Student Loan Debt Overview

$1.78 trillion. That's a lot of money! It's the total amount of student loan balance in the US, as of June 2023. That's a big number. Think about all the things you could buy with that kind of money. But this much student loan balance is a big problem. Let's explore what is driving it.

What is the total student loan debt in the US?

The total student loan balance is a very important number to know! It is a huge problem facing the USA right now! As of last year, the amount of money Americans owe on federal and private student loans reached a whopping $1.78 trillion (Federal Reserve Bank of New York). That's a staggering sum of student loan balance. This student loan balance amount is an important statistic for considering its impacts on individuals and society as a whole.

How many college seniors have student loans?

In 2022, almost three-quarters (71%) of college seniors who graduated carried student loan debt. (The Institute for College Access & Success). This number shows how prevalent the issue is for recent college graduates. That is a very big number of young people with huge amounts of student loan debt and it shows the amount of work we need to do to reduce it.

What is the average student loan balance?

The typical amount of money borrowed for federal student loans was $28,950 (National Center for Education Statistics). But, some college students in their early 30s who take on the balance in student loan debts might have a higher average than $43,000 (Urban Institute). This shows there is a great need for more assistance in helping young college students to avoid owing high amounts of money and the challenges it poses for their future financial health. This student loan balance information highlights that student debt affects many young adults.

Borrower Demographics and Loan Balances

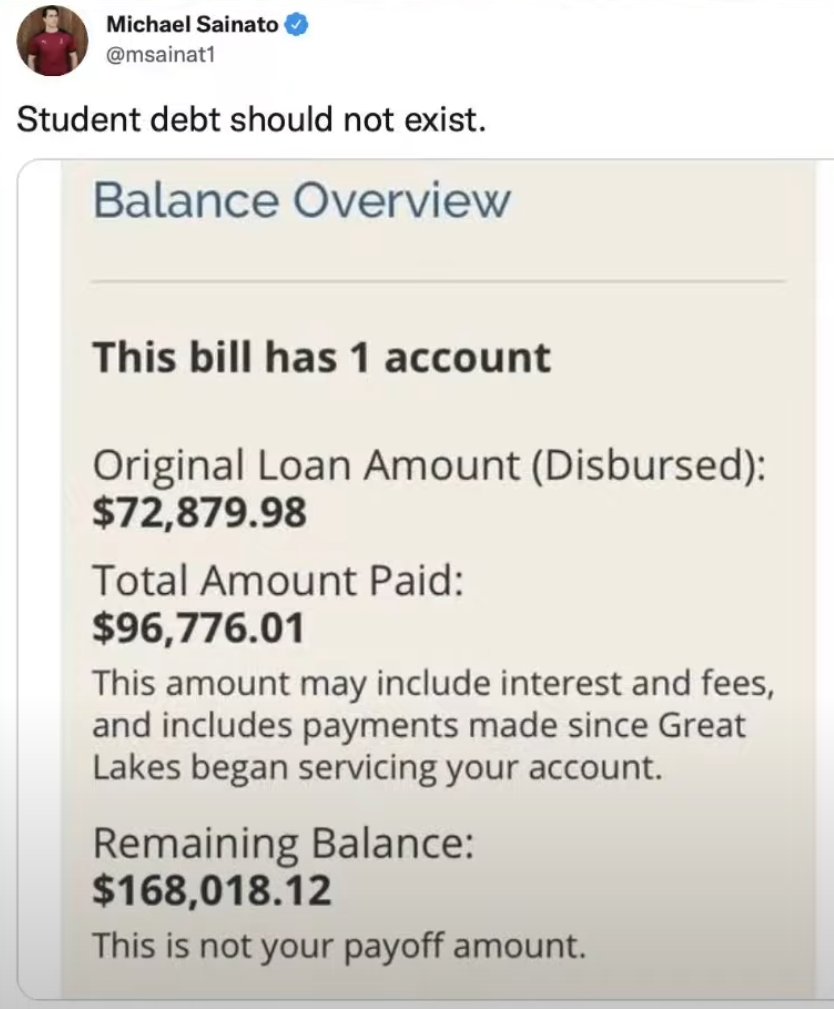

Source: twimg.com

The student loan balance situation is different for various groups. Knowing who owes what can help us understand the overall problem better. Let's see who's carrying the largest student loan balances.

Which age group has the highest student loan balance?

