Federal Student Loan Repayment: Key Dates and Deadlines

Knowing your student finance payment dates is important to avoid trouble. Understanding the deadlines helps you plan better. Missed payments can hurt your credit. Let's look at federal loan repayment details.

What is the typical monthly payment due date?

Source: american.edu

Federal student loans (after July 2014) usually need payment on the 13th of each month. This is a significant detail for your budget. It's helpful to have this payment schedule in mind. Keep this in your financial calendar.

How long is the grace period for federal loans?

A grace period gives you six months after leaving school or lowering your course load. That time gives you time to get ready. You can usually use this six months to find a job. You’ll start repaying loans six months later if you didn’t need more time for example.

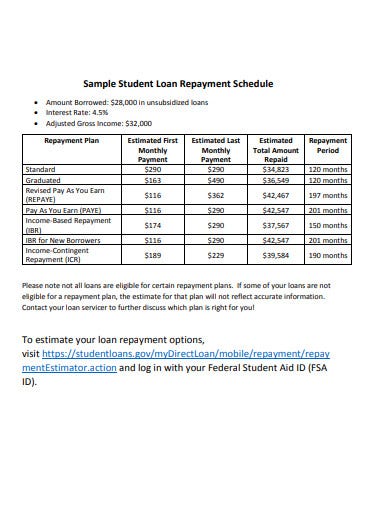

What repayment plan options are available?

There are three typical plans for federal student loans. They help you pay off loans better.

- Standard: 10 years. It's the most basic repayment time.

- Extended: Up to 25 years. For people who might need more time to pay back.

- Graduated: Starting low, paying more later. You pay a little more as time goes by.

How does the 10-year standard plan work?

The 10-year plan lets you repay loans gradually. Monthly payments stay similar, but you pay them back in 10 years total. That's an important thing to understand if you need 10 years or less time for repayment. A consistent repayment rate for a fixed time.

How long can extended repayment last?

The extended repayment option can cover up to 25 years. If you really need a lot more time, that’s available. You should think about all of the factors in order to see what's the best for you, such as if you expect a better income later in life.

When do graduated payments increase?

Graduated payment plans usually have smaller payments at the start, and increase later. Most start by increasing in about two years and more after that depending on terms. Keep this change in mind, for the long-term implications, and don’t feel stressed if they increase later in time.

Understanding the 6-Month Grace Period

The six-month grace period for student finance payment dates is a big deal for student loan borrowers. It's a chance to prepare before serious repayment starts. Let's explore the details of this student finance payment dates topic.

When does the grace period start?

The six-month period starts right after your studies. That includes when you finish, drop below part-time classes or graduate. It’s an important student finance payment dates aspect for all borrowers. This means you can work and plan before those first student finance payment dates show up.

How is half-time student status determined?

Half-time status depends on the classes you're taking. Different schools use a little different rules so check your schools details, but usually a half time schedule typically refers to some number of hours of credit per week that is officially part time at the institution. Each school and university determines the rules in these student finance payment dates situations, or other financial institutions associated with the education. You need to check the institution or school's policy regarding how many credit hours constitute a half-time student. The amount of credit hours needed to determine part time for different programs can vary greatly depending on the school or university involved and what level they provide for courses in specific subjects.

Can the grace period be extended?

Typically, the six months aren’t extendable in most cases for student finance payment dates. Your education institution and lenders, especially if part of a government agency, will likely not add additional time. Student finance payment dates are important.

Source: ytimg.com

How is the 6-month grace period calculated?

It starts at your last day of class. This is when you are considered no longer enrolled in the studies program at the education institution. Calculating it precisely will help you arrange and budget when the student finance payment dates will start coming in.

When does repayment begin after the grace period?

After your grace period ends, repayment of student loans often starts with a monthly due date for example, the 13th. Paying according to schedule can often minimize fees from finance services and your overall creditworthiness will remain sound and more appealing for future business matters or borrowing. If your payments show that you pay accurately and timely it should not affect future financial matters for new loans and borrowing

What happens if the grace period ends before employment?

