Individual risks depend on various aspects of any trade. Many successful traders find a consistent approach within a market niche successful for after-hours trades. Remember that not all trades with stocks after hours guarantee profits, a consistent part of the stocks after hours market. Thorough preparation and a realistic approach to success are needed. Some strategies in the field of stocks after hours trading do have solid evidence of a greater profit potential when approached carefully.

Comparing After-Hours Trading to Regular Sessions

Stocks after hours have a different rhythm. The volume and price actions for stocks after hours significantly deviate from the day session. The atmosphere is drastically dissimilar. Understanding this shift is crucial for investors and traders who follow Stocks after hours. The patterns of stocks after hours differ immensely.

Key differences include:

- Reduced Liquidity: After hours liquidity dwindles significantly, this impact on Stocks after hours price discovery is important to note.

- Smaller Order Sizes: Trades often are smaller, influencing how quickly prices adjust during Stocks after hours.

- Lower Volume: Significant volume reduction reflects trading's calmer pace during stocks after hours.

- Increased Volatility in Certain Cases: Unexpected news can create spikes or significant drops in stocks after hours' values.

Different rules apply for Stocks after hours. Understanding the after-hours behavior helps in forming more reliable judgments about stocks. The volume can sometimes rise unexpectedly during Stocks after hours and fall in others, impacting traders and investors. Analyzing the patterns helps forecast and prepare for Stocks after hours events.

5 Key Differences Between Day Trading and After-Hours Trading

After-hours trading differs significantly from the day session. Stocks after hours activity displays key variations:

-

Liquidity: Day trading enjoys much higher liquidity. Stocks after hours have reduced trading volumes.

-

Order Types: Orders are frequently less substantial and numerous during Stocks after hours trading sessions, leading to slower price adjustments.

-

Volatility: News and rumors, absent during day sessions, play a major role in driving fluctuations in Stocks after hours, and the speed in which this can occur.

-

Market Sentiment: Stocks after hours' patterns, particularly influenced by overnight news, give insight into emerging investor emotions. Interpreting these patterns is part of understanding Stocks after hours.

-

Trading Environment: The presence or absence of a full team of traders to impact Stocks after hours makes significant differences in the rhythm and trajectory.

How Volatility Affects Stocks After Hours

Extreme changes in Stocks after hours price can occur because of limited trading participation. The behavior of stocks after hours reflects their reaction to evolving scenarios.

High volatility usually signals uncertainty or significant news in Stocks after hours trading that might not have been anticipated. Analyzing stocks after hours price movement needs special scrutiny because market impact varies, influenced by volume and liquidity at times. This aspect needs consistent observation during Stocks after hours for accurate judgment.

Stocks after hours have moments of increased or decreased volatility. Understanding patterns and characteristics will aid evaluation. Tracking stocks after hours allows seeing fluctuations better than the day. Stocks after hours prices have varied impacts during periods of instability, a trader needs to account for that with their trading approach for stocks after hours.

Evaluating Market Sentiment After Hours

Examining how markets respond in stocks after hours shows evolving sentiments about a stock. Stocks after hours behavior presents clues, a keen observer can decipher these trends by paying close attention to patterns of trading during Stocks after hours.

Changes in volume during stocks after hours are helpful in detecting this dynamic market emotion that sometimes precedes trends. The impact on stocks after hours is usually an early indication.

Consider this: After-hour movement offers early indications for the opening session for a particular Stock and offers some insightful glimpses on Stocks after hours market outlook. Evaluating the overall tone helps identify possible market outlooks reflected in stock activity and sentiment expressed after hours.

Tools for Monitoring After-Hours Stock Activity

Tracking stocks after hours necessitates reliable tools. Observing stocks after hours can offer unique benefits that day session data fails to capture. Tools used often include online charting software or websites, designed specifically for Stocks after hours data, capable of handling complex trading and displaying useful real-time info, all geared towards successful monitoring.

Finding tools to monitor stocks after hours accurately is key to successful decision-making during Stocks after hours periods. Choose tools carefully to ensure quality. Use features for technical indicators. Pay attention to alerts and updates of stocks after hours as those are very significant features when evaluating market activity and price fluctuations on a stock and assessing the Stocks after hours trading outlook. Stocks after hours trends require specific toolsets designed for observing after-hour activities, allowing proper decision-making processes, crucial for understanding Stocks after hours dynamics.