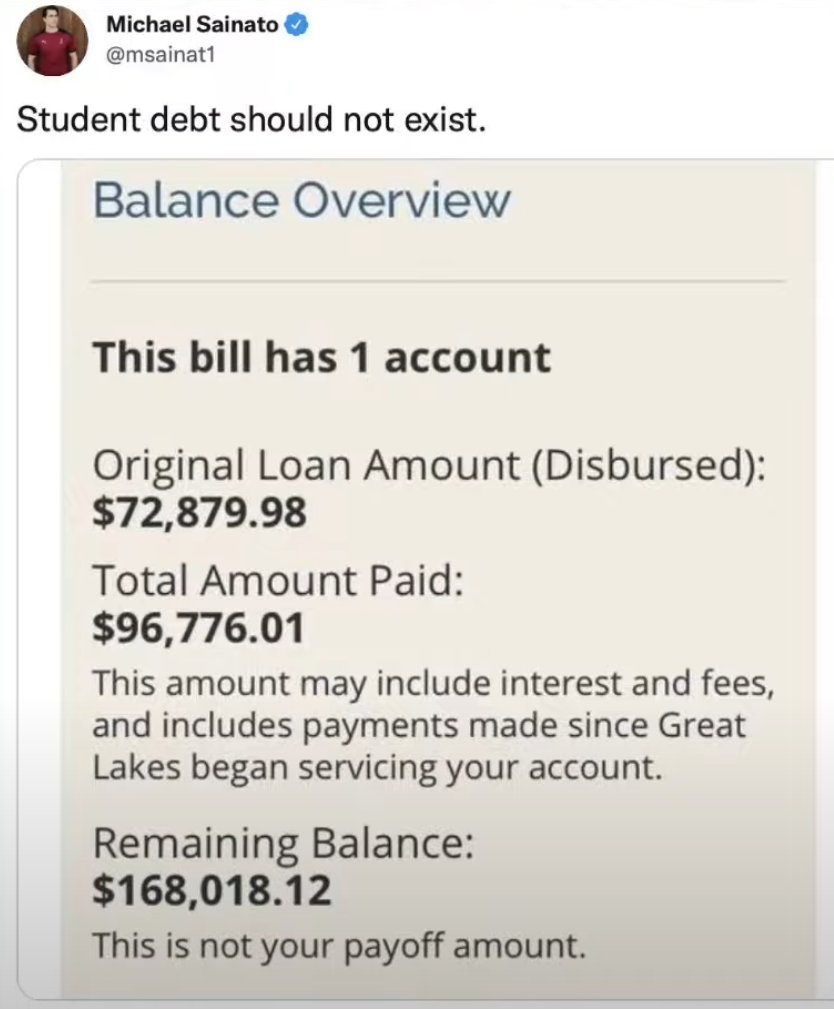

Source: axios.com

Borrowers in their early 30s typically have the biggest student loan balances. The average is over $43,000 (Urban Institute). This group has had time to accrue student loan balance and also time to begin their careers and still have those student loan balances. This is important because it tells us that student loan balance isn't just a problem for recent grads; it continues to affect people as they get older.

Average student loan balance by degree type

Sadly, specific data on student loan balance by degree type isn't readily available. But, we know professional degrees, like medical or law, often lead to more debt than other degrees. High-value degrees could mean students face larger student loan balances when considering those career choices. Higher student loan balances tend to arise when selecting professional degree programs or majors, while many general or traditional programs often involve less debt and student loan balance than others.

Student loan balance by income level

There isn't a table or clear data showing the exact student loan balance by income. But we do know lower-income families often face the greatest challenges in repaying student loan balance. This might be connected to limited financial support, since high-income individuals may be in a better position to handle the monthly payment of a larger loan amount. So it's possible they carry more student loan balances than those earning less.

