Understanding Student Loan Debt Statistics

A staggering $1.75 trillion in student loan debt is now a significant part of American households. That's a huge number, making it a huge concern! It's important to understand these loans, their costs, and how student loan repayments impact our financial futures.

What is the average student loan debt?

In 2021, the average student loan taken out by a graduate was $28,400. This is quite a lot of money. Thinking about how to handle and manage these repayments becomes an important part of being a responsible borrower. This fact alone gives an important indication of the pressure new grads feel.

How has student loan debt trended?

Student loan repayments have become a serious concern. Over the past decade, student loan debt nearly doubled! The growing debt and related pressure have created an urgent situation that affects countless students, professionals, and even the economy as a whole.

What is the projected student loan debt?

Experts predict student loan debt will continue to grow and reach $2.4 trillion by 2032. This alarming outlook underscores the urgent need to address the situation and manage expectations better regarding financial stability after graduation. The challenge and struggle are likely to remain.

Important Considerations

- Average graduate loans in 2021: $28,400.

- Total 2022 student loan debt: $1.75 trillion.

- Projected 2032 student loan debt: $2.4 trillion.

- Debt nearly doubled in a decade!

Understanding these numbers provides important insight into the growing student loan repayments problem and the significant implications for individuals, families, and the future.

Analyzing the Demand and Supply of Student Loans

Rising tuition costs are a major reason why the demand for student loans is growing. It's creating a tough situation for many students and making student loan repayments more challenging. More money needed means more student loans are taken.

Why is student loan demand increasing?

Source: pikbest.com

Tuition fees are going up. This rise makes it harder for students to pay for college without borrowing money through student loans. The increasing cost of student loan repayments becomes an obvious burden. The rising costs of higher education cause many people to consider taking on loans.

How does limited supply affect loan availability?

There aren't enough scholarships or grants available to help students pay for college. This creates more competition for the limited funding that's available for student loan repayments. Fewer grants make borrowing more necessary, pushing students to use student loans as their main source of funding. That, in turn, creates even more demand for student loans to meet these rising educational costs. Student loan repayments become a significant issue.

What factors drive demand?

Source: cnet.com

Higher education is expensive. This fact is obvious. Many students need to take student loans for higher education expenses, including textbooks and room and board in addition to tuition. This pressure means student loan repayments are necessary to keep studying and advancing one’s education. This forces students to consider a wider range of borrowing options.

Decoding Student Loan Interest Rates and Pricing

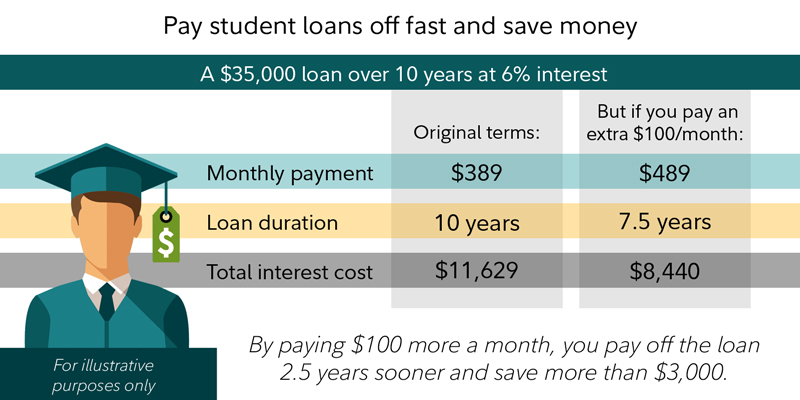

Understanding student loan interest rates is a big part of student loan repayments. Knowing the prices can help you figure out your budget for student loan repayments. It's important to understand the difference between federal and private student loan repayments.

Source: fidelity.com

What are average interest rates on student loans?

Federal student loans, which are often seen as a safer option, had an average interest rate of 2.73% for undergraduates in 2022. This means it can significantly impact how quickly someone repays a loan. Private student loan repayments may end up costing more. Private student loans, however, have higher rates.

How do private loans rates differ?

