Where to Invest Money: Understanding Your Options

Where to invest money is a crucial financial decision, shaping your future wealth. Understanding your options is paramount to smart investment. Knowing where to invest money involves assessing your personal circumstances, financial goals, and risk tolerance. Every person’s financial situation is different, which impacts where to invest money. Start with clear answers, and avoid quick fixes; the route to investing is usually longer. Don’t hurry to decide, consider carefully. Your first priority in determining where to invest money is determining goals. Where to invest money strongly connects to future expectations.

Where to Invest Money: Exploring Different Asset Classes

Different asset classes carry varied levels of risk and potential return. Where to invest money hinges heavily on which class you choose. Understanding these classes helps in strategically deciding where to invest money. Stocks, bonds, real estate, commodities, and alternative investments are options. Where to invest money is never a universal choice. Consider a range of options. This often leads to better decisions on where to invest money. Real estate usually gives steady returns. Diversifying your portfolio with various asset classes minimizes risk when considering where to invest money. Carefully analyze the options related to where to invest money. Research is essential before deciding where to invest money. Evaluate risk for each of the categories. Research your risk and return expectations before committing to where to invest money. Your research can be done before deciding on where to invest money and making such major steps

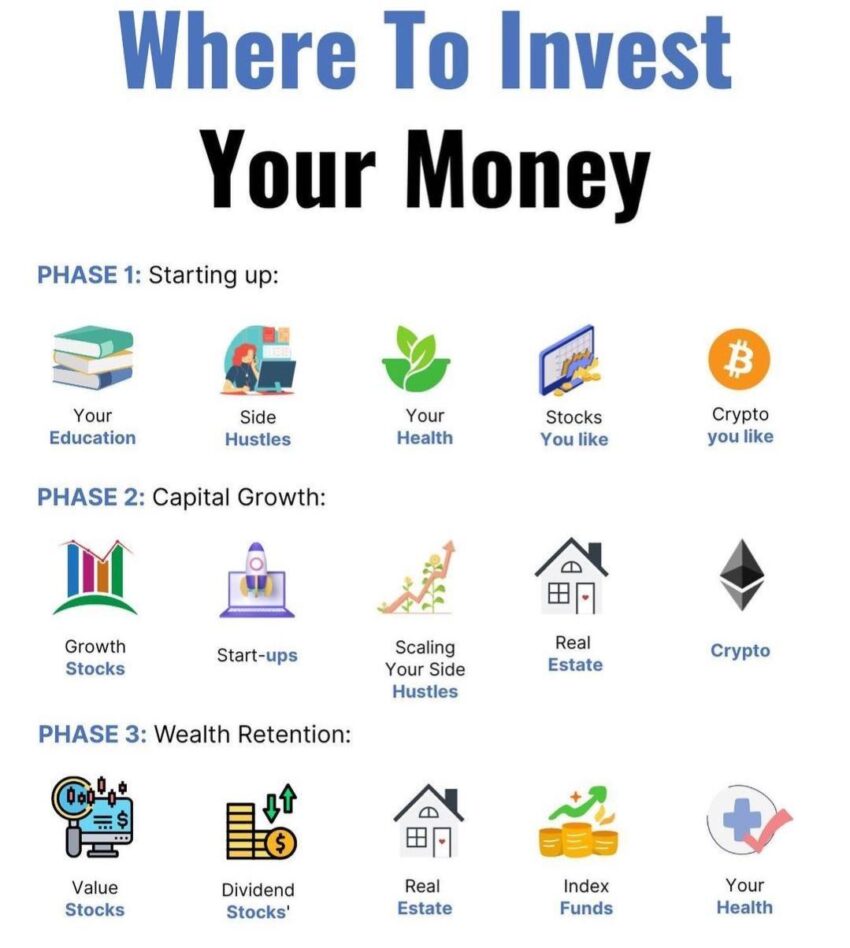

Where to Invest Money: Choosing the Right Investment Strategy

Source: redd.it

A defined strategy is a cornerstone for successful investing. A tailored strategy aligns perfectly with personal goals for where to invest money. Understand how it works to determine where to invest money. Strategies like dollar-cost averaging and index fund investing play a key role in determining where to invest money. Setting realistic financial goals matters immensely in where to invest money. Investment strategy helps dictate your specific method of where to invest money. How your finances operate defines what strategy suits best. Before applying strategies consider how each decision changes where to invest money in long-term. This impacts your earnings significantly. Choose a simple method if possible, simplicity in financial planning is important to how you decide on where to invest money. Each investor must select a proper plan.