If you don't get a job before your grace period ends, repayment of your student loans will need to start right away, meaning, without waiting, according to schedule. It may still require you to pay based on monthly schedules and the exact student finance payment dates and times as shown by your student loan issuer, which, as before, helps keep creditworthy details of you organized so future borrowing issues or other issues don't arise. Be sure to keep accurate track of your loan agreement and how it interacts with those schedules from any organization you are working with. Remember to contact your lender or financial organization to sort details and learn more if issues come up so you aren't caught off guard.

Comparing Federal Student Loan Repayment Plans: 10, 25, and Graduated Options

Understanding student loan repayment plans is super important for student finance payment dates. These plans affect how much you pay each month and over the life of the loan. Different plans have different numbers of years.

How long is the standard plan?

The standard repayment plan usually takes 10 years. This means you'll have monthly payments for ten years in total to repay all that you owe according to the agreement terms and associated schedules related to student finance payment dates and times.

What's the maximum length of extended repayment?

The extended repayment plan lets you pay back loans for up to 25 years. That gives you extra time. It's especially helpful for borrowers needing more time. The important thing to realize about student finance payment dates and the plan involved is that there are options that are associated with them to suit each personal need in budgeting.

How often do graduated payments increase?

Graduated payment plans usually have smaller payments at first. Payments gradually get bigger. Usually these payments increase around every 2 years on an associated timeline related to student finance payment dates. It works according to your student finance payment dates to manage and allocate a specific timeline for each.

When do lower initial graduated payments change?

Lower initial payments typically start increasing usually in the second year. This often happens with most financial instruments in student finance payment dates matters.

Are there eligibility criteria for the 25-year repayment plan?

Sometimes, there are rules for the 25-year plan. This specific plan isn't for everyone and specific eligibility must be met and verified in some situations in these matters about student finance payment dates for some borrowers. The extended plans are part of various student finance payment dates considerations. You need to confirm with a financial institution what criteria they are operating with when using those longer student finance payment dates plan options.

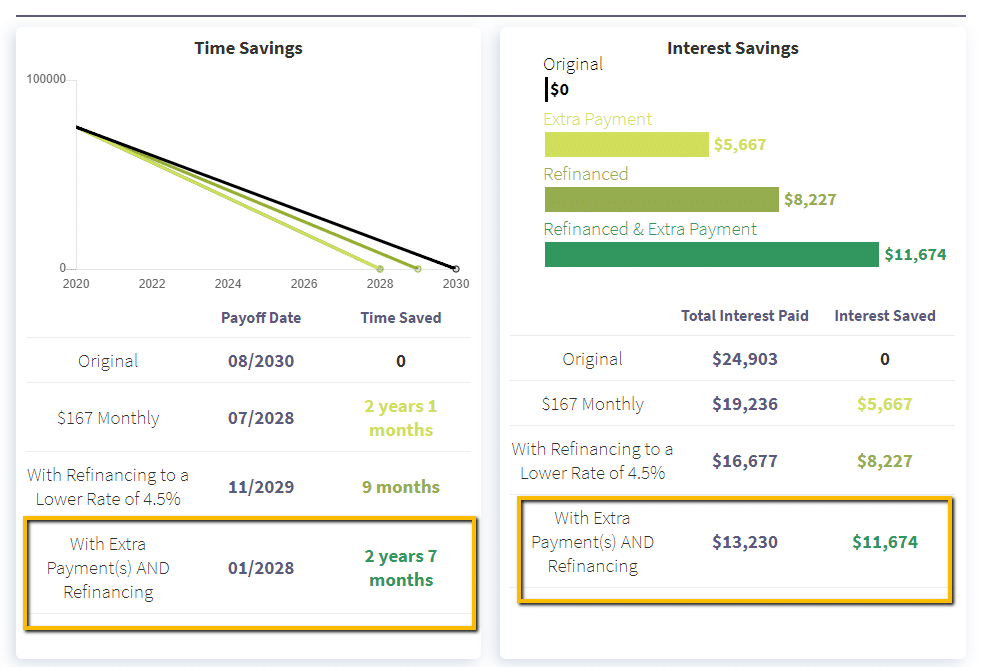

Can I switch repayment plans if needed?