Private student loan interest rates were notably higher, around 8% in 2022. This difference in student loan repayments between federal and private loans makes it very important to think about your options. For example, a recent graduate, Sally, borrowed $65,000 with a 5% rate, demonstrating how these details impact the burden of student loan repayments. This huge difference shows it’s important to shop around.

What influences rate variations?

Source: studentloanborrowerassistance.org

Many factors influence the rates on student loan repayments. Creditworthiness plays a role; lenders often base interest rates on how much risk they think a borrower will pose. Other things that affect student loan repayments include factors like loan terms and the specific type of loan (federal versus private student loans). Carefully considering these things will help a student prepare for their student loan repayments. Choosing a more responsible loan method will likely result in student loan repayments being more easily managed and fewer future financial difficulties. A low credit score or an unsuitable repayment plan might result in a significantly higher student loan repayments.

Benchmarking Student Loan Delinquency and Default Rates

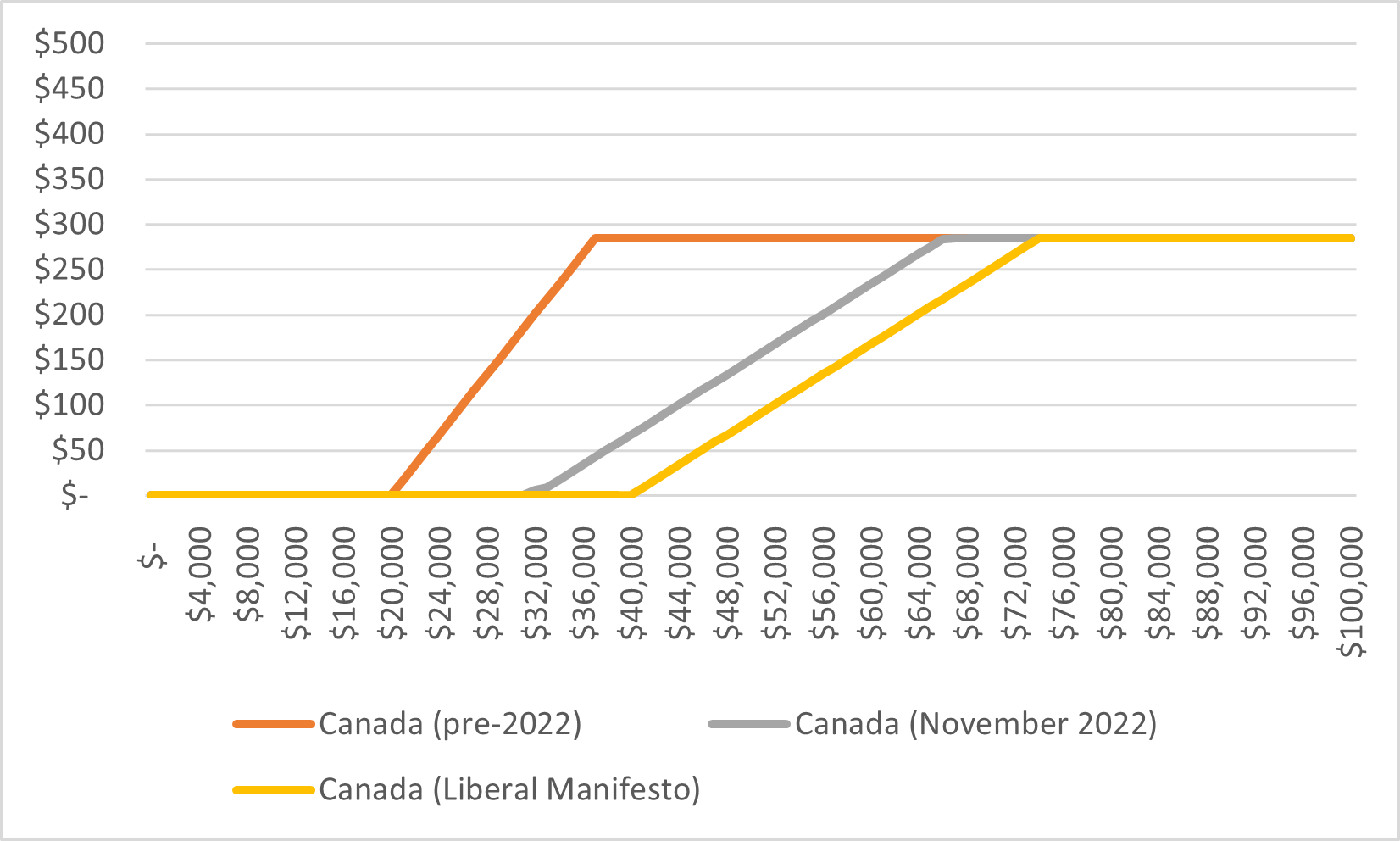

Source: higheredstrategy.com

Student loan repayments can be tricky. Understanding how often people miss payments is important for understanding the overall picture of student loan repayments. Looking at data on student loan repayments can help us see patterns.

What are benchmarks for delinquency and default?