Where to Invest Money: Factors to Consider

Several crucial factors affect your choice of where to invest money. Risk tolerance, financial goals, time horizon, and economic conditions all significantly influence decisions on where to invest money. Start by listing goals that shape financial strategies on where to invest money. Every goal needs to be weighed against financial situations. Understand long-term needs from your specific investments. All this significantly alters choices in where to invest money. Before making financial decisions like where to invest money make a list of important parameters to analyze each investment option. This often becomes clear when choosing where to invest money. If the timing is uncertain, you should consult. Consult with financial experts, research market trends, evaluate personal needs when choosing where to invest money. Each factor impacts investment planning, especially deciding where to invest money. Factors that play a huge role in choices related to where to invest money must be studied extensively. Your chosen strategy is always dependent on where you choose to invest your money.

Where to Invest Money: Seeking Professional Advice

Professional financial advisors can offer expert guidance. Professional help significantly alters investment outcomes when discussing where to invest money. Consulting financial professionals empowers informed choices for investments. Professional help greatly eases choices on where to invest money and the investment portfolio process. Seeking guidance from experts provides different insights from where you can invest your money and allows broader views on possible investments. Before committing, consider hiring a qualified advisor. Your investment can flourish with the aid of experts for a more secure decision of where to invest money. Discuss and collaborate on the goals to see where to invest your money wisely. Many individuals greatly benefit from professional guidance, influencing where they invest money wisely. Understanding the nuances of investments, including understanding where to invest money effectively, often demands the guidance of financial experts. Seeking support from knowledgeable professionals is key for effective decision-making regarding where to invest your money.

5 Top Investment Options for Beginners

Where to invest money is a big decision. Choosing from the many options can feel overwhelming. For beginners, certain choices are smarter than others. These top five options are relatively easy to understand and manage, giving you a solid starting point in your investment journey. Start smart by looking at options carefully.

-

High-Yield Savings Accounts: Simple, low risk. A great place to stash cash. Think of this like a high-interest bank account. Many high-yield savings accounts offer more return than a traditional savings account, and your money is insured.

-

Certificates of Deposit (CDs): A guaranteed return over a certain period. Fixed interest rate is nice. You can determine how long you wish to let the money sit earning money in this type of place in the market for where to invest money. Lock in a specific interest rate.

-

Money Market Funds: Slightly more complex. But often give a decent return with fluctuating, yet safer returns. An investment opportunity that keeps your capital liquid and productive. Good returns and flexibility, you choose the term, when it's good, move.

-

Index Funds: Low cost, wide diversification. Tracking a certain market is attractive, simple investment for newcomers and long term people in where to invest money. Very easy-to-follow structure; don’t stray too far. Very consistent for beginner investor.

-

Robo-Advisors: Hands-off approach for automatic investments. Designed to meet beginner investors in the where to invest money field. Simple, good for getting started and keeping you from too much attention. No individual stock buying is a good thing for this beginning investor in where to invest money.

Where to invest money wisely can improve financial success in years to come. Finding reliable resources about where to invest money can build your investment knowledge.

7 Reasons to Invest Your Money Now

Time is your friend, or perhaps not, with this situation. This can sometimes be scary in terms of where to invest money. Timing can really matter; don’t think that any random day of where to invest money is the best day. This is a process you don’t need to be afraid about; you can be more intelligent and prepared to invest.

-

Future Security: Investment is a step for future goals. Start early, and watch how your capital will be larger over time. Build more. Investing makes sense. Where to invest money becomes an important thought.

-

Financial Growth: Your capital will grow larger over time. You won’t be disappointed if you are persistent in where to invest money. Good choices about where to invest money really impact your finances. Investing has some impact.

-

Inflation Protection: Protect your money from the gradual decline in value (purchasing power). You don’t need to fear it too much. Where to invest money is the subject. Where to invest money will create the best strategy.

-

Compound Interest: Money working for you! An active and wise process will earn you big gains. Invest often in order to have more in the future. Your capital will grow more, just because of the growth from where to invest money. Make money using the compound method in order to start being wealthy; this may sound very difficult. Invest in order to improve yourself and have a stronger grip in where to invest money.

-

Financial Independence: Long-term savings in order to become less reliant on job/salary for basic survival. Plan ahead with smart investments; then where to invest money will feel great and become very easy to handle. Money works best with wise where to invest money opportunities and choices in terms of the market in the future. Focus on where to invest money so you have the freedom you deserve.