Source: examples.com

Source: whitworth.edu

You might be able to change your repayment plan if needed for any reason related to the loan according to your situation related to the loan. In other situations this can’t be changed once decided upon due to factors related to the loan and payment arrangement details in terms of associated schedules of student finance payment dates and how the particular arrangements or other factors for individual lenders will be accounted for in changing plans. Talk to your loan provider for detailed info about any specific details and situations, such as student finance payment dates if that applies.

Managing Private Student Loan Repayment

Private student loans have different rules about student finance payment dates compared to federal loans. Understanding these rules helps you stay organized. Let's learn more about private student finance payment dates.

How do I find my private loan due dates?

To find your private student loan due dates, you must contact the company that gave you the loan directly. It's their information, not a general public record or common online reference in terms of student finance payment dates or timelines for this. This step is needed to correctly plan and prepare for individual circumstances and ensure proper payment methods or arrangements on time in order to keep a healthy credit profile that could affect future opportunities for credit.

Who should I contact for payment details?

You should talk directly to the private student loan lender for payment schedules and student finance payment dates and amounts due. They will know the details. Look for this important student finance payment dates info directly with the provider of the private loan as opposed to another source or company since their rules may differ and these important aspects differ and apply uniquely in each. You must take action in ensuring proper contact information or contact with an associate is established in order to stay compliant with policies about student finance payment dates, terms and payment arrangements so financial stability is preserved, and no difficulties occur at times about scheduled payments and student finance payment dates involved in a personal timeline that impacts how it interacts or applies for the payments.

Source: studentloanplanner.com

Do private loans offer grace periods?

Source: storyblok.com

Private student loans might, or might not, have grace periods. This means there might, or might not, be time before loan repayment. Look closely at the paperwork for any grace period about the loan and what applies when planning your student finance payment dates or timelines as required in personal terms for private loan borrowers, so those aspects are accounted for appropriately based on circumstances from each financial service provider of a private loan that's a party to the contract in terms.

Can private loan interest rates be fixed or variable?

Interest rates for private student loans can be fixed or change (variable). Check the loan documents to see which is correct about your loan since this will influence a proper plan when paying or arranging payments related to your individual and specific student finance payment dates for your loan, especially for the longer term in payments or terms related to payment. Ensure all of the rules are met with each repayment schedule and student finance payment dates. This should be considered when looking at the rules related to personal situations or unique private lender offerings related to repayment in total in order to have this accounted for and organized well, which has consequences or considerations if you want to make these arrangements and changes to repayment timelines later on in situations or circumstances requiring changes to student finance payment dates terms to consider.

Do repayment terms for private loans vary by lender?

Private loan terms will change by company since these can differ by lenders (and will have different rules in general related to your loan agreement and overall payment methods according to terms with different scheduled deadlines) in terms of student finance payment dates or overall timeline to consider these or other individual conditions. Private loan payment arrangements may differ by loan providers. Check the rules for your provider related to payment arrangements and what are acceptable timelines or periods associated for student finance payment dates involved, because you may not want to get out of agreement with those policies or terms for private loan lenders. This could affect situations if there is any need to change terms later, especially terms or schedules connected to payment deadlines about student finance payment dates and the payments.

What options exist if I struggle to make private loan payments?

Source: imgur.com

If you face trouble paying a private student loan, talk with your lender right away. This helps understand the possibilities related to making adjustments to those deadlines connected to student finance payment dates that could involve changes to payments in overall plans in repayment scenarios involving this sort of arrangement for a more workable budget to ensure better future prospects.

Consequences of Late or Missed Student Loan Payments

Missing student finance payment dates can cause real problems. Knowing the consequences helps you avoid trouble. Paying on time is very important.

What are the penalties for missed payments?