Source: warriortrading.com

How to Start Investing in Stocks After Hours

Stocks after hours trading is a world apart from the regular market. Understanding these nuances is key to success. Stocks after hours have unique characteristics, significantly affecting your strategy. Starting with the basics of Stocks after hours investing is paramount for any aspiring trader. Getting a grip on Stocks after hours strategies, a few good resources on Stocks after hours trading and dedication will set the base.

Getting Started with After-Hours Stock Trading Platforms

Choose platforms with strong performance records. Experience is everything. Reviews matter more than slick ads. Don't let hype deceive you. Reliable Platforms are vital for successful Stocks after hours investing.

Security is the top priority. Ensure that any platform selected is vetted by trusted bodies for reliable Stocks after hours service. Transparency is your ally. See if data provided matches the current real-time, high-speed Stocks after hours data to help your trades and strategies.

Consider commission structure, especially since there's additional pressure in the unconventional environment of Stocks after hours. Platform costs vary widely and impact profitability. Explore your available options thoroughly when selecting a Stocks after hours platform for trading.

Tips for Success in After-Hours Stock Trading

Don't treat Stocks after hours trading like the daily trading sessions. Develop specific strategies designed around the unique dynamic of the extended trading hours. Thoroughly analyze fundamental news of company stocks and look into quarterly financials in Stocks after hours when there isn't any major movement. Understand the market sentiments within that time-period of Stocks after hours and use it as an opportunity for more in-depth analysis before going in full-blast during Stocks after hours. This could be valuable insight you could leverage within the Stocks after hours trading window.

Set clear objectives for each Stocks after hours trading session, much like in the conventional trading schedule. Don't take every opportunity to gamble. Risk and reward, with a proper analysis, should inform every transaction within the unconventional domain of Stocks after hours.

Staying calm under pressure in high-voltage trading environments is key to Stocks after hours success. Keep emotion out of decision-making during high-anxiety periods during Stocks after hours, this could determine your trade. Have contingency plans in place. Stocks after hours trading carries special considerations that require unique planning, think outside the usual playbook within the unusual trading environment of Stocks after hours.

Legal Considerations for Stocks After Hours

Understand regulations specific to Stocks after hours. Each jurisdiction has unique compliance aspects related to this market. These aspects need a grasp on specifics relevant to legal compliance in each region. Rules in trading Stocks after hours vary between markets. Each market, particularly in Stocks after hours, has specific trading guidelines. Consult local authorities for relevant guidelines related to your position when conducting stocks trading within the Stocks after hours marketplace. Avoid getting entangled with illegal activities within the murky arena of Stocks after hours and keep an eye out for hidden hazards.

Always seek advice from professionals. There might be a specific professional needed, check for their advice. Your approach should have full understanding of the market specifics associated with trading Stocks after hours to remain on the legal and regulatory side of the market. Compliance laws in Stock markets, particularly when considering Stocks after hours, can be tricky; seek the advice of professionals when dealing in these types of deals.

Be informed about any specific legal frameworks surrounding Stocks after hours trading in your location, and never hesitate to ask if you're uncertain. You must grasp the subtleties when interacting with market instruments that function under Stocks after hours. Don't overlook consulting trusted experts for a clearer understanding in complicated legal nuances. Stay current, comply with every Stocks after hours market mandate, regulations and legalities to make appropriate investments within Stocks after hours environment.

Risks and Rewards in Stocks After Hours Investing

Understanding risk in Stocks after hours is critical, just as important is analyzing reward prospects within the dynamic Stock after hours arena. Evaluate your position correctly based on Stocks after hours data when taking positions during that time of day to trade effectively in Stocks after hours trading environment. Recognize potential gaps in information when there aren't live market players. That is also important during Stocks after hours trading environment. Thoroughly assess the volatility and other unique considerations of Stocks after hours compared with day time trades. Volatility during after hours can vary greatly compared to during market hours. Stocks after hours offer potentially significant rewards if approached appropriately. Be aware that rewards vary in this non-typical trading arena of Stocks after hours. Risks in the niche Stocks after hours markets differ substantially when contrasted with the standard trading days. Research Stocks after hours trends. Don't treat the Stocks after hours as day trading market to invest. Do your homework regarding the risk versus reward prospects in your desired strategy within this dynamic Stocks after hours market. Learn from the experienced traders in the field of Stocks after hours.

Significant analysis should go into choosing which time to execute orders during this trading style within the unconventional market of Stocks after hours. Consider this period to evaluate your investments based on the real-time metrics gathered and evaluate your decision correctly before committing yourself and executing trades based on Stocks after hours. Make sure that your methodology for Stocks after hours fits the market and does not create gaps in your transactions in your investments when choosing Stocks after hours.