-

Early Start to Richness: Time to improve your financial life from young ages. Start today in where to invest money for a bigger future with your where to invest money. Investing is an advantage!

-

Wealth Accumulation: Create a safety net and assets that continue growing and making a better place of financial future. It all revolves around wise investments with where to invest money. Don’t be hesitant. Make these smart investments today! Where to invest money wisely creates a stronger foundation for a wealthy future.

Where to invest money now is more meaningful now more than ever! Your wealth accumulation can benefit so much with your time and attention to the process. Investing money effectively makes you wealthy over time, which is a valuable aspect of investing in order to make you rich over the course of your life.

Where to invest money will continue to grow!

Where to invest money makes sense.

Where to invest money today is a worthy choice.

Where to invest money helps make money over time.

Where to invest money really makes sense for our times now.

Where to invest money has huge potential in building wealth!

Where to invest money will improve your wealth for years.

Where to invest money wisely now makes sense, you must act decisively.

Where to invest money now makes the future easier and richer.

Where to invest money can generate future earnings.

Where to invest money must be thought over carefully and attentively in order to produce more revenue.

Where to invest money smartly, with purpose, helps with overall wealth development.

Where to Invest Money: Comparing High-Yield Savings Accounts

Choosing where to invest money wisely in savings accounts can boost earnings! Some key points on high-yield savings accounts can assist in making great decisions.

High-yield savings accounts, one place where to invest money wisely, offer more significant returns compared to traditional accounts. An obvious choice that you can use wisely, these accounts increase your wealth; that’s why you should try these today! You will be thankful for having looked into how great savings accounts work, how high-yield savings accounts offer an increase in return.

Comparing accounts means examining different interest rates and fees, which is helpful to ensure maximum earnings. Check minimum balance requirements and terms. Understand where to invest money. Also be on the lookout for terms and conditions as well when researching savings accounts where to invest money; terms are very important and should not be skipped.

Look into your available options in order to have better insight in where to invest money. Some accounts pay more depending on market conditions and where to invest money; take time to assess them as these fluctuate according to the needs in order to earn even more! Research and read over important terms to avoid unexpected changes. This could change over time. It helps to consider them wisely. Also understand all charges or expenses.

Understanding these details can greatly help you choose a high-yield savings account! It is one of many great answers regarding where to invest money today. It shows the details about your investment options in a clear way to learn where to invest money in savings.

Where to invest money wisely is extremely important!

3 Steps to Building a Solid Investment Portfolio

Creating a robust investment portfolio involves more than simply selecting a few assets! The structure for where to invest money has many aspects. Start early for the long term in where to invest money wisely; it can save your money for your entire life. This step-by-step approach helps in making sound choices when it comes to investment; therefore you won't have regret and remorse over time for poor or inadequate investment choices. You have great reasons to think about these steps about where to invest money. Begin today and invest!

-

Set Financial Goals: Determine why you are putting money to work—retirement, house, kids' college fund? Make sure you keep your goals very clearly focused in mind regarding where to invest money for great outcomes, positive growth and great returns. Be clear about your intentions and goals for where to invest money and why you invest today.

-

Develop a Diversified Strategy: Don’t put all your eggs in one basket. Choose a selection of investments. Explore a great variety when you consider where to invest money and keep in mind what might produce returns over a significant span of time; your choices in where to invest money could mean a great difference! Include a wide range of investments; explore various aspects, such as bonds, stocks and a plethora of places for where to invest money. When it comes to where to invest money, diversify!

-

Create and Stick to a Budget: Establish realistic investment goals within a budget! You could be saving very much; you could save much more! Where to invest money could create that great path. Set a consistent schedule for making smart investments for your future! Avoid excessive spending and stick to the investments you previously selected. Manage and plan wisely regarding where to invest money! Budget properly regarding where to invest money in order to plan accordingly; then take these steps in making money; use every step you make, as those who choose this method become rich for life with sound choices in order to obtain these great goals in where to invest money, today! Where to invest money is now an active and efficient strategy for your current investment needs and for many other investments of different amounts of money for the many investments in the future. Create a sensible schedule. Stick to it, invest, grow your funds, and save! You won't regret any of this, make solid plans in where to invest money wisely, and think ahead as well.