Economic Impact of Student Loan Debt

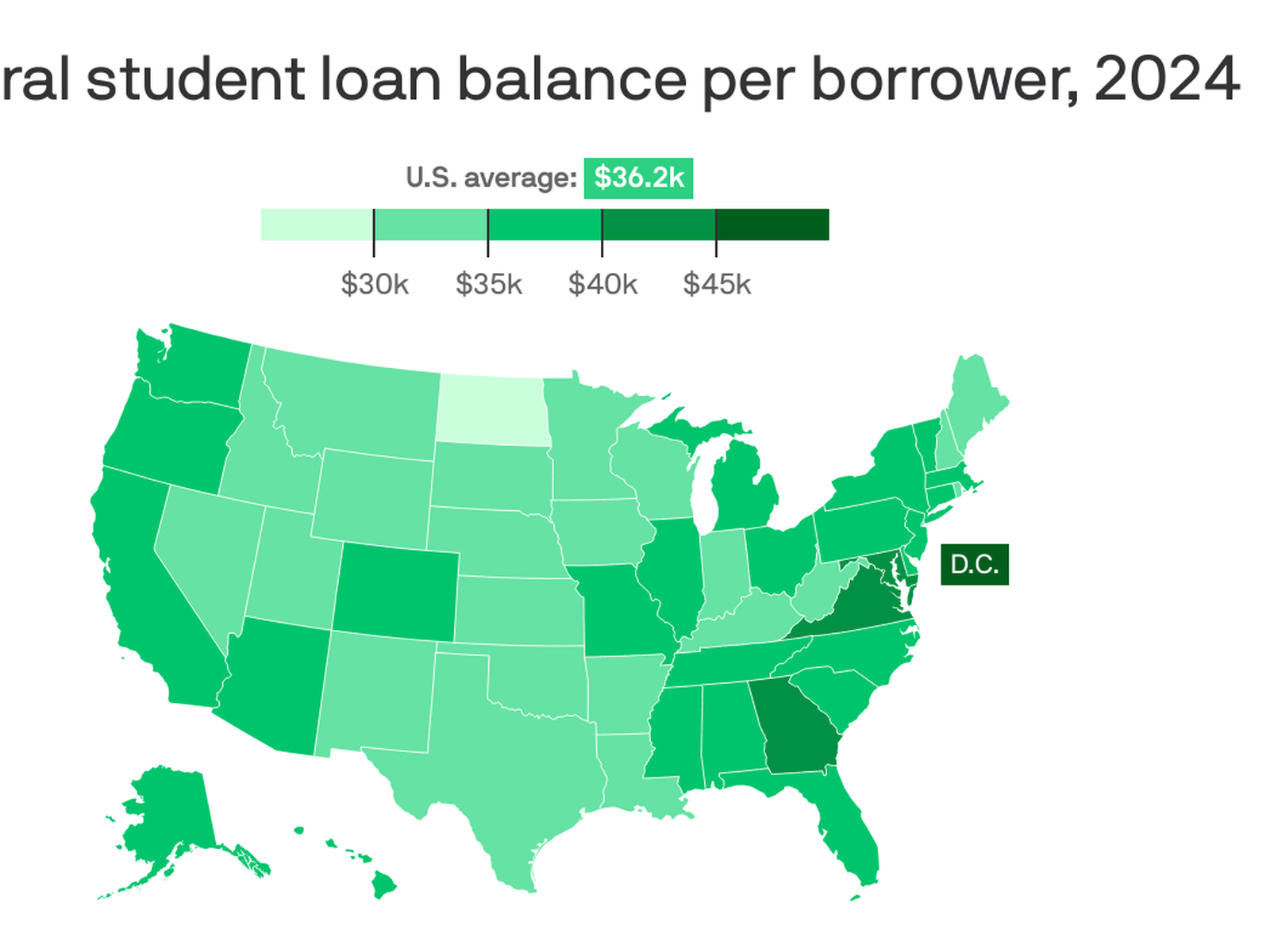

Source: harvard.edu

Student loan balance is a significant factor in many financial decisions. Let's see how it affects some important life goals.

How does student loan debt affect homeownership?

A large student loan balance can make buying a house tough. A significant 20% of borrowers said they delayed buying a home because of their student loan balance (New America). This means they had to put off an important goal. This is important because buying a home is a key financial step. Having a huge student loan balance can greatly affect people’s ability to do this.

Source: wichitaliberty.org

Impact of student loans on retirement savings

Source: ticas.org

Student loan balance can also impact how much people save for retirement. About 15% of borrowers say their student loan balance reduced how much they could save for later (Pew Research Center). Having this big student loan balance makes saving for retirement harder. Having a huge student loan balance has a major effect on the savings rate people can achieve, especially concerning savings for the future and retirement years.

Student loan default rates and consequences

Sadly, some people can't keep up with their student loan balance payments. About 5% of borrowers default annually (The College Board). This impacts their credit score, making it harder to borrow money for other things, like a car or a house. Defaults on loans can lead to even greater problems down the line because the lender usually takes steps to reclaim payment or interest on the balance and defaults, affecting the credit history and making future borrowing very difficult,

Solutions for Student Loan Debt

Student loan balance is a major problem, but solutions exist. Let's look at some ideas.