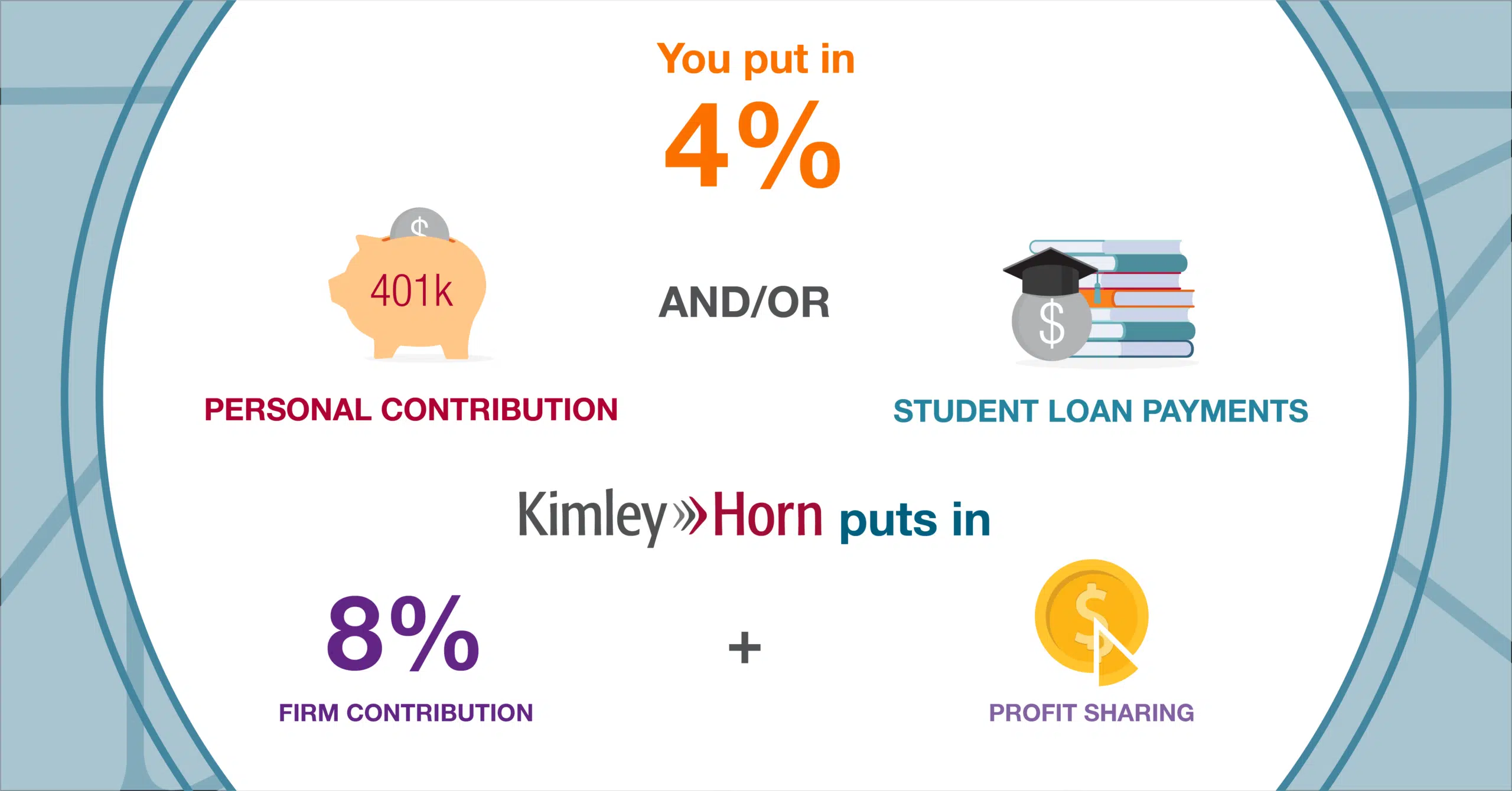

Source: kimley-horn.com

Delinquency means someone missed a student loan payment. A default is when someone misses a student loan payment for a longer period of time and can't repay it anymore. The figures show how often student loan repayments are not made on time.

What is the comparison for default rates?

In 2021, the rate of missed payments (delinquency) on student loans was 8.4%. The overall rate of missed payments on other kinds of debt was lower at 3.7%. This shows student loan repayments can be a particular problem. The default rate was much lower at just 0.8%—meaning a much smaller percentage of student loan borrowers failed to make student loan repayments entirely. Knowing these numbers makes you understand why people are paying more attention to student loan repayments.

How is the overall household debt affected?

Student loan repayments are part of a larger picture of household debt. Higher rates of missed payments for student loans can put a strain on people's budgets and the entire economy. Student loan repayments and missed payments make up a sizable part of overall debt, emphasizing the need for responsible management. Student loan repayments can create a larger problem, creating worries about their finances and stressing out the whole family, which in turn makes it harder for them to make other payments. This means student loan repayments are a significant factor for everyone. High student loan default rates have effects on the entire economy, highlighting the importance of responsible budgeting and managing student loan repayments. The details show just how big an issue student loan repayments really are. The overall picture emphasizes why good money management, even with student loan repayments, is important.

Source: access-wealth.com

Historic and Future Trends in Student Borrowing

Student loan repayments have a long history, and we can see how things have changed over time. Understanding this history can help us better understand student loan repayments today and into the future.

How has total borrowing evolved?