Where to Invest Money: Examining Stocks

Source: wp.com

Stocks represent ownership in a company, potentially leading to greater rewards with increased risk in where to invest money; when you consider investing in the stocks and share market, be prepared for all outcomes and plan appropriately, otherwise, be prepared for mistakes that occur when taking great risks regarding where to invest money. When exploring stocks, be sure you are adequately and soundly researching where to invest money.

Stocks are one aspect of investment choices where returns vary greatly. Consider different industries for the companies you consider where to invest money and have greater risk/reward in stock markets! Companies and shares of companies have differences, some having much potential gains whereas others could fall below expectations for their stocks. Explore potential for returns when using the potential that a stock will provide for returns! Companies are worth so much potential; but stock shares are affected greatly and very drastically if your choices of where to invest money are very difficult to foresee or predict regarding stocks and the company's financial prospects. You will want great returns over time, thus the many risks that exist need to be looked over very closely to prevent failure. Thus you need a strategy to be better and have greater success with stock returns. Review stocks from varying industries to gain insight. Where to invest money in stocks often comes with the opportunity of considerable financial returns over the long-run or periods! Think over whether stocks may cause harm in investments with shares, otherwise understand stocks when examining stock prices for companies where to invest money.

Your success in investing in stocks in the stock market and shares in different corporations could make you or break you, be cautious about stock investing when considering places for where to invest money in stock options in different shares, so think over where to invest money wisely! You want gains and returns so don't overlook all the considerations before buying and putting your capital in stocks in order to gain some amount of understanding as you look in greater depth in where to invest money! Companies in stocks in general today will influence you! Carefully assess various elements like market trends and past performance regarding companies of your choice, and determine whether stock shares offer sufficient returns for you or not. Stocks are just a form of an option to consider, when seeking where to invest money, not the best strategy! Stocks are worth consideration in terms of their options but remember that shares and stocks for companies could lose considerable amounts depending on company failures, or business problems.

Stocks may appear very appealing and easy as they can rapidly provide gains. The market in stocks requires caution, especially if thinking of the amounts lost that sometimes could come with such trades or purchases with where to invest money; stock shares and other such shares. Always understand possible downsides of stock investments and look over these issues when considering where to invest money into stocks! Be realistic. Where to invest money is tricky business for stocks and you want to look at things more carefully as stock investors; many others before you did poorly in these types of options. This takes careful and wise decisions regarding your where to invest money, and your planning! So look before you leap! Choose companies and their options wisely regarding your chosen method of investing.

6 Steps to Picking Stocks Wisely

Picking stocks wisely is a key part of growing your investments. Understanding where to invest money is crucial. Knowing how to evaluate stock options is equally important when deciding where to invest money. There's no magic formula, but these steps will give you a better chance at success when deciding where to invest money.

-

Research thoroughly: Look deeply at companies and industries. What's the company's recent performance like? Where to invest money depends greatly on this. Look into their future prospects – are they making money, and where are they going in the future, making smart investment decisions, knowing where to invest money.

-

Define your goals: Why do you want to invest money in stocks? Are you looking for short-term gains, or do you want your money to grow steadily over time, choosing wisely, knowing where to invest money? What kind of investment is right for your particular needs? What are the expectations on returns? Choosing where to invest money should involve knowing your goal and desired outcomes.

-

Set a budget: Decide how much money you can invest, knowing your risk tolerance and available funds, for proper investments and successful results and picking the perfect spot to invest your money. What's a smart, and responsible way of doing this investment thing? Be practical and reasonable about investing wisely in stocks to generate better returns when planning where to invest money.

-

Diversify your portfolio: Don't put all your eggs in one basket. Where to invest money strategically diversifies your chances of maximizing profit from your smart investments. Diversification ensures security when deciding where to invest your money, protecting your interest. What's a healthy approach in making decisions to invest wisely in stock options?

-

Monitor your stocks regularly: Stay aware of any major news events that may affect the company or the industry and take note, analyzing stocks regularly and where you can effectively place the invested money is your key. What factors need attention when evaluating possible stocks to buy for future gains and potential profits? Keeping track, adjusting strategies and monitoring the progress of the investments, considering different options, determining and exploring the potential of all investment strategies, knowing where to invest money for maximum gain.

