Magnitude of Student Loan Debt

A staggering $1.7 trillion. That's the total student loan debt in the US, as of 2023. Wow. This number is a big deal, right? It affects many people. Let's explore the facts about student loan accounts.

What is the total student loan debt in the US?

Source: medium.com

The total amount of student loan accounts is a massive $1.7 trillion. This is a lot of money! It is quite a large number. Imagine trying to count that many dollars; it would take a very, very long time! It highlights a large financial burden for many.

How many Americans have student loans?

Source: uga.edu

Sixty-two point nine million Americans have student loan accounts. That's a huge number of people affected by this debt. It's a pretty significant portion of the population. It means many people are impacted by the weight of this financial obligation. Student loan accounts are a significant part of many Americans' lives.

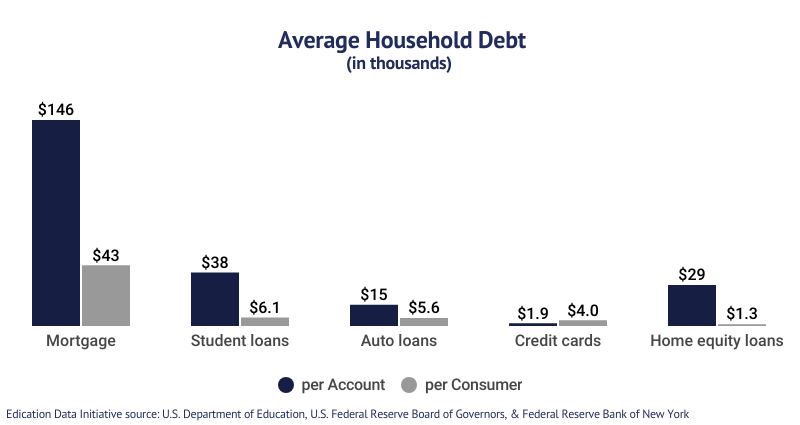

What's the average student loan balance?

The average student loan balance for those under 60 years old is $37,192. That's quite a chunk of money. Knowing this average balance helps give us an idea of the average individual debt. It's quite surprising. People are burdened by this financial commitment from their student loan accounts.

Key takeaways: Student loan accounts are a serious issue in America, affecting many people with massive sums. The average debt for young adults in particular is quite high.

Student Loan Delinquency and Default Rates

Source: pikbest.com

Knowing how many student loan accounts are in trouble is important. Let's look at the numbers related to delinquency and defaults on student loan accounts.

What's the current student loan delinquency rate?

In December 2022, the national student loan account delinquency rate was 11.5%. This means about 11.5% of all student loan accounts were behind on payments. This is a concerning number. It shows a sizable chunk of borrowers are struggling to keep up with their monthly student loan account payments. A high rate like this can create problems for everyone involved with the student loan accounts.

What's the student loan default rate?

Source: studyx.ai

Thirteen percent of borrowers default within the first year of repayment. That's a pretty significant percentage of people having difficulties repaying their student loan accounts, particularly right away after the first year. It suggests that many students face challenges getting their student loan accounts under control.

Student loan default rates over time

Unfortunately, we don't have specific data about student loan account default rates across time. It would be helpful to know how those rates have changed over the years, as that would offer better context for today's numbers.

Having historical data would show trends for future students and the possible effectiveness of new payment plans. We need information on how student loan account default rates have shifted across time to properly understand the severity and consistency of this financial burden for borrowers. It's a useful way to compare and contrast how issues related to student loan accounts have changed or have stayed consistent in past years.

Socioeconomic Impacts of Student Debt

Student loan accounts can have a big impact on people's lives and future plans. Let's look at how these student loan accounts affect different groups.

How does student debt affect women?

Women carry a huge part of the total student loan debt, making up about two-thirds of it. This shows how much women are affected by these student loan accounts. It's quite a burden on women. It highlights a possible imbalance related to student loan accounts.

Student loan debt disparity by race

Black college graduates usually owe about $25,000 more in student loan accounts than white graduates. This is a significant difference in the student loan accounts held by these groups. This shows that different groups may experience unequal outcomes when taking on student loan accounts. It shows a disparity.

Graduating debt-free: What are the odds?

Only 18% of bachelor's degree recipients in 2022 graduated debt-free. It means that the majority of students leave college owing money through student loan accounts. This shows a large problem. Many students aren't able to finish school without taking on student loan accounts.