Student loan debt has really increased over the past 10 years. It's about doubled, and that's a major change. It's something we need to consider in how student loan repayments are managed.

What influenced past borrowing trends?

Tuition costs have gone up over the years. This has directly affected the amount of student borrowing for educational expenses. Higher tuition often forces students into increased student loan borrowing for student loan repayments. That can also make student loan repayments more complicated.

What are the future debt projections?

Experts expect student loan debt to keep growing. It is projected to surpass $2.4 trillion by 2032. It’s definitely a key factor to consider in how we manage student loan repayments. This big number needs careful thought, and looking at ways to manage student loan repayments better.

Source: colinryanspeaks.com

Key Takeaways: Managing Student Loan Repayment

Student loan repayments can be a big deal. Making smart choices early can help a lot in student loan repayments. These tips might help.

How can one minimize borrowing?

Look for grants and scholarships. They can help cover college costs without needing student loans. Saving money can also help students reduce their borrowing for student loan repayments.

What factors influence optimal repayment?

Federal student loans often have lower interest rates, which can make student loan repayments cheaper. Consider different repayment options carefully for your situation. Finding the repayment option best for you will ease student loan repayments. The right repayment plan, combined with responsible borrowing habits, means managing student loan repayments better.

Where can borrowers find reliable resources?

The government website, https://studentaid.gov, has great information about student loans and repayment options. Student loan repayment options are usually very varied, so finding the best one for yourself requires investigating and thinking through student loan repayments. The Student Loan Hero website can provide other help with student loan repayments, as well. By carefully thinking about all available student loan repayments methods, borrowers can often create an efficient method for student loan repayments and make repayments easier to manage.