-

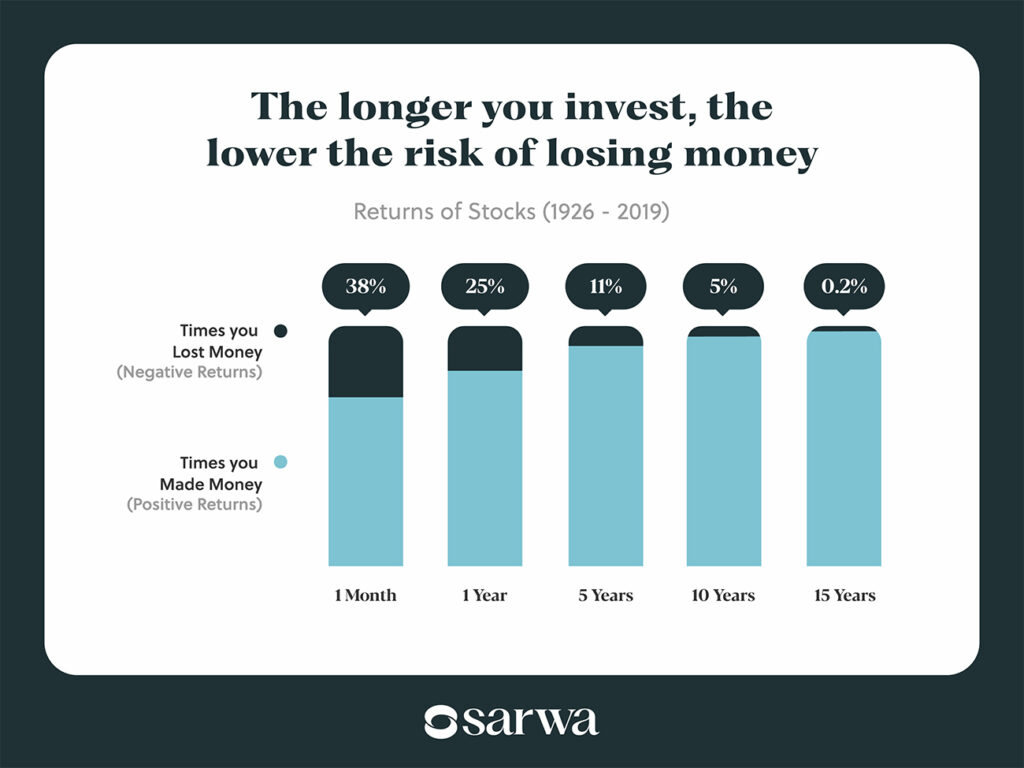

Be patient: Investing in stocks is not a quick way to get rich overnight. Your gains in money come from good and stable long term decisions and making thoughtful decisions while determining where to invest money. Time is a very valuable component when deciding where to invest your hard earned money and finding the best approach, knowing where to invest money, will require a great deal of time and analysis to arrive at a satisfying outcome. Patience is a great virtue, and one that is essential for choosing a great spot to invest money. Understanding the basics is crucial to being able to analyze where to invest money properly.

Source: b-cdn.net

10 Mutual Funds That Offer Great Growth Potential

Deciding where to invest money wisely is not easy, but good choices lead to prosperity and successful strategies. Finding mutual funds offering significant returns can be very rewarding if choosing investments wisely to maximize the money potential.

Source: ytimg.com

The list includes potential high-return investments but does not suggest an immediate decision where to invest money – make sure that research fits your needs before investment, looking carefully into factors when deciding where to invest money. It also must not be used as an immediate decision for making investment choices for putting money somewhere. The right decision depends on different individuals with their specific situations when determining where to invest money.

… (additional points on each fund: fund strategy, past performance, and fees) … You should perform a comprehensive background check, evaluating carefully before you invest, knowing what will suit best. Considering where to invest your money. Deciding on your investment options requires careful attention, determining whether to invest. Researching possible options in finding where to invest your money, keeping in mind long term goals and your expectations is wise.

2 Crucial Mistakes to Avoid with Your Investment Plan

Bad decisions are easily made, especially when deciding where to invest money. Mistaking factors lead to losing money. Knowing which to avoid is key to preventing errors when planning where to invest money.

-

Lack of planning: Investing without a clear strategy is a sure way to waste money. Don't invest unless you know your goals and timelines; determine where to invest your money, ensuring that the strategies match expectations. Choosing suitable and convenient methods and ways in investment decisions involves much consideration before making decisions about your investments and planning the future outcome and gain.

-

Ignoring your risk tolerance: Investing involves a level of risk, so invest where you know your level. Invest wisely while determining where to invest money, ensuring appropriate measures of control. Choosing and implementing decisions when considering where to invest money requires attention.