Missing student loan payments brings penalties, like late fees. Late fees are extra money you owe. Understanding your student finance payment dates and times and what is due on the schedules is critical for this aspect. Paying accurately when it's due keeps fees from occurring or from accruing or adding to overall debt for the situation at hand.

How do late payments impact my credit score?

Late student loan payments can lower your credit score. This can affect getting other loans, or getting things like an apartment. A good credit score shows good financial habits. Avoiding missed payments and paying when they are due are keys to maintain positive standing with financial organizations involved when managing those payment schedules and the important student finance payment dates involved for borrowing situations to keep an appealing credit profile for future opportunities.

Can late fees increase over time?

Yes, late fees for missed student finance payment dates might keep rising. That means it will cost you even more in fees over time for your overall total owed for payments to correct any issues related to paying past the established dates and timelines.

Will a history of late payments affect my future borrowing ability?

A history of missed student finance payment dates may affect future borrowing. If you have late payments often or persistently, lenders will be more likely to give you a negative score in future creditworthiness evaluations related to personal financial situations that could otherwise qualify you if your student finance payment dates were correct each time to avoid negative effects on your overall standing regarding other borrowings or lending situations.

How much damage can late payments inflict on my financial profile?

Late payments might negatively affect how banks or other financial services institutions see you financially overall. Understanding your payment history in overall arrangements or timelines involved regarding your specific student finance payment dates with financial arrangements or companies is vital to maintain creditworthiness, since those factors impact various prospects.

Where can I find resources to manage my payments effectively?

For support about student finance payment dates you should check with your student loan service company. If problems or concerns come up with the loan process you should talk directly with a loan agent about resolving problems with payment arrangements or the student finance payment dates or timelines being followed in those arrangements to stay well within a suitable compliance with agreements. They likely have free help tools. Using automatic payments is an additional measure you can explore and consider for helping avoid missed deadlines.

Key Takeaways: Essential Facts about Student Loan Repayment Dates

Knowing your student finance payment dates is important! This helps you plan. Understanding these facts about student finance payment dates makes repayment easier.

Where to find official information on federal loans?

For details on federal student loans, visit the official government website. That site has all the specifics on repayment and student finance payment dates for you. The important student finance payment dates you need to find should be on there, as well.

What's the typical due date for federal student loans?

Federal student loans (after July 2014) typically need payment on the 13th of each month. This is after the six-month grace period. It is critical to remember these payment schedules in student finance payment dates and timelines if you're looking at ways to correctly prepare and manage your personal finances when it comes to these matters.

How long is the federal loan grace period?

The grace period is six months for federal loans. This time is after leaving school, and you have that six-month period to look for jobs or other related financial work-related situations involved in that situation when planning or managing repayment time for loans in terms of deadlines associated or otherwise in the payment arrangements. Knowing those time aspects for student finance payment dates will make it clearer to manage student finances properly, such as with payment timelines, for individuals dealing with their particular issues with handling student loan repayment methods or agreements and student finance payment dates aspects involved in each.

What are the main federal loan repayment options?

Common federal loan repayment plans include 10-year, 25-year and graduated repayment. The different options vary in how monthly payments are set in time, considering that student finance payment dates are critical for determining an appropriate student loan plan to consider, in budgeting and scheduling to fit personal preferences about financial issues with that aspect. Each individual can then adjust those options, based on specific needs at each point of time if changes need to be considered later on based on what best fits their circumstances.

What's the key difference between 10-year and 25-year plans?

A 10-year plan typically has fixed payments each month, whereas a 25-year plan usually has lower payments. The main difference between 10-year and 25-year plans has to do with payment amounts rather than a longer period of payment deadlines overall if they need the different plans.

Why are on-time payments important?

Paying on time for student finance payment dates is very crucial for a healthy credit score. Also, if payments are not on time, late fees can arise, in particular instances in this process. Making on-time payments avoids those penalties and also protects credit standing that helps avoid negative consequences, that will affect credit scores or personal finances over time that could make accessing credit much more challenging for borrowers who fail to uphold good payment history for financial products and arrangements in paying or arranging for monthly repayments involving specific student finance payment dates.