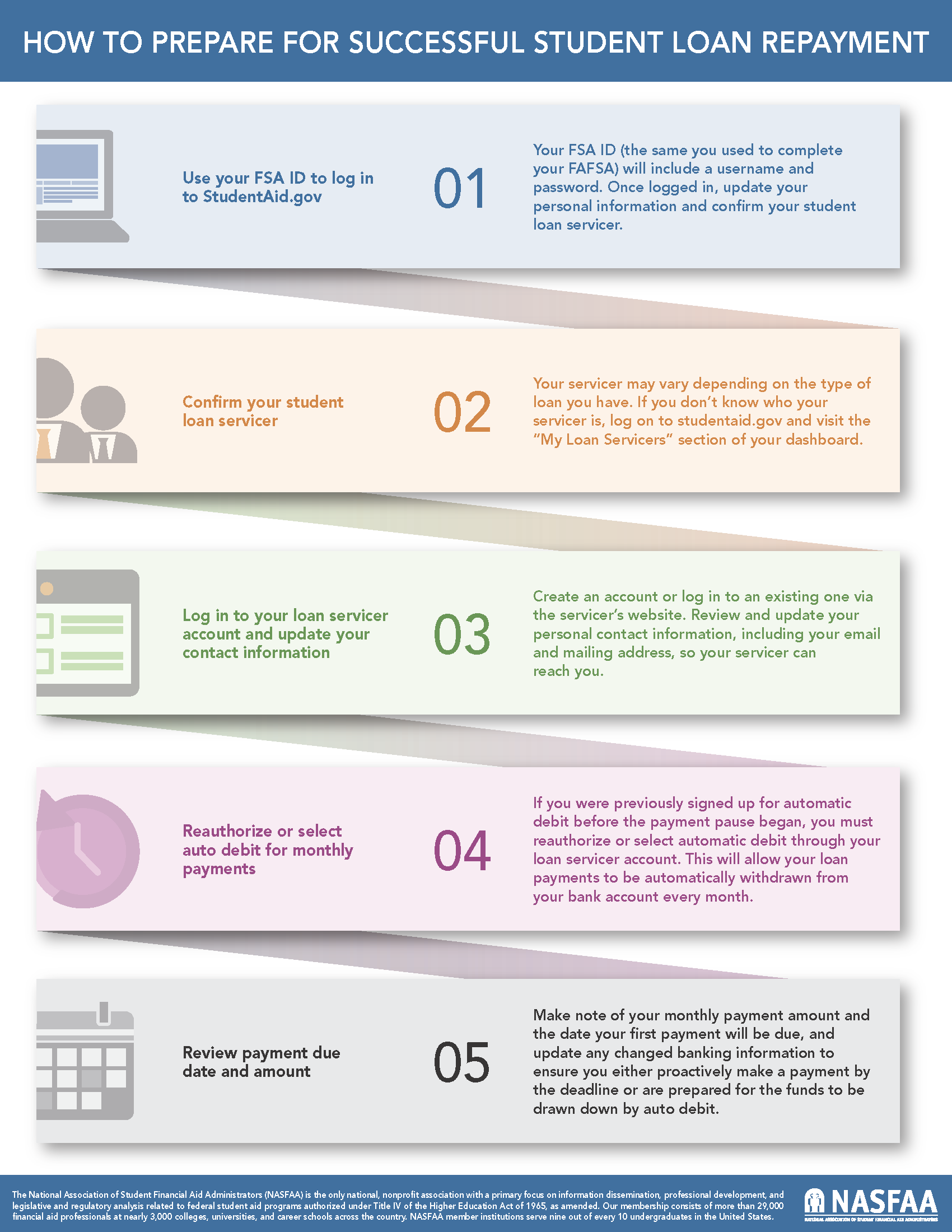

Challenges in Student Loan Repayment

Source: educationdata.org

Repaying student loan accounts can be tough. High costs and tricky rules make it hard for many. Let's see why student loan accounts can be such a challenge.

Why is student loan repayment so difficult?

High tuition costs and rising interest rates make student loan repayment difficult. Many student loan accounts have balances well into the tens of thousands of dollars, making the monthly payments a struggle. These student loan accounts are often difficult for new graduates to keep track of.

What are the common student loan balance and costs?

Unfortunately, specific numbers on the most common balances aren't available. But we do know that these student loan account balances can reach quite high figures. High tuition and loan interest rates greatly increase student loan balances, and that affects repayment ability. Student loan accounts with large sums and high interest rates pose major challenges.

Student loan forgiveness and bankruptcy restrictions and how they affect student borrowers

Federal student loans are very hard to remove in bankruptcy cases. This can make a bad situation worse. Students facing major problems from their student loan accounts often feel like their only options aren't the best. Students end up caught in long, ongoing cycles of student loan account debt as a result. This emphasizes the crucial need to overhaul education financing.

Policy Interventions and Future of Student Loans

Government actions and new ideas aim to improve the student loan account situation. Let's look at possible solutions for student loan accounts.

Source: avanse.com

Government interventions in student loan crisis

Governments try to help with student loan accounts by doing things like loan forgiveness programs and limiting interest rates. These actions offer relief. Loan forgiveness can lessen the load on student loan accounts. Caps on interest can keep student loan accounts from getting too expensive.

Alternative student loan models explored

Some new plans for student loan accounts try to share the financial burden. This means making education providers' incentives and profits be aligned with how well students do, creating a plan that makes it fairer and less burdensome to student loan accounts. New loan models focus on lowering the overall cost for students by connecting the financial benefits to everyone involved. Such alternative models are looking at tying benefits and incentives better for all parts of the system when dealing with student loan accounts.

Free higher education and the trend's numeric impact

Offering tuition-free higher education could really affect student loan accounts. More graduates with their student loan accounts would get paid jobs and start to help repay their loans. It's hard to say for sure exactly how much it would reduce the problem. Free tuition might improve the quality and financial prospects for graduates. This will significantly improve overall success of graduating students with fewer or no student loan accounts.

Key Takeaways: Student Loan Debt Landscape

Source: sfsu.edu

Let's summarize the big picture of student loan accounts.

Source: cloudfront.net

The current state of student loans

The current situation with student loan accounts is serious. $1.7 trillion in student loan debt affects 62.9 million Americans. This huge amount of student loan debt makes things difficult for many people with their student loan accounts. Delinquency rates were at 11.5% at the end of 2022, showing that a large portion of people struggle to keep up with their monthly payments on student loan accounts. This makes it a big challenge. Also, around 13% of student loan accounts default within the first year of repayment—a very troubling trend in student loan accounts.

The impact of debt relief

Debt relief programs might help struggling borrowers. Thinking about how different relief plans might affect repayment on student loan accounts is key to helping understand possible outcomes and impact on student loan accounts.

Looking into future scenarios with debt relief intervention programs

Future scenarios involving student loan relief interventions would influence overall outcomes regarding the repayment on student loan accounts. The best plan would be one that is affordable, practical, and fair for both borrowers and those holding the debt. This is really important when considering the future.