4 Key Traits of a Good Investment

A solid investment is vital when dealing with funds for financial gain. Choosing the appropriate place to invest money requires careful attention and thoughtful evaluation, analyzing the financial goals and needs when deciding where to invest your hard earned money wisely.

-

Reasonable return: Expecting to earn great returns shouldn't cause rash decisions; evaluating the risk versus reward and properly investing wisely requires thorough analysis when determining where to invest money.

-

Adequate liquidity: When deciding on funds and strategies for investing in certain items, be mindful of where to invest your money. This element of an investment requires clear strategies about liquidity.

-

Sound management: Proper investment oversight, whether professionally or by oneself, impacts decision-making concerning where to invest the funds effectively, properly and smartly.

-

Sustainable potential: Picking suitable options when choosing an investment plan ensures sustainable potential, ensuring success in investments when planning where to invest your hard-earned cash. What considerations would make sense and prove successful when carefully assessing places where you could wisely invest? A good investment should have a potential of lasting, maintaining the growth. Carefully researching appropriate investments is necessary and very useful for people wishing to determine suitable ways where to invest money in different investment plans for good profits.

How to Evaluate Bonds Before Investing

Before investing in bonds, understand the critical components of bond evaluation to maximize potential returns and secure investment decisions while considering places to put money to grow profits. Evaluating different bonds properly should focus on all critical points. Where to invest your money with sound decisions that prove suitable.

-

Credit rating: A high credit rating from reputable organizations signifies reliability and shows whether the investment option in question fits and determines your requirements for return on investment for placement decisions about funds to invest in. Consider the reputation, determining its worth, its future projections in relation to growth in profits and income and considering suitable locations. Where to place and invest money requires solid and valid factors for accurate assessments and sound considerations before executing transactions and procedures about investment methods in funds. Understanding your risk tolerance and suitable investment opportunities is important, taking advantage of strategies while choosing options about investments.

-

Interest rate: Analyzing interest rates and the effects on returns will enable decision-making and determination of locations that will suit the purpose, ensuring the correct methods for effective returns and outcomes from placements. When researching where to invest money, thoroughly investigate interest rates as well. Evaluating interest rates and their potential influence on return amounts helps with accurate calculations and enables correct decision-making for appropriate placements.

-

Maturity date: Understanding the return time is crucial, showing potential gains; investing in bond placements carefully determines the time required, which is essential in generating profits when choosing placements for generating and increasing the capital in investments. It's vital to factor in expected return time, maturity and projected growth while choosing spots to invest your money to reap benefits of potential gain. Considering and evaluating places where to invest funds will influence returns, choosing investments based on suitability. Where to invest requires sound judgements in analyzing bond return opportunities while ensuring suitable risk reward ratio based on projected maturity.

-

Risk level: Assessing possible financial risk associated with particular bond selections allows for investment safety considerations and strategies based on their level of financial risk to safeguard investments from financial damage while finding the proper place to invest the funds safely to generate high profit with reduced loss risks when strategically choosing to invest and understanding the associated risks with possible investment choices and places where to wisely invest. Considering investment placement strategy, thoroughly examining available choices in placing money can lead to informed decisions while assessing return and investment options that meet the investment strategy effectively and appropriately and strategically.

3 Simple Ways to Learn About Investment Options

Quick ways to get smart about where to invest money, grasping basic investment knowledge is vital for financial growth.

-

Read financial guides: Numerous articles, blogs, and books provide clear, easily understandable explanations. Where to invest money effectively, find out through good reading.

-

Take online courses: Many platforms offer introductory investment courses; a fantastic option for grasping where to invest money. Get a handle on fundamental investment concepts.

-

Talk to a financial advisor: Talking to a pro will bring real-world insight. Where to invest money requires guidance. Consider professional guidance from those experienced in finances; a practical approach for where to invest money. This direct approach, through personal financial mentors, often brings clarity on where to invest money.

Source: personalfinanceclub.com

7 Reasons People Should Be Investing Their Money

Making the most out of your financial well-being, taking calculated steps regarding where to invest money are vital.

-

Future financial security: Investing allows you to grow your wealth, leading to financial stability in the future. Crucial steps in the direction of where to invest money effectively are always necessary.

-

Increased wealth potential: Over time, your investment earns returns, boosting your financial resources considerably. Essential insight into where to invest money effectively.