Effectiveness of loan forgiveness programs

One way to tackle student loan balance is through forgiveness programs. These programs aim to reduce or wipe out some of the debt. Whether these programs are effective remains a question. It can help some people with massive student loan balances and relieve a lot of stress. But they can also affect other people. It's not clear exactly how useful or impactful forgiveness programs are for many.

Increasing college affordability

Another solution is to make college cheaper. Lower tuition fees could help reduce the student loan balance students take on. That way, they might need to borrow less, and have less student loan balance in the long run. Having a higher standard or level of student financial assistance might lessen the debt, allowing those student borrowers to finish college without having too large a student loan balance.

Benefits of financial literacy programs

Helping people manage their money is really important. Financial literacy programs can teach borrowers how to handle their debt more effectively. Having effective methods and strategies can also significantly affect people's ability to tackle the overall debt problem and also, it gives individuals ways to effectively manage their finances more successfully in the long term. Programs focused on financial literacy and good personal finances might create and teach responsible strategies and plans for borrowers with outstanding debt to consider when tackling their financial concerns effectively.

Potential policy reforms for debt management

Making student loan repayment easier is an important idea. Some policy changes might help lower interest rates or set up different payment plans. For instance, reforms designed to help debtors with significant debt problems by giving options on plans or payment assistance to alleviate a huge student loan balance can often create good strategies that enable individuals to address financial difficulties while paying their debt, for example by making plans or giving options that make sense and are fair, to help with making payments and loan balances manageable. Different repayment strategies might be ideal options or possible for people who have issues repaying their student loans or debts.

Current status of grant and scholarship opportunities

Grants and scholarships can help reduce the total amount of student loan balance many students take on. More support and additional programs in these categories might significantly ease some student loan debt problems, especially since, it has already become quite hard to reduce the amount of student loan debt by encouraging or supporting students more in these types of aid and funding programs that aid in lowering the amounts borrowed.

Future of Student Loan Borrowing

Thinking about what's coming for student loan balance is important. Let's look at the possible future trends.

Source: phenomenalworld.org

Projected student loan debt trends

Predicting the future of student loan balance is hard. Right now, the total student loan balance is a huge $1.78 trillion (Federal Reserve Bank of New York). But we don't have clear numbers about what the total amount might be in the coming years. We need more information to make good predictions for future student loan balance amounts.

Trends in borrowing behaviors among students

We don't really know how student borrowing habits might change. The total amount of student loan balance and average student loan balances often depend on lots of things, such as the economic situation or the changes in the educational system itself. Understanding these changes in borrowing habits is important to predict future trends in the student loan balance problem. Without data to support these kinds of statements about student loan balance, it's really difficult to accurately describe future trends for student loan borrowing, or to guess if more or less borrowing will occur in the future or how it will differ. We really need better info and data for a more in-depth look into these possible student loan borrowing trends for the future.

Key Takeaways: Understanding the Student Loan Landscape

The student loan balance is a serious issue. Let's summarize some important points.

Source: finhealthnetwork.org

Summary of key student loan statistics

The total student loan balance in the US is a huge amount: $1.78 trillion (Federal Reserve Bank of New York). A very large student loan balance number. Also, 71% of 2022 college graduates had student loan debt (Institute for College Access and Success). This shows student loan balance is a common situation for many young people.

Importance of responsible borrowing

Borrowing money responsibly is key to handling student loan balance. It's good to think about how much you can realistically afford to pay back before borrowing money. Be realistic about your income. Carefully evaluating loan terms and checking if possible alternatives like grants exist is a really smart way to handle your student loan balance! Thinking carefully before borrowing is a big help. Understanding how student loan balances work well is essential before borrowing for many programs and plans for students to succeed with financial freedom in mind.

Available resources for managing student loan debt

Luckily, there are ways to deal with student loan balance. Talking with someone who can offer guidance can help, maybe a financial advisor or someone trained to manage student loans. Look for financial support programs. Learning more about ways to handle debt could greatly benefit borrowers! If people know and can access resources, like loan counseling and helpful support programs or tools for paying down student loan balance, the challenges they face in doing this successfully and feeling at ease financially can lessen for most people and for young adults in particular, significantly easing financial stress. Learning how to best manage or tackle the financial situations relating to a huge student loan balance is a valuable step forward and has great value.