-

Inflation protection: Investing is often necessary for combating inflation; safeguard purchasing power. Focus should be on selecting places where to invest money intelligently to mitigate the risks.

-

Time value of money: Early investments take full advantage of the time value of money principle, maximizing growth. Investing wisely at different phases can significantly change your potential results and your thoughts about where to invest money, too.

-

Financial independence: Investing for the long term will inevitably contribute to independence from others for money-related choices regarding where to invest money wisely.

-

Build wealth: Investment growth provides building blocks for substantial accumulation.

-

Potential for greater returns than other saving methods: Compare investments with savings to recognize superior growth. Be shrewd regarding where to invest money. Don't ignore potentially great places to invest money, based on informed options.

Where to Invest Money in a Recession-Prone Economy

Recessions, periods of economic slowdown, present challenges regarding where to invest money. A thoughtful and diversified approach minimizes financial risks.

-

High-yield savings accounts: A reliable, often low-risk, alternative for secure interest accumulation in times of economic uncertainty where to invest money safely. Assess if you want a more secured financial strategy.

-

Treasury bonds: Government-backed securities are appealing choices where to invest money. Treasury bonds bring relatively stable returns in tough markets.

-

Corporate bonds: With caution, a measured option. Corporate bonds potentially yield more. Where to invest money should still be investigated, and this route taken cautiously.

-

Real estate investment trusts (REITs): REITs may show good resilience even during recessions, potentially offering steady earnings streams in challenging market situations. Evaluate your specific needs concerning where to invest money, based on this possible route.

4 Low-Cost Investment Choices for Budget-Conscious Investors

Where to invest money smartly, keeping a tight budget in mind is vital for building assets wisely.

-

Index funds: A diverse collection of stocks mirroring the stock market. Cost-effective means of generating market-relative returns. Think carefully about how these index funds match up with your aims where to invest money effectively, to obtain the returns you desire.

-

Exchange-traded funds (ETFs): A group of investments that mirror a financial market. Cost-effective strategies for managing your financial status through where to invest money carefully. Make decisions based on thorough investigations regarding where to invest money prudently.

-

Low-expense ratio mutual funds: Explore a range of investment styles via a professionally managed group. Effective investment pathways concerning where to invest money at minimum expenses. Be thoughtful regarding where to invest money for maximum gains on a tight budget.

-

Direct stock investing: Where to invest money in your chosen industry, sector, or specific company; requires diligence to avoid potential risk. Evaluate the potential with strong insight and good diligence concerning where to invest money.

Top 5 Funds for Long-Term Investors

Focus on long-term, diversified strategies that maximize growth, concerning where to invest money.

-

Vanguard Total Stock Market Index Fund: Provides broad exposure to U.S. equities; great value option. Crucial elements for long-term results should focus where to invest money prudently.

-

Schwab Total Stock Market Index Fund: Low-cost exposure to the entire U.S. stock market. Where to invest money effectively can bring superior outcomes over long time frames, through the smart strategy with this option.

-

Vanguard S&P 500 Index Fund: Investments aligned with the 500 top US corporations provide a specific market sector. Determine how a suitable choice for where to invest money relates to your goals.

-

iShares Core U.S. Aggregate Bond ETF: A mix of high-yield bonds in the U.S. treasury bonds. Make educated guesses concerning where to invest money with informed understanding, which are better than just going on intuition.

-

Schwab U.S. Aggregate Bond Index Fund: A collection of U.S. government, municipal, and corporate bonds, suitable for diversification. Investment results should be analyzed in great depth when looking at where to invest money.

Where to Invest Money: Balancing Risk and Return

Where to invest money is a big question. People want high returns, but risk is key. A good approach to where to invest money is to balance both. This means choosing investments that have a decent possibility of generating profit. You must weigh your desired profit amount with the chance of loss. Consider the potential downsides, the chance that it goes south quickly, the probability that you can lose money faster than you imagined.

A well-balanced portfolio involves a mix of options, low-risk and high-risk. Understanding where to invest money is more complex than simply wanting fast returns. Think long term, your long-term goals will play a vital role in deciding where to invest money.

Where to invest money should reflect your financial situation and tolerance for risk. The best path for where to invest money includes looking at diverse investment options. Consider these essential components of successful investing and deciding where to invest money. Don't stick with a single investment for where to invest money. A diversified approach is crucial for protecting your financial health. Your risk tolerance and investment goals should dictate where to invest money and when to make adjustments.

Assess your personal finances to decide what suits your risk tolerance. It depends on factors, including financial goals and how comfortable you are with potential losses when trying to determine where to invest money. Consider short-term needs versus long-term aspirations to successfully choose where to invest money. This allows you to plan better. What kind of returns you want for the money and what risk level are you okay with will impact where to invest money. Factor this all in, while carefully choosing where to invest money.

Where to Invest Money in a Low-Interest Environment

Low interest rates change how investors approach where to invest money. Many people look for higher returns when interest rates are low. But higher returns generally involve a higher risk. This impacts decisions on where to invest money in today's market conditions. Interest rates affect all types of investment. Therefore, a crucial factor in determining where to invest money in such circumstances is choosing between different types of assets with an eye toward a balance of risk. A low interest environment typically motivates searching for higher yields. Investors often try different avenues in order to obtain more returns from their investment strategy by determining where to invest money.

When rates are low, seeking higher yields can tempt some investors toward higher-risk assets for where to invest money. But careful assessment of these higher-risk alternatives should be made to ensure that they are worthwhile for where to invest money, while still maintaining the goal. Understand the interplay between risk and return. Knowing where to invest money is critical in today's financial world. The importance of diversification can not be emphasized enough when deciding where to invest money in today's world. Where to invest money depends largely on this concept. Diversify assets in an account if you are concerned about loss to prevent a domino effect in one area that damages others. When evaluating risk levels it is essential to have your strategy, along with your goal and current situations in mind before choosing where to invest money. A strategy of balancing short-term and long-term interests must be at the forefront when considering where to invest money. Your timeline for goals greatly impacts this discussion regarding where to invest money.

7 Tips for Choosing a Financial Advisor

- Verify Credentials: Check licenses, certifications.

- Assess Experience: How long in the field, what types of experience.

- Review Fees: How they're compensated (or where the revenue comes from in terms of payment from where to invest money.) Transparency about costs, clarity about fees. Be wary of hidden fees, understand the exact fees from this financial advisor to choose the one that's right for where to invest money.

- Demand Expertise: Confirm they have proficiency in areas crucial for where to invest money. Investment approach for what your goals need and match that to a well-researched financial advisor. Don't waste your money.

- Seek References: Reach out to satisfied clients, seek out case studies. Are there past achievements regarding their record in the industry to demonstrate ability in finding solutions for investment choices from where to invest money? This insight helps gain perspective from satisfied clientele to decide if it is someone you trust regarding investment advice from where to invest money.

- Ask Questions: Important to feel assured that this financial advisor aligns with the philosophy to the choice for where to invest money for you. Be proactive in questions for understanding. Explore how they work, ask the financial advisor to give your goals and questions to explore whether it aligns with your philosophy on choosing from the investments from where to invest money.

- Get it in Writing: Confirm investment plan with an advisory proposal and fees in clear documents when determining from where to invest money.

Where to Invest Money: Online Brokerage Platforms

Online brokerages are convenient avenues for where to invest money, but the choices for investing your money from here can be vast, confusing even. Use tools. Explore fees, platform usability. Where to invest money? Decide. What about educational resources, tools and how they support your understanding about your financial situation, for your decision of where to invest money. What type of customer support are you getting? Understanding the specifics for online brokerage services before investing your money there is wise to gain better comprehension for where to invest money and how to avoid the challenges of choosing wrongly.

Several companies offer comprehensive options regarding how and where to invest money. Online platforms usually have an abundance of features and different resources, which you can utilize for gaining clarity and making a smarter choice about where to invest money. The best options should accommodate various investor needs for where to invest money from this online platform.

Things to know about online platforms for choosing from options and deciding where to invest money:

- Ease of use

- Low investment minimums

- Customer support

- Financial and educational resources regarding where to invest money

It all boils down to carefully deciding on which online brokerage you choose and carefully decide where to invest money through this platform. Be wise and comprehensive with this analysis of choosing a great option.

How to Start an Investment Account Online

- Choose a Brokerage: Research carefully and then select from your researched choices, choose which broker you trust regarding choosing from a collection of choices for where to invest money.

- Open an Account: This process often has different forms to follow on each platform from where to invest money.

- Deposit Funds: Input the sum you plan to deposit for your investment, and begin building your account balance through carefully deciding where to invest money.

- Select Investments: Research and understand different avenues and opportunities to explore from where to invest money from. Understand how different methods can impact returns, as well as the overall implications from your investment options, on how it changes the balance or sum regarding where to invest money from your